Fundamental Analysis & Market Sentiment

I wrote on 25th May that the best trades for the week would be:

- Long of Bitcoin following a daily (New York) close above $111,743. This did not set up.

- Long of the GBP/USD currency pair. This gave a loss of 0.54%.

- Short of the USD/ZAR currency pair. This gave a loss of 1.01%.

The overall loss of 1.55% equals a loss of 0.52% per asset.

Last week was broadly very quiet, with stock markets inching higher, especially in Germany, where the DAX reached a new all-time high before turning more bearish towards the end of the week. There were no dramatic news releases or unexpected economic data to change the mood from mildly risk-on.

Last week’s most important data releases were:

- US Core PCE Price Index – as expected.

- US FOMC Meeting Minutes – no surprises.

- US Preliminary GDP – just a tick lower than expected.

- German Preliminary CPI (inflation) – as expected.

- Australian CPI (inflation) – just a tick higher than expected.

- RBNZ Official Cash Rate, Rate Statement, and Policy Statement – a 0.25% cut as expected, although a slightly dovish tilt was made on the path of future rate cuts, although this had little effect on the Kiwi.

- US Unemployment Claims – slightly worse than expected.

After markets closed for the week, President Trump announced the tariff on steel and aluminium will be doubled this Wednesday from 25% to 50%. This will likely produce a more risk-off market as the week gets underway, but there is always a chance that a deal will be announced before Wednesday.

Top Regulated Brokers

The Week Ahead: 2nd – 6th June

The coming week has what will probably turn out to be a more decisive schedule of high-impact data releases.

This week’s important data points, in order of likely importance, are:

- US Non-Farm Payrolls and Average Hourly Earnings

- European Central Bank Policy Meeting

- US ISM Services PMI

- US JOLTS Job Openings

- Bank of Canada Policy Meeting

- Swiss CPI (inflation)

- Australia GDP

The most impactful events on the Forex market will likely be the top two items.

Monthly Forecast June 2025

For the month of June 2025, I forecast that the EUR/USD currency pair will increase in value.

For the month of May 2025, I made no monthly forecast as although there was a long-term trend against the US Dollar, the price action suggested that a major bullish reversal could be underway.

Weekly Forecast 2nd June 2025

As there were no unusually large price movements in Forex currency crosses over the past week, I make no weekly forecast.

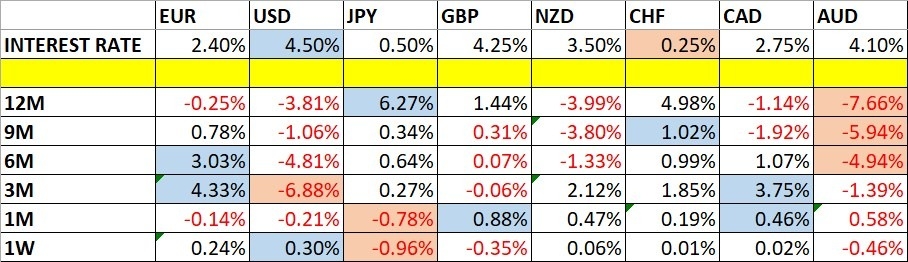

The US Dollar was the strongest major currency last week, while the Japanese Yen was the weakest. However directional movement was very low. Volatility decreased last week, with only 7% of the most important Forex currency pairs and crosses changing in value by more than 1%. Next week’s volatility is likely to be higher.

You can trade these forecasts in a real or demo Forex brokerage account.

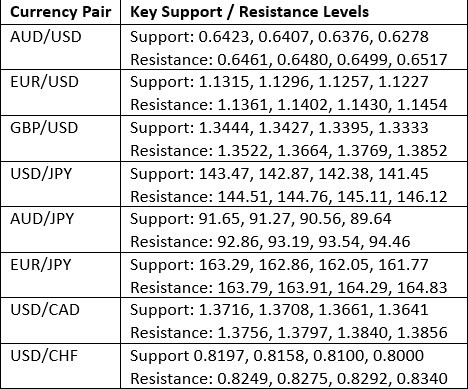

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a hammer candlestick which closed higher but with a large upper week. I see this as, surprisingly to some, a bearish candlestick. The price remains close to the multi-year low made a few weeks ago. There is a clear long-term bearish trend.

The bullish case is represented by the fact that the price has not yet broken the multi-year low, and in this area at the low we have a horizontal level which has already proved to be strong support, at 97.67.

I think it makes sense to be trading in line with the long-term trend which will be short of the greenback. If there is short-term bearish momentum when the price opens this week, you should be more confident in going short here.

EUR/USD

The EUR/USD currency pair made a new multi-year high in April above the round number at $1.1500, but since then it made a bearish retracement followed by another upwards movement. However, that sounds much more bearish than the price action really looks. It seems the bullish momentum is running out of steam.

Despite that reason to be cautious for bulls, the price is still not far from a multi-year high, so a bullish push could dramatically change the technical scenario here.

Another factor that might give bulls a tailwind is the long-term bearish trend in the greenback, and the impending tariff deadline in July, as well as president Trump’s announcement a few hours ago that tariffs on steel and aluminium would be doubled from 25% to 50% effective this Wednesday, might also help to push the price higher.

I will enter a new long trade in this currency pair if we get a daily (New York) close above $1.1513.

GBP/USD

The GBP/USD currency pair reached a new multi-year high price at the start of last week, well above $1.3500. However, it then fell over the remainder of the week, although trend traders are likely to mostly still be long here.

I see the long-term strength in the British Pound (boosted by higher than expected inflation producing an outlook of relatively high interest rates) coupled with the long-term bearish trend in the US Dollar as likely to produce more long-term bullish breakouts here, which might be successfully traded with a relatively tight trailing stop – about 1 ATR daily of a long-term value tends to work best with this currency pair.

I will enter a new long trade if we get a daily (New York) close above $1.3558.

The S&P 500 Index

The S&P 500 Index rose last week as risk sentiment improved a little, with the price ending the near local highs above the support level at 5,777, which is also confluent with the 200-day moving average, as can be seen in the daily chart below.

President Trump’s announcement that he will double the tariff on steel and aluminium this Wednesday is not necessarily believed as certain to take effect, but it is quite likely to produce a bearish open when the US stock market opens this week. This agenda item will also likely cause markets to start thinking that the July tariff deadline is also approaching for the whole world’s trading relationship with the USA, so that could be another factor adding to bearishness here.

Although the price is trading not very far from its record high and above the 200-day simple moving average, it is worth noting that this Index is below its level of 6 months ago, which is a bearish sign – showing the price has basically been trading sideways for half a year.

On the other hand, the fact that the price seems to be strongly respecting the confluent support area at about 5,777 is a bullish factor.

I will be very to go long of this Index in the unlikely event that we get a daily close above 6,142.

Bitcoin

Bitcoin continued to decline, quite firmly, over the week. The price is now looking a little heavy as it threatens the $102,500 which looks like a pivotal line in the sand. If the price gets below $101,500 it will be more than 3 times the long-term ATR from the highest daily close, which will shake out most trend traders, and possibly produce a stronger fall.

I will enter a new long trade if we get a daily (New York) close above $111,743 this week but I think this is unlikely to happen.

The shine seems to have come off Bitcoin, but this area around $101,500 to $102,500 does look pivotal, so a bullish bounce from there might signify a good long trade entry opportunity, but I will be more cautious.

Bottom Line

I see the best trades this week as:

- Long of Bitcoin following a daily (New York) close above $111,743.

- Long of the GBP/USD currency pair following a daily (New York) close above $1.3513.

- Long of the EUR/USD currency pair following a daily (New York) close above $1.3558.

- Long of the S&P 500 Index pair following a daily (New York) close above 6,142.

Ready to trade our weekly Forex forecast? Check out our list of the top 10 Forex brokers in the world.