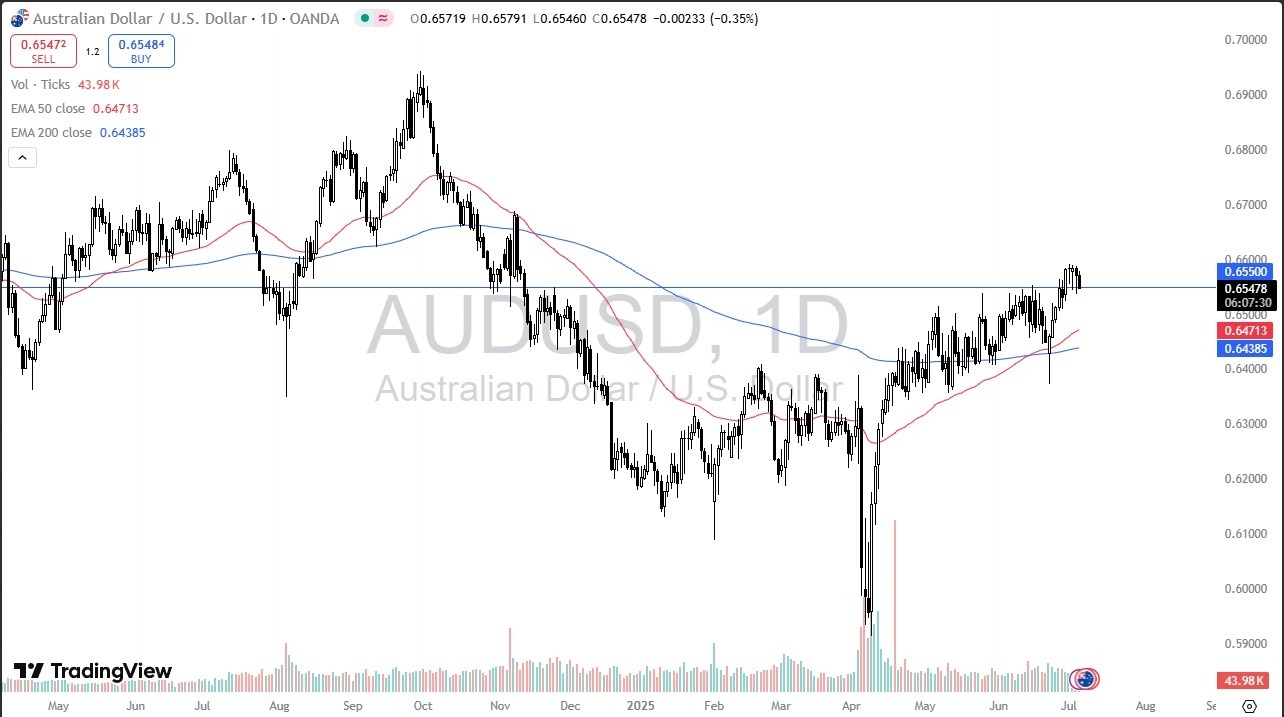

- The Friday session was pretty thin, as it was Independence Day in the United States, so I would only read so much into this price action, but it is worth noting that we find ourselves yet again at the 0.6550 level, an area that has been like a magnet for price for what seems like my entire adult life.

- That being said, and all jokes aside, we are essentially in a grinding upward channel that is more buy-on-the-dip than anything else.

- It's worth noting that Thursday, Wednesday, and even Tuesday candlesticks were all hammers that had touched this area and then turned around.

- So, one would assume there's a lot of buying pressure, and perhaps the reason that the candlestick changed so much on Friday is that there just weren't that many people at work.

Waiting for Momentum

Top Regulated Brokers

We'll have to wait and see if we break down from here, then the 50 day EMA at 0.6471 might be targeted. But if we bounce from here, then we've got to get past the 0.66 level to really see any momentum coming back into this market, perhaps opening up a move to the 0.67 level.

The Australian dollar has been a miserable place to live over the last couple of months, but I am watching this because it seems to be defying the selling of the US dollar at least aggressively that we have seen in other pairs like the euro and the pound So what this leads me to believe is that in general people are concerned about Asia and they're pro Europe We'll have to wait and see so this leads to other trades such as Euro/Aussie or Pound/Aussie etc.

This is an important chart to pay attention to because if the US dollar really starts to strengthen we may sell off rapidly. But as things seem to be over the last couple of months, dips are bought into, and we just grind higher.

Ready to trade our Forex daily analysis and predictions? Check out the largest forex brokers in Australia worth using.