While Israel’s recent strikes on Iran have sparked global market jitters, Solana’s bullish momentum remains robust, driven by strong investor confidence, surging network activity, rising ETF approval odds and a strong technical setup projecting an over 1,100% rally to areas above $1.000.

Top Regulated Brokers

Crypto Traders Shrug Off War and Inflation Fears

Despite heightened geopolitical risks following Israel’s military actions against Iran, crypto traders have shown remarkable resilience. While traders scaled back expectations for interest rate cuts in the United States, investors continued to pour capital into Solana-based investment products, signaling stronger confidence in Solana’s upside potential.

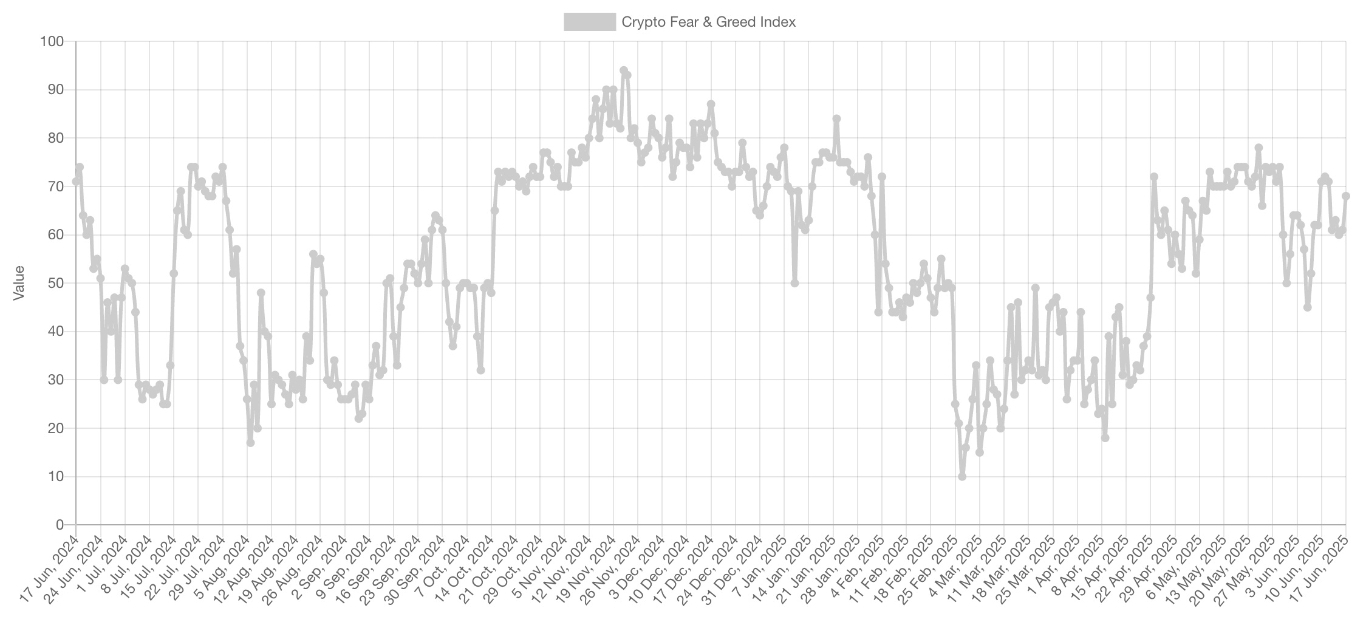

Traders’ sentiment remained steady despite the worsening socio-economic outlook, as market emotions remained positive. The Crypto Fear and Greed Index, while dipping to 61 from 71 over the past week, remains in the “greed” zone at 68 at the time of writing, signaling persistent bullish sentiment.

Crypto Fear and Greed Index. Source: Alternative.me

Crypto Fear and Greed Index. Source: Alternative.me

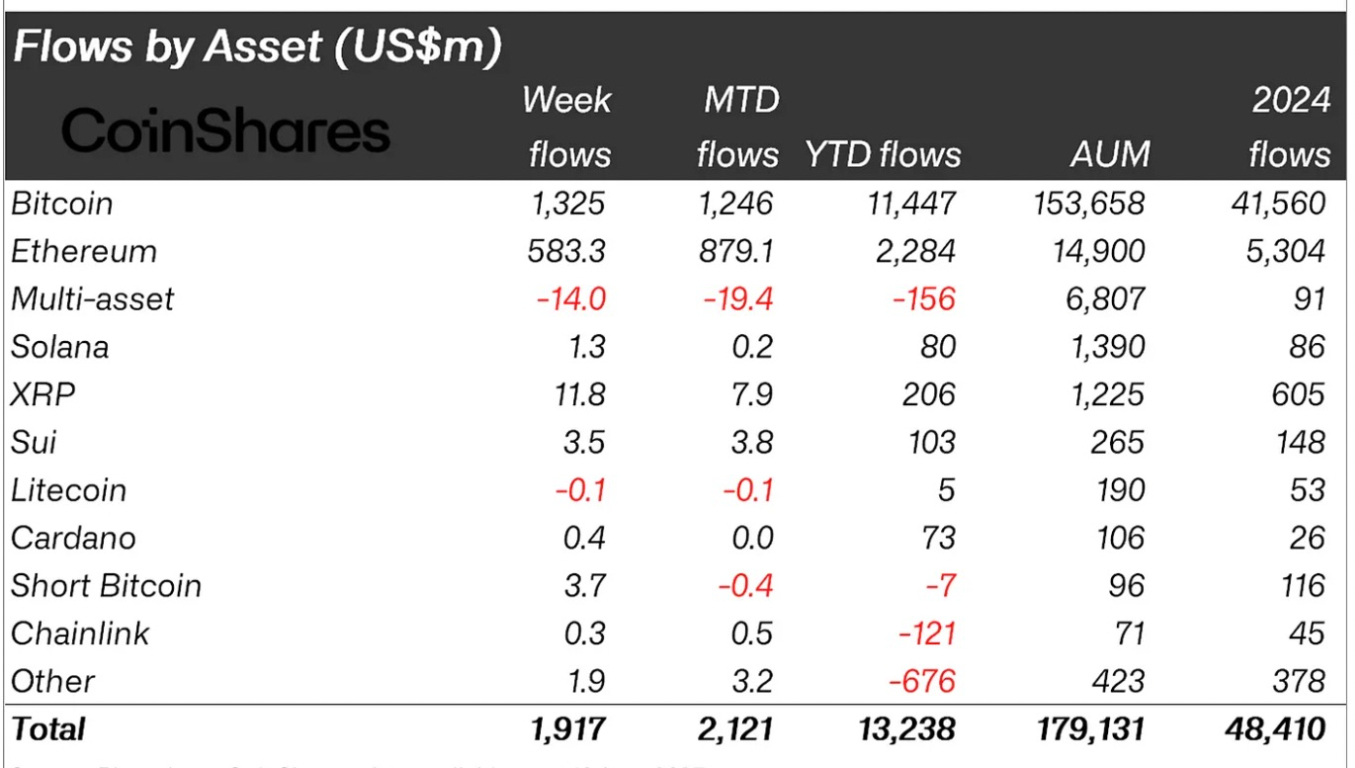

This investor confidence is further bolstered by continued capital inflow into Solana-based investment products. According to data from CoinShares, Solana investment products recorded $1.3 million in inflows last week, reflecting sustained institutional and retail interest even as traditional markets wavered.

Flow by Asset Source: CoinShares

Flow by Asset Source: CoinShares

This had helped ease traders’ concerns about a potential economic recession and the adverse effects of the conflict involving Iran, with market participants expecting tensions in the Middle East to ease, according to Yahoo Finance reports.

Solana ETF Approval Odds Jump Above 90%

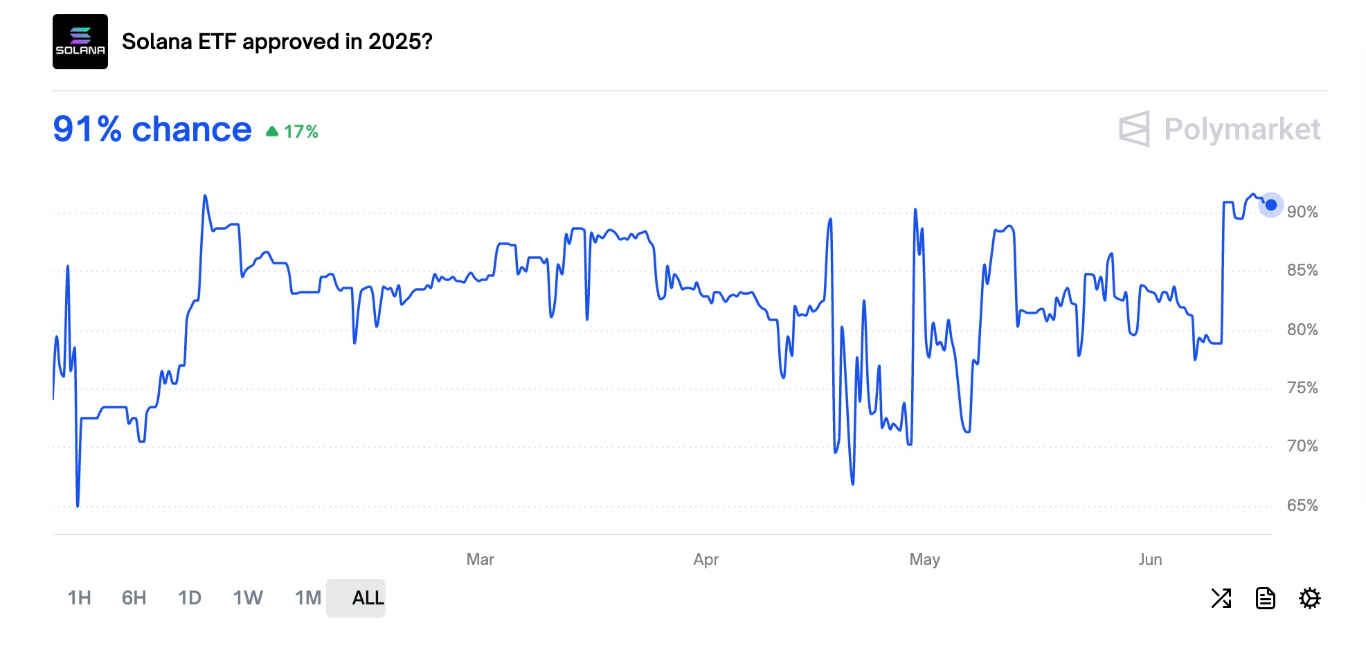

Speculation around the approval of the first spot Solana exchange-traded fund (ETF) in the United States remains the most significant catalyst behind SOL’s upside potential. Bloomberg ETF analysts said that the US Securities and Exchange Commission (SEC) could “act early” on Solana ETF filings, placing the approval odds at around 90%.

Meanwhile, approval odds on Polymarket have jumped to 91% on June 7 from 67% on April 21.

Solana ETF Approval Odds on Polymarket. Source: Polymarket

Solana ETF Approval Odds on Polymarket. Source: Polymarket

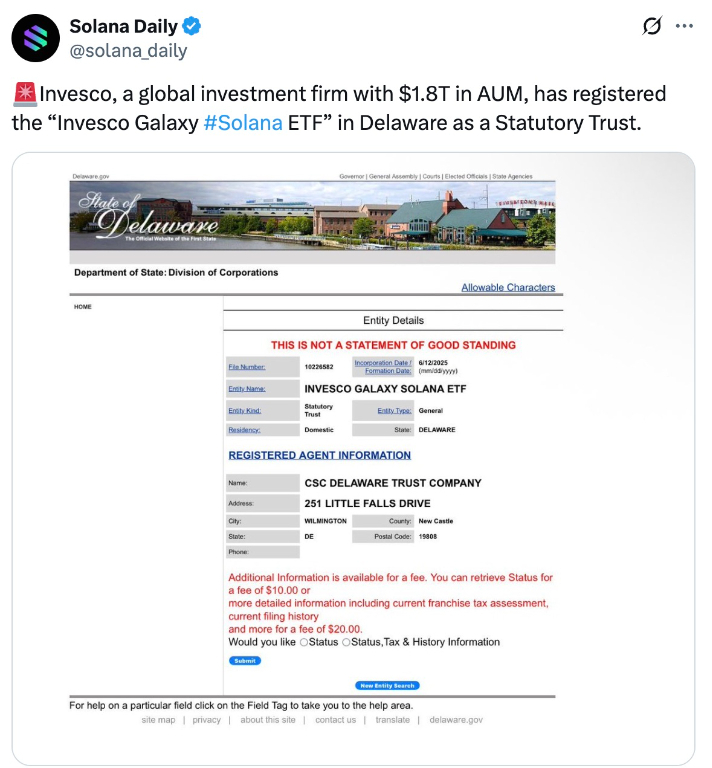

This increased optimism came after seven asset managers filed their S-1 forms for Solana ETFs with the SEC, signaling progress in the approval process.

Additional firms like Invesco and Galaxy have signaled intentions to follow suit, announcing intentions to launch a Solana ETF Trust in Delaware.

Source: Solana Daily

This adds to the robust institutional interest in Solana, potentially unlocking significant institutional capital. Unlike traditional assets, which often retreat during geopolitical crises, Solana’s decentralized nature and appeal as a hedge against inflation appear to be driving its resilience, keeping its path to $1,000 and beyond intact.

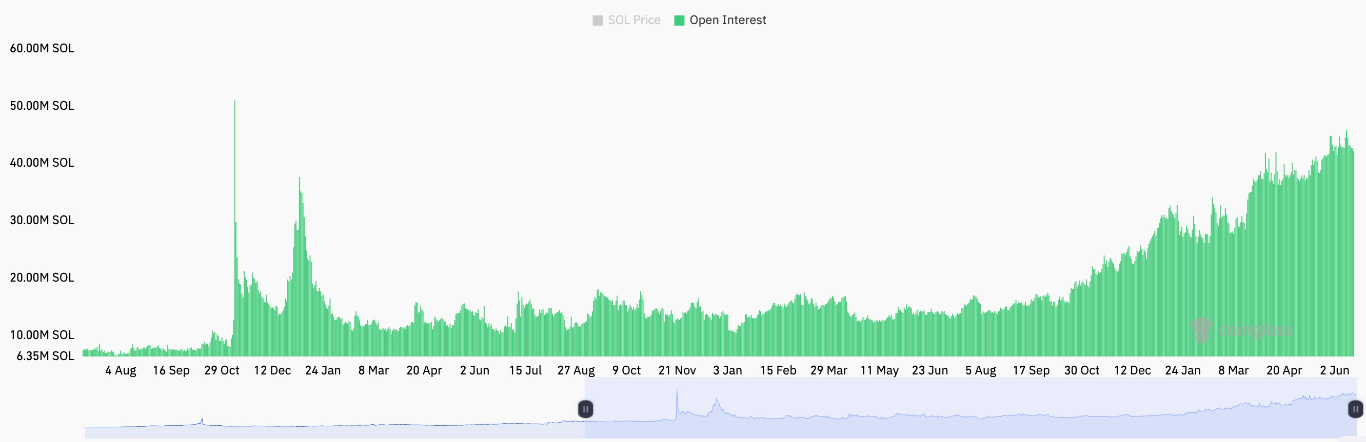

High Open Interest and Increasing TVL

An increase in open long positions in the futures market preceded SOL’s rally to $151 today and increased its upside potential. The total open interest on SOL futures reached 45.87 million SOL on June 12, the highest since June 2023 and up 22% over the last 30 days. The OI remains high at 42.1 million SOL, worth about $6.4 billion at the time of writing on June 17.

SOL’s open interest ranks third in the cryptocurrency market and is over 71% higher than the demand for XRP derivatives.

Solana Futures Aggregate Open Interest, SOL Source: CoinGlass

Solana Futures Aggregate Open Interest, SOL Source: CoinGlass

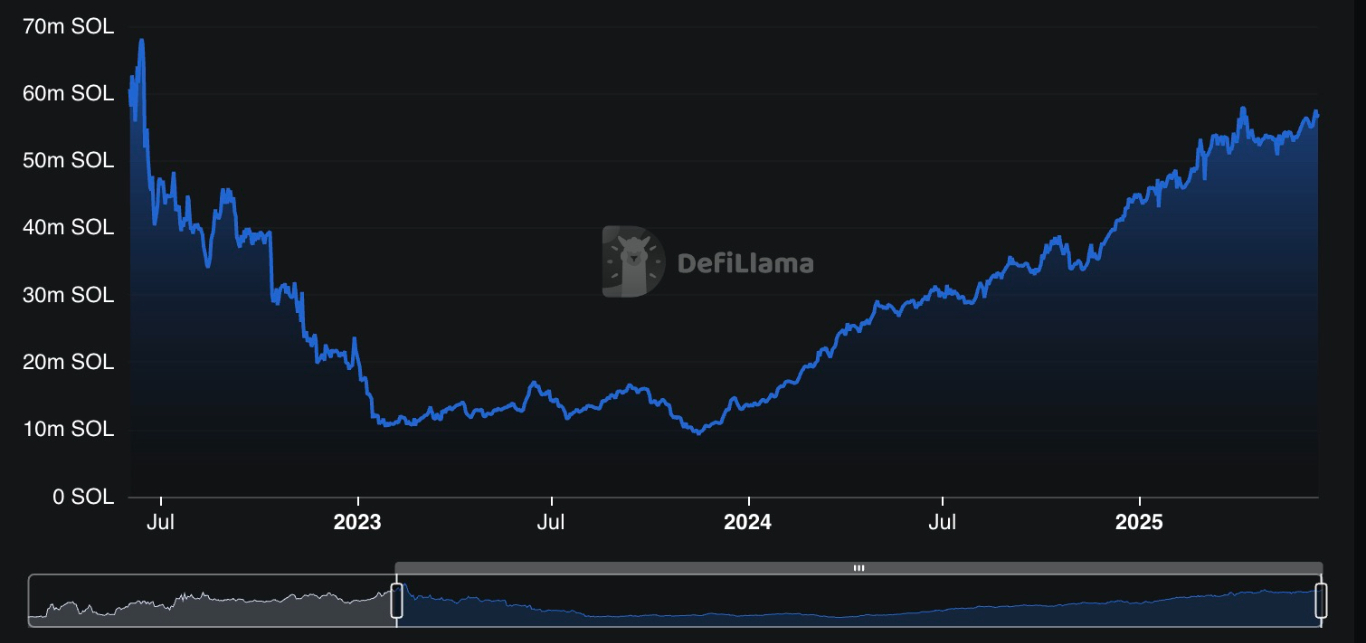

The growing OI indicates strong institutional participation and increasing demand for SOL in the derivatives market, and with increasing total value locked (TVL), it increases its upward price trajectory.

According to DefiLlama, Solana’s TVL has grown 5% from 53.5 million SOL on May 11 to 56.4 million by June 16. This growth reflects rising confidence in Solana’s DeFi ecosystem, with platforms like Sanctum, Jito, and Kamino seeing deposit increases of 44% and 25%, respectively.

Solana TVL and Daily Transactions. Source: DefiLlama

Solana’s daily transaction count has also risen by 36% over the past month to 76.6 million, and its decentralized exchange (DEX) volume leads the industry at $2.61 billion daily, commanding a 27.7% market share ahead of Ethereum and BNB Chain.

This high network activity, coupled with growing adoption in DeFi, NFTs, and projects like Solana Mobile’s Seeker phone (with 100,000 pre-orders), underscores Solana’s utility and supports its long-term price potential toward $1,000.

SOL Price Bull Flag Hints at $1,700

SOL price has formed a bull flag chart pattern on the weekly chart, as shown below.

A bull flag pattern is a bullish setup that forms after the price consolidates inside a down-sloping range following a sharp price rise.

Bull flags typically resolve after the price breaks above the upper trendline and rises by as much as the previous uptrend’s height. This puts the upper target for SOL price at $1,777, or a 1,100% increase from the current price.

SOL/USD daily chart. Source: Cointelegraph/TradingView

SOL/USD daily chart. Source: Cointelegraph/TradingView

The daily RSI increased to 50 on June 17 from 36 on May 31, indicating increasing bullish momentum.

SOL’s bullish case hinges on the price overcoming the resistance between the 50-week simple moving average at $170 and the $200 psychological level. The next level barrier to overcome would be the all-time high at $295, reached on Jan. 19.

Conversely, a weekly candlestick close below the flag’s upper boundary at $145 would see the price drop back into the confines of the flag, with the 100-week SMA providing support on the downside.

Ready to trade our analysis on Solana? Here’s our list of the best MT4 crypto brokers worth reviewing.