- The US dollar has been all over the place against the Swiss franc during trading on Tuesday, which makes quite a bit of sense.

- We have a lot of questions asked about risk appetite.

- Because of this, I think you have to understand that it's likely traders will continue to pay close attention to the latest headlines coming out of the Middle East.

Obviously, that is a very fluid situation that I think a lot of people are nervous about this. The Swiss Frank is a safety currency even more so than the US dollar is so it'll be interesting to see how that plays out.

Top Forex Brokers

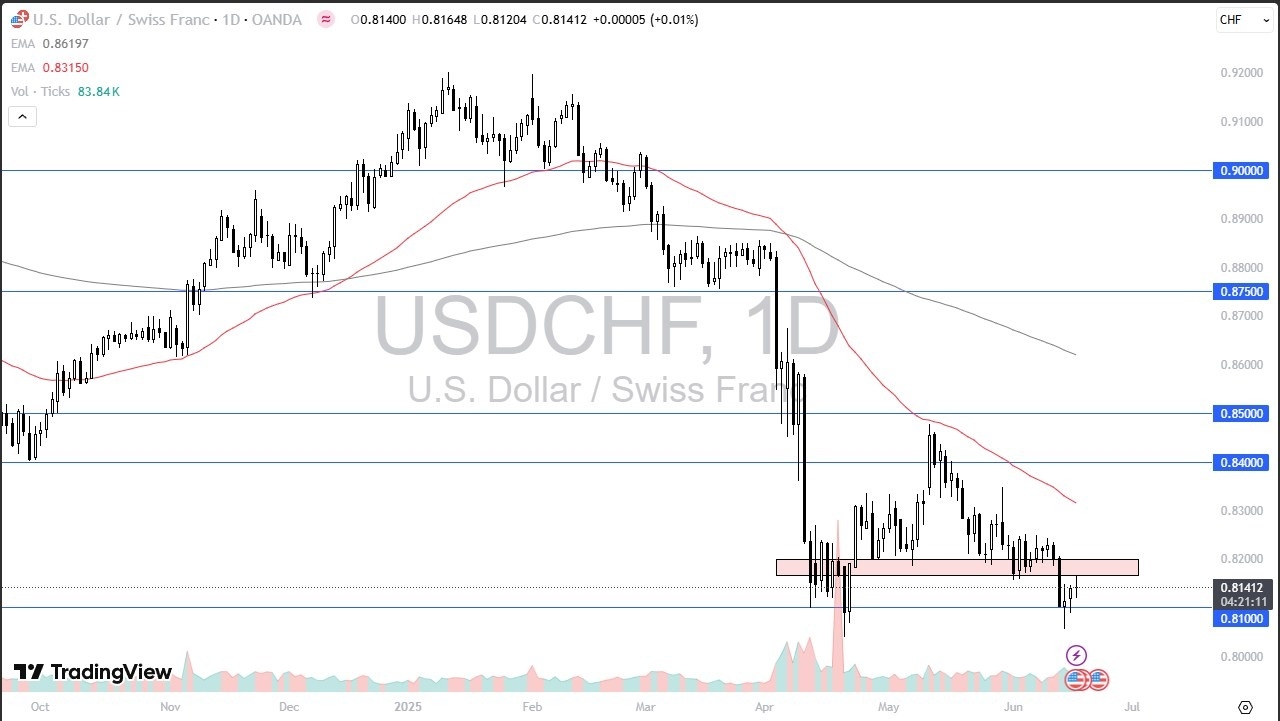

With that, I think you have to recognize that this is a market that is also in the process mainly of trying to test new lows, the 0.81 level is an area where we've seen a lot of action. And I think that probably continues to be the case going forward. If we can break above the 0.82 level, then it's very possible that we have a scenario where the market participants go looking at the 50 day EMA. When I look at this chart, it is overextended. And the US dollar is oversold against most currencies, the Swiss franc won't be any different.

Interest Rate Differential Matters

But with that, you have to recognize also that the market participants will be looking at the interest rate differential occasionally. And the interest rate differential does favor the US dollar.

So I think by taking out this candlestick from the late part of last week, basically Thursday, then we could send this market popping a little bit higher. All things being equal. This is a market that is going to be very choppy, and you need to be very cautious with your position sizing.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.