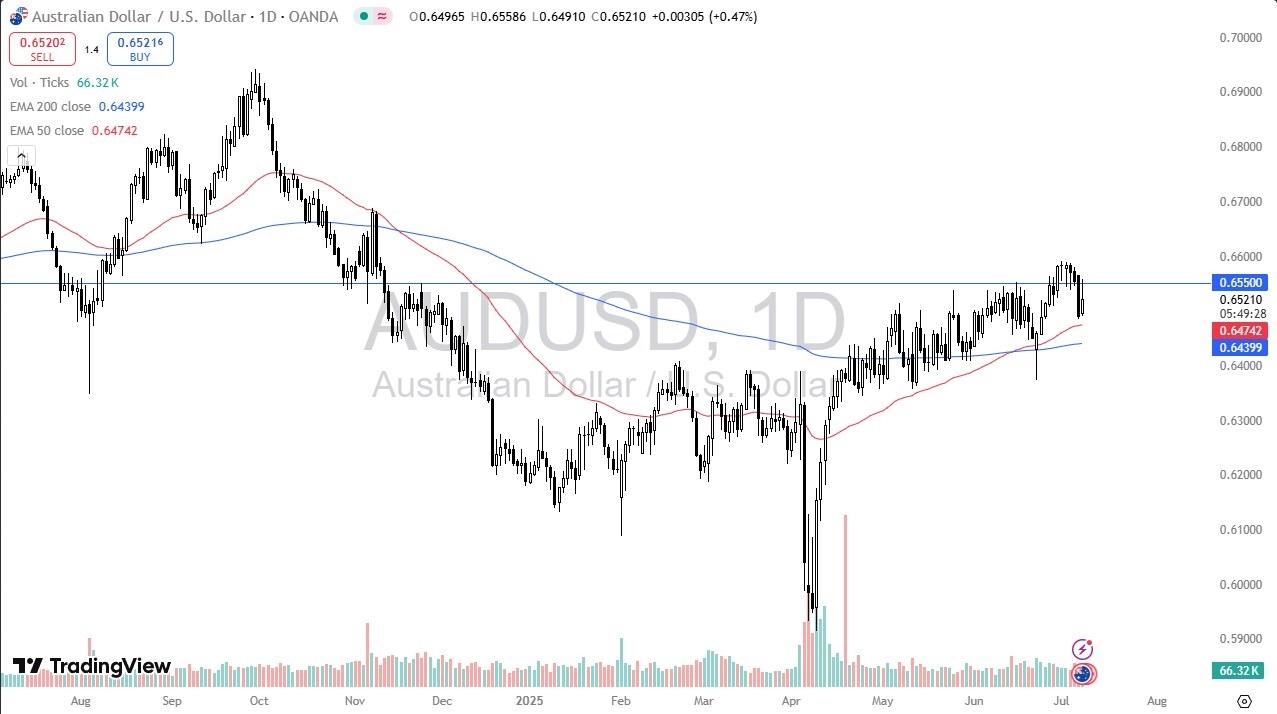

- The Australian dollar has rallied a bit during the trading session here on Tuesday after the RBA decided not to cut interest rates, which, of course, the market had anticipated.

- Because of this, it looks as if the Australian dollar ran right straight up in the air to the 0.6550 level.

- The 0.6550 level is an area that has been important multiple times and is a bit of a magnet for price, if you will.

- If we can break above there, then we have to keep an eye on 0.66. A move above 0.66 opens up the possibility of a move to the 0.67 level and beyond.

Dollar Fighting Back Against Trend

Top Regulated Brokers

The U S dollar has been soft for some time, but the reaction early on Tuesday probably had nothing to do with the U S dollar and everything to do with the Reserve Bank of Australia. We have given back quite a bit of those gains, and this shows just how difficult it is going to be for the Australian dollar to truly take off, especially considering how soft the U S dollar has been against most other currencies.

If we were to turn around and break down from here, I'd keep an eye on that 50 day EMA near the 0.6, 4, 7, 5 level because a breakdown below there would be essentially a breakdown below a major trend line that the market of course has been paying close attention to for what seems like a lifetime. Now it's a very slow and choppy market, but it has a slight upward tilt.

It just doesn't have any momentum to break out. However, if we were to get it, the market could jump quickly as the interest rate differential and trade headlines continue to power this pair as there is no agreement between US and Canadian authorities.

Ready to trade our daily AUD/USD Forex analysis? Check out the best forex trading platform for beginners Australia worth using.