- The US dollar has fallen significantly during the trading session on Wednesday, and it may not have had a whole lot to do with the Canadian interest rate decision.

- Although that obviously had an influence on the Canadian dollar itself, but really at this point, I think you've got a situation where a lot of people I think had expected Canada cut rates and they really didn't.

- The big mover though in my estimation is probably the non-farm payroll numbers coming out of ADP showing a much weaker US employment situation than originally thought.

Then of course the ISM services PMI number came out at 49.9. So just barely contractionary, but enough that it was a one-two punch for the US dollar during the day.

Top Regulated Brokers

A Grind Lower?

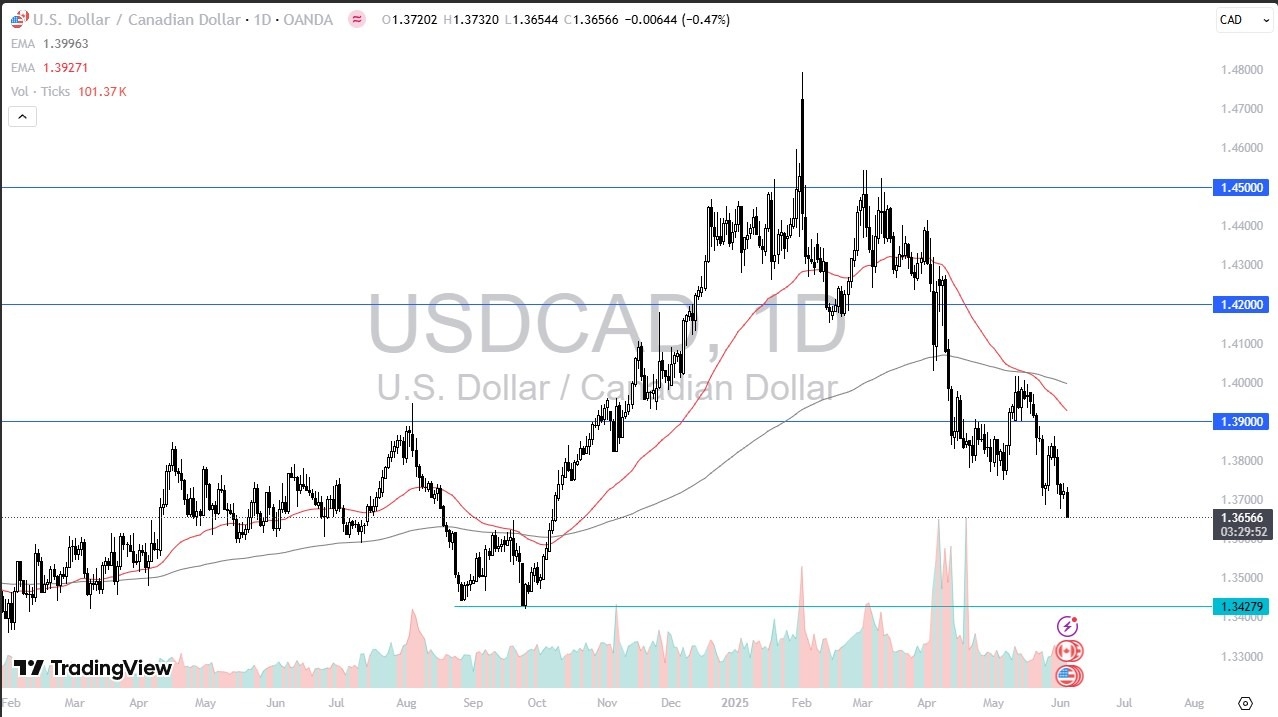

So, with that being said, the market certainly looks as if it is going to try to grind its way towards the 1.34 level, but there is this little area between here and there. So, I think you probably favor the downside for a little bit here, but I don't know how much momentum you really have because both of these countries will be releasing employment numbers on Friday.

So, what happens if they both come out poor? That would be your real question. What if they both come out hot? What if the US number comes out higher than expected and the Canadian numbers come out lower than anticipated? So, I think for the next day, day and a half or so, you probably have more of a drift lower. But Friday will be the day that things are a little bit clearer as to where we may go over the next several weeks. However, remember that the Canadian economy is almost wholly dependent on the US economy. In other words, if things get bad in America, they will get worse in Canada.

Ready to trade our USD/CAD daily analysis and forecasts? Here's a list of the best Forex Trading platform in Canada to choose from.