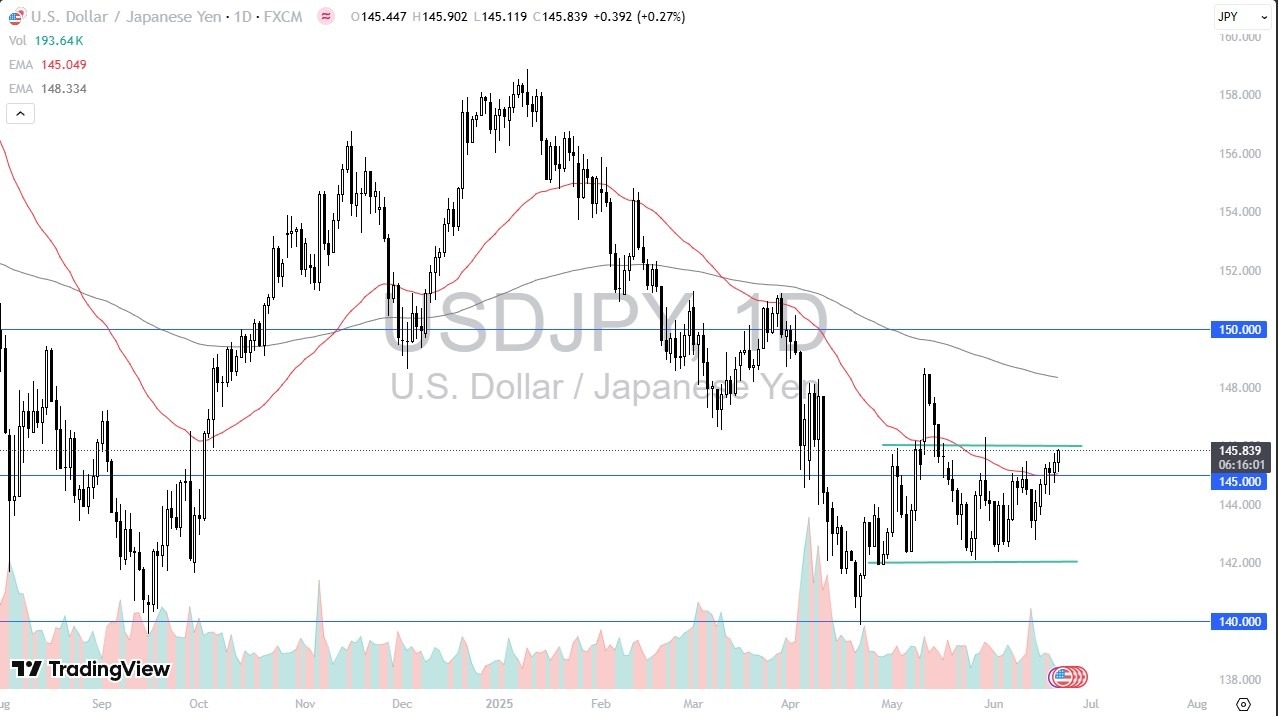

- The US dollar initially pulled back just a bit during the trading session on Friday but then turned around to show signs of life as the ¥145 level is a major support level.

- It’s a large, round, psychologically significant figure, and it also features the 50 Day EMA, so I believe it makes a lot of sense that it continues to hold as support for short-term traders.

- However, I also recognize that the ¥146 level will be thought of as a major barrier, and if we can break above there, then it opens up the possibility of a move to the 200 Day EMA, which is just above the crucial ¥148 level.

Bottoming Process

Top Regulated Brokers

I think were in the middle of a bottoming process, but I don’t necessarily think that we are just going to sliced through ¥146 level easily. The fact that we have been bouncing around in this range for a while now makes a certain amount of sense, with the ¥142 level is a major support level, and has offered a bit of a bottom for the market. Ultimately, I think short-term pullbacks are likely, but I also think they are more likely than not going to be bought into, because that is what we have seen over the last several weeks. Ultimately, the interest rate differential continues to favor the US dollar, so I think that as a little bit of a buffer anyway.

If we were to break down below the ¥142 level, then it opens up the possibility of a move down to the ¥140 level, which of course is an area that has been supported previously, and it is a large, round, psychologically significant figure, and an area where we see a lot of interest in this area. That being said, the market continues to be very noisy, so look for some type of value in order to take advantage of it on dips, but I’m starting to like the upside much more than I did just a few weeks ago.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.