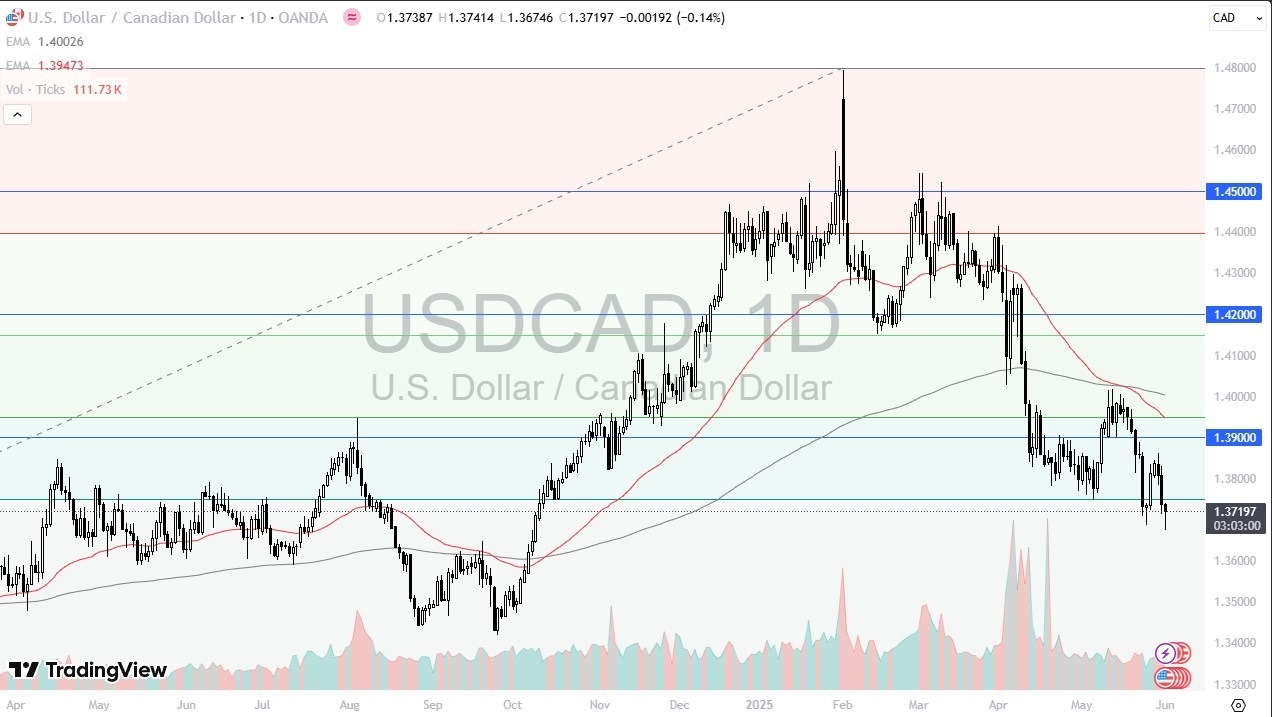

- The US dollar has plunged against the Canadian dollar during early trading on Monday but has seen buyers come back into the market in order to support the currency pair.

- At the end of the day, it looks like we are trying to form some kind of hammer, and an area that’s been supported previously, with its epicenter being the 1.37 level.

What is Market Hinting?

Top Regulated Brokers

Sometimes the market will do what it can to confuse traders, but when you sit back and actually watch what’s going on, and perhaps more importantly, put it in the context of everything going on, it makes a lot of sense that you would see a few hints as to where we might go next. Quite frankly, during the early part of the New York session, we got the Manufacturing PMI numbers coming out lower than anticipated, and in fact showing signs of contraction, which had people selling off the US dollar and starting to think that the US was heading into a major recession. That being said, what I like to pay attention to is what is happening, not what should happen.

Looking at this chart, I find it very telling that the US dollar has rallied significantly, and although it is slightly negative, the reality is that the Canadian dollar not being able to hang on to gains against the US dollar probably says everything you need to know. Because of this, I think that a bounce is somewhat imminent, and it is worth noting that the overall attitude of market participants seems to be leaning back toward the US dollar, as I have seen the US dollar at least stabilize if not push back against other multiple large currencies around the world. With this, I’m looking for this market to perhaps bounce in the short term from an extremely important support level.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.