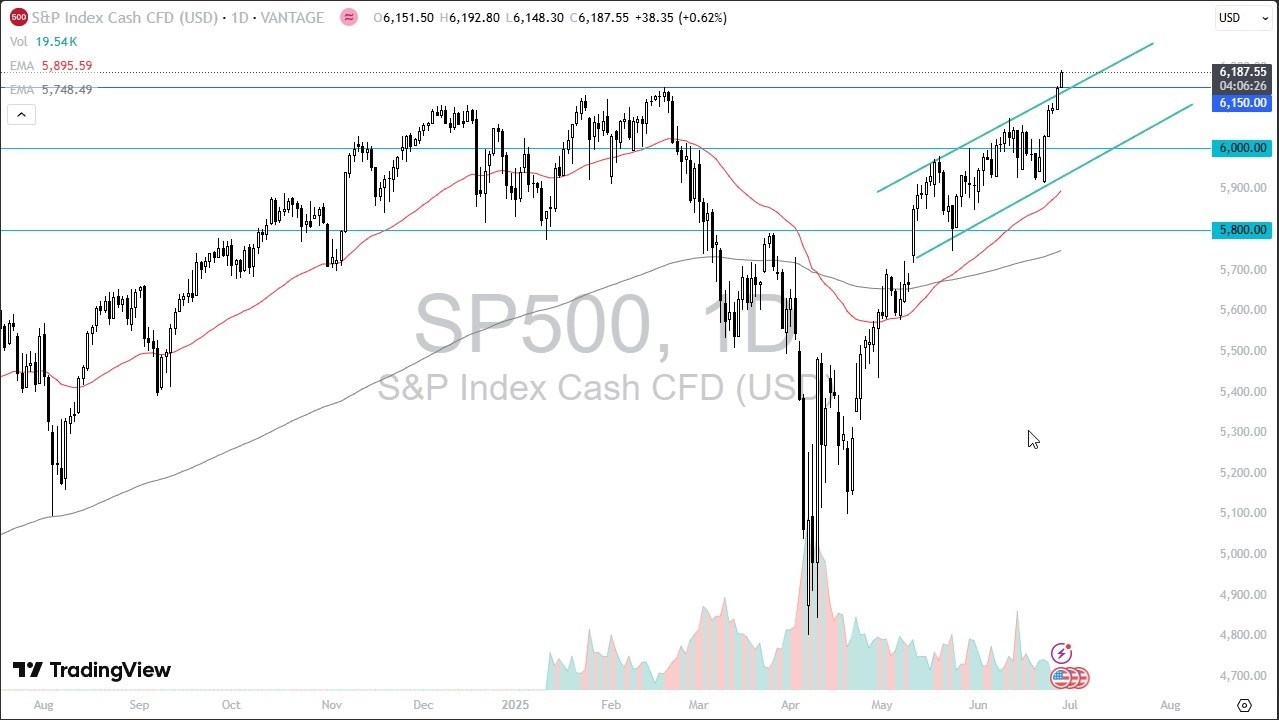

- The S&P 500 has rallied again during the trading session on Friday as we continue to see a lot of upward momentum.

- And really at this point, we are breaking out of a channel and entering what I typically would anticipate is the impulsive phase of a breakout of a channel.

- A lot of times you'll see the top line of the channel get broken, and then we really start to launch and then eventually find the resistance line of that channel later on down the road.

Ultimately, we are at all-time highs, and I just don't see how you could short this market. If the market were to reach down to the 6,150 level, I anticipate seeing a lot of support as it was previous resistance.

Top Forex Brokers

Trade Deals Done?

Keep in mind that we have gotten headlines of Chinese officials suggesting that they have a trade agreement with the Americans and also the Americans are likely to sign an agreement with Europe sometime next week. So, if that's going to be the case, then that removes some of the last barriers to the market going higher. Interest rates are expected to be cut in September by the Federal Reserve and that has people excited as well.

It'll be interesting to see how the market reacts to that because a lot of times you get a negative reaction once it actually happens at least for the short term. Regardless, I think this is a buy on the dip type of market and really, I have no interest in shorting at least until we break down below the 50 day EMA, which is all the way down at the 5885 level. To the upside the market has a likelihood of reaching 6300 but we don't know how long it'll take. I think we're in the midst of an actual huge FOMO rally and a short squeeze so I do think we will go higher and it may be relatively quick we'll just have to wait and see.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.