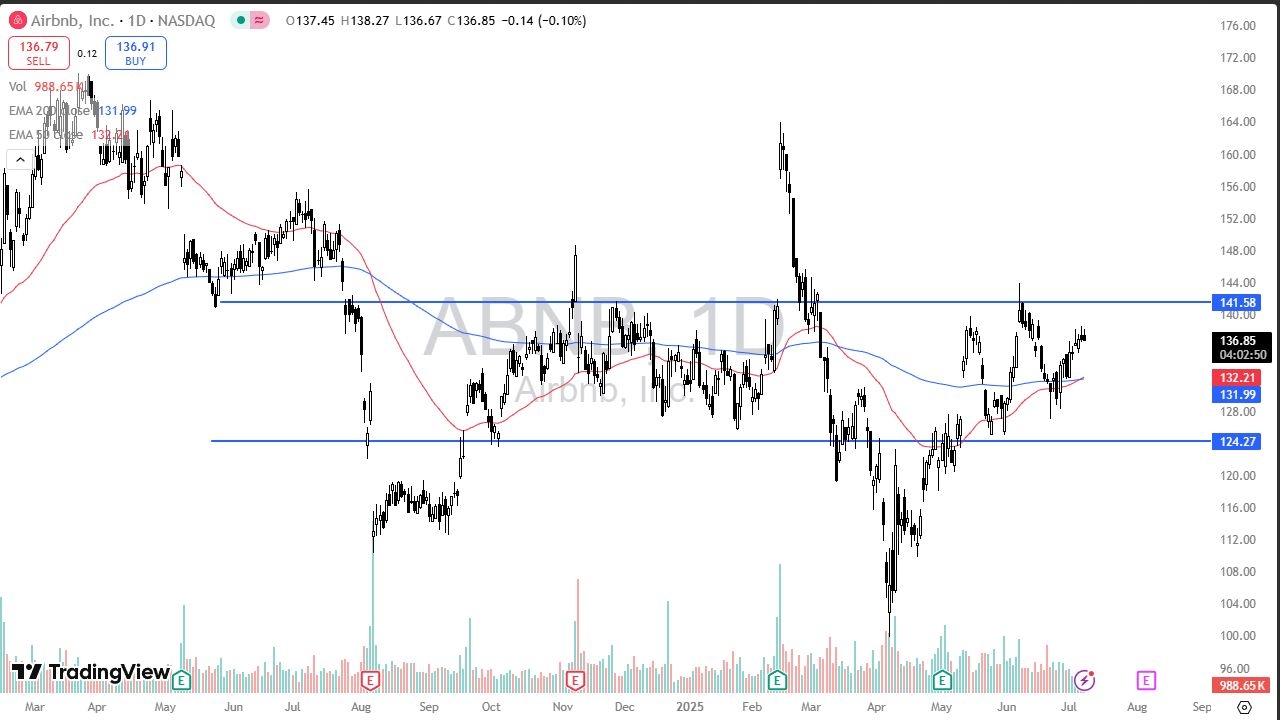

- Airbnb has initially tried to rally during the trading session on Wednesday but then gave back the gains as we continue to see a lot of noisy behavior right around the $130 level, which extends to the $141.50 level, which is the top of the overall consolidation area.

- However, this is a market that has a couple of clear levels be paying close attention to as it could lead to a trading opportunity.

Technical Analysis

Top Forex Brokers

The technical analysis for this market obviously is somewhat sideways over the last couple of months, which is interesting, considering that a lot all stocks have shot straight up in the air and now find themselves pushing even higher. However, Airbnb continues to see some questions about the public out there looking to rent the units. Travel is down a bit, and that obviously is a major influence on this market. Nonetheless, it does look like there are people willing to step in and buy this market, but I would also point out that volume is a little thinner that it had previously been, leading me to believe that we may have a significant range bound trading opportunity.

In an environment like this, I find it easier to buy dips than to short the market, mainly due to the way the stock market is constructed most of the time. It’s also worth noting that the 50 Day EMA is starting to cross above the 200 Day EMA, kicking off the so-called “golden cross”, but the moving averages are just slightly positive, so I think that leads to a “buy on the dips” type of market within the larger range between $124.25 on the bottom, and $141.50 on the top.

I do anticipate a pullback here, but I think the moving averages, followed by the $128 level, could end up being a nice entry point in this market. Conversely, if we were to break above the $144 level, I think at that point in time Airbnb really starts to pick up momentum, perhaps on a run toward the $160 level above.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.