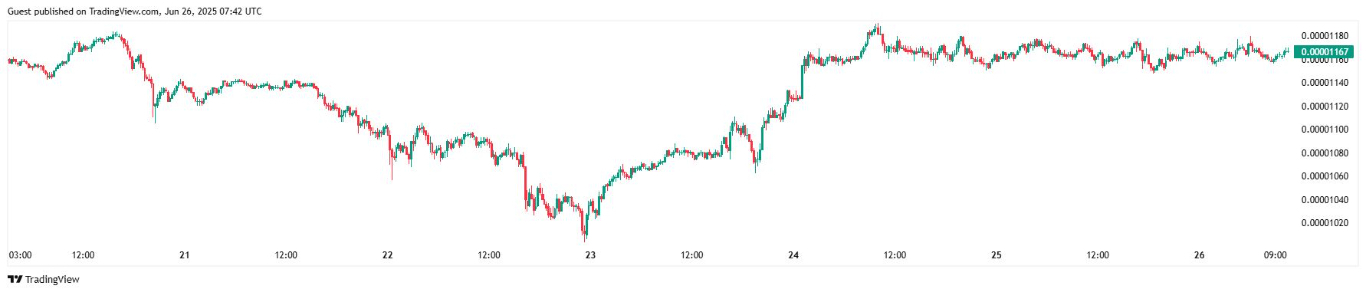

Shiba Inu (SHIB) is currently trading at approximately $0.00001168, which reflects a marginal intraday change of -0.00000010 (-0.86%) over the past 24 hours.

Technical Indicators Suggest Range-Bound Momentum

SHIB's current price structure reflects consolidation beneath a descending trendline stretching from early April. Despite multiple attempts, bulls have been unable to sustain a breakout above the psychologically significant $0.00001200 level.

The Relative Strength Index (RSI) hovers near 49 and signals a neutral momentum zone. This reading suggests neither overbought nor oversold conditions, highlighting the cautious sentiment that dominates SHIB’s current market behavior.

The Moving Average Convergence Divergence (MACD) remains flat, which shows a slight bearish bias as the signal line hovers just above the MACD line. While not decisively negative, this setup reflects the absence of strong bullish momentum needed for a breakout.

Adding to the neutral picture are the On-Balance Volume (OBV) and Elder’s Force Index (EFI). Both suggest weakening demand, with neither side establishing firm control. These indicators point to a tug-of-war between optimistic buyers hoping for a reversal and cautious sellers anticipating further downside.

SHIB is currently trading just below its 50-day EMA (around $0.00001185), which has acted as short-term resistance over the past several sessions. The 200-day EMA is positioned lower, around $0.00001030. This reflects a longer-term bullish trend, although short-term conviction remains weak.

Bollinger and Keltner Bands Hint at Imminent Breakout

A notable technical observation is narrowing Bollinger Bands, a classic precursor to increased volatility.

Combined with the tightening of the Keltner Channels, this setup often signals an upcoming breakout or breakdown. The direction of the move, however, remains uncertain until price action confirms either outcome.

To the upside, a breakout above $0.00001200, especially if accompanied by strong volume, could trigger a move toward the $0.00001244 resistance zone.

On the downside, a drop below $0.00001120 may accelerate the decline toward $0.00001060 to $0.00001080.

On-Chain Metrics Remain Mixed

SHIB’s on-chain activity throughout June has been subdued compared to earlier periods of retail-driven hype.

While token burns continue to reduce supply, the pace has slowed and has not significantly influenced short-term price movement. More importantly, address activity and transaction volume have decreased slightly, which shows reduced retail speculation.

That said, the Shiba Inu ecosystem continues to evolve. Shibarium, its Layer 2 solution, has seen gradual traction among developers.

If applications begin to launch and drive user activity, SHIB could see renewed demand and liquidity inflows.

Whale Activity Signals Accumulation

Despite the muted retail presence, on-chain data shows modest accumulation among whale addresses. Large holders have increased their positions over the past two weeks, which suggests a cautious yet confident approach to SHIB’s medium-term prospects.

Interestingly, this accumulation has not been aggressive. Whale positions have remained distributed across exchanges, which may indicate preparation for both long-term holds and potential exits based on how price action develops.

Key Support and Resistance Levels to Watch

Traders should closely monitor the following technical levels in the coming sessions:

Immediate resistance: around $0.00001185, followed by $0.00001218

Psychological barrier: near $0.00001250

Support zone: $0.00001120, with stronger support near $0.00001060

A strong close above $0.00001200 could confirm a bullish breakout, drawing in momentum traders with eyes on the next resistance near $0.00001290 to $0.00001330.

On the flip side, losing the $0.00001120 support level could invite heavier selling pressure and push SHIB toward multi-week lows.

Ready to trade our technical analysis on cryptocurrencies? Here’s our list of the best MT4 crypto brokers worth reviewing.