Long Trade Idea

Enter your long position between 289.13 (the low of the current sideways trend) and 309.59 (the high of the current sideways trend).

Market Index Analysis

- UnitedHealth Group (UNH) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All three indices are in a strong uptrend and have reached heavy resistance levels but could push higher in the short term.

- The Bull Bear Power Indicator of the Dow Jones Industrial Average completed a bullish crossover.

Market Sentiment Analysis

Equity markets could enter a period of increased volatility. While traders believe the ceasefire between Israel and Iran will hold for now, conflicting reports about the destruction of Iranian nuclear facilities by the US bombing raid might keep traders on edge. Defensive sectors, including healthcare, are poised to outperform other sectors should uncertainty and volatility remain the dominant theme over the summer months.

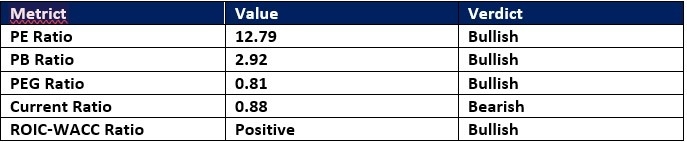

UnitedHealth Group Fundamental Analysis

UnitedHealth Group is a leading US health insurer / health care provider. UNH is the largest healthcare company by revenue and the world’s seventh-largest company by revenue; however, a series of issues have caused its share price to collapse by over 50%.

So, why am I bullish at current levels?

The sell-off has left UNH at a once-in-a-generation valuation. UNH pays a quarterly dividend, adding to its long-term appeal. I also believe that the implementation of AI will lower operating costs and boost efficiency moving forward. The uncertain economic environment should increase its demand as a defensive play, and UNH continues to generate long-term value.

The price-to-earnings (PE) ratio of 12.79 makes UNH a cheap stock. By comparison, the PE ratio for the Dow Jones Industrial Average is 16.46.

The average analyst price target for UNH is $385.88, suggesting massive upside potential. This level also roughly coincides with the 50.0 Fibonacci Retracement Level.

UnitedHealth Group Technical Analysis

- The UNH D1 chart shows a rising wedge formation, a bullish chart pattern.

- The Bull Bear Power Indicator shows a positive divergence, suggesting a pending price action reversal could follow.

- A potential breakout above the rising wedge formation would allow UNH to close a previous price gap and take price action above 375.00

- Trading volumes have increased on bullish days

Top Regulated Brokers

My Take

I would take a long position in UNH between 289.13 and 309.59 and would also add to that position if a sell-off materializes amid the long-term upside potential. UNH also has a dividend yield of 2.88%. UNH is an excellent pick for a retirement and dividend portfolio, or any kind of medium to long-term horizon investment.

- UNH Entry Level: Between 289.13 and 309.59

- UNH Take Profit: Between 376.84 and 417.12

- UNH Stop Loss: Between 269.14 and 248.88

- Risk/Reward Ratio: 4.39