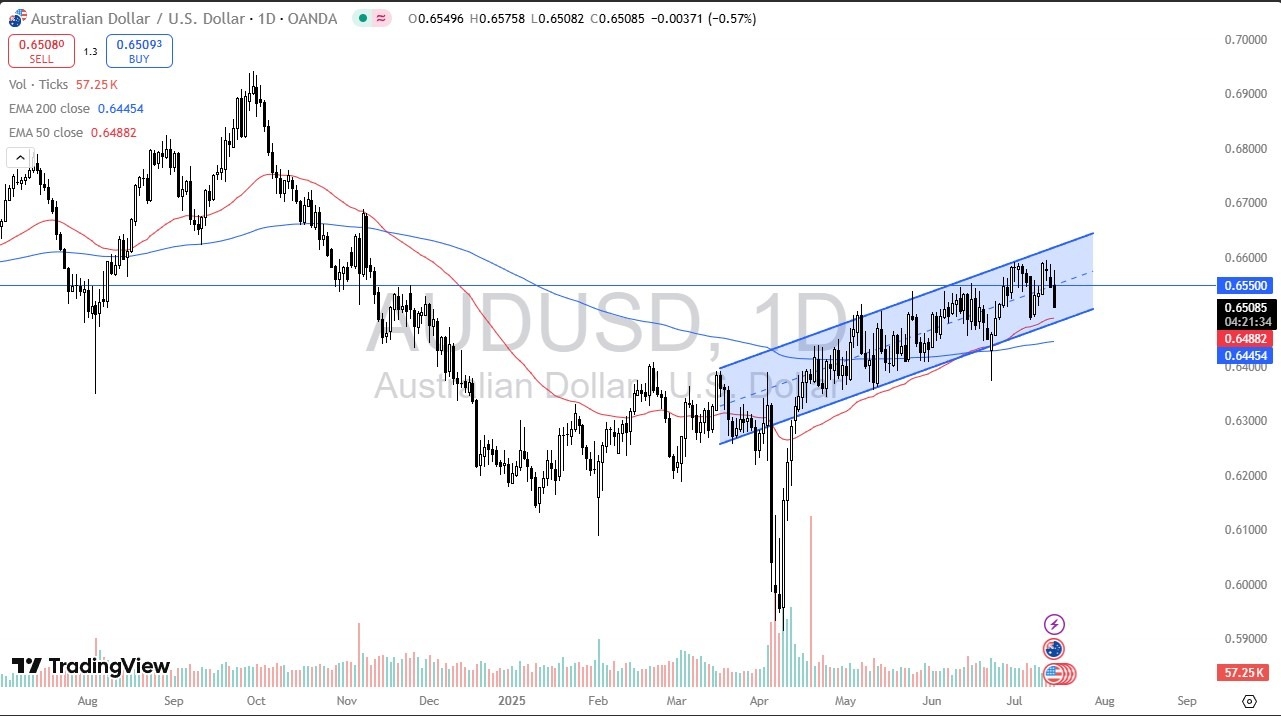

- The Australian dollar initially tried to rally during the trading session on Tuesday, but we continue to see a lot of noise above the crucial 0.6550 level, an area that I have been paying attention to for a couple of months now.

- This has been extraordinarily resistance to buying pressure, and I think given enough time, we will have to come to terms with whether or not the 0.6550 level is an area that is trying to offer a longer-term ceiling.

Technical Analysis

Top Regulated Brokers

As things stand right now, it is worth watching the Australian dollar, because we had initially tried to rally, but then plunged rather rapidly. At this point, as I write this article, we are near the 0.65 level, and underneath there we have the 50 Day EMA as well as the bottom of the overall channel that the market has been trading in before that. If we were to break down below the bottom of the channel, then at 0.6450, we have the 200 Day EMA as well. In other words, we have a lot of support underneath but quite frankly, the Australian dollar has been extraordinarily unimpressive over the last couple of months.

While we have seen the euro and the British pound absolutely pummeled the US dollar, the Aussie has been interesting in the sense that it just can’t seem to take off to the upside. It’s also worth noting that the US dollar is starting to strengthen against the Japanese yen, so you can make an argument that this is a regional play, meaning that Australia is mired in the lackluster behavior of Asian markets overall. The New Zealand dollar is very similar, as it just can’t seem to take off to the upside with any type of strength.

On a move below the 200 Day EMA, I think the Australian dollar completely implodes. We could see a drop all the way down to the 0.61 level. However, I think it’s more likely than not that we just bounce from somewhere in this general vicinity, due to the fact that it’s what’s been going on for 3 months now.

Ready to trade our daily Forex analysis? Here's a list of the best licenced forex brokers in Australia to choose from.