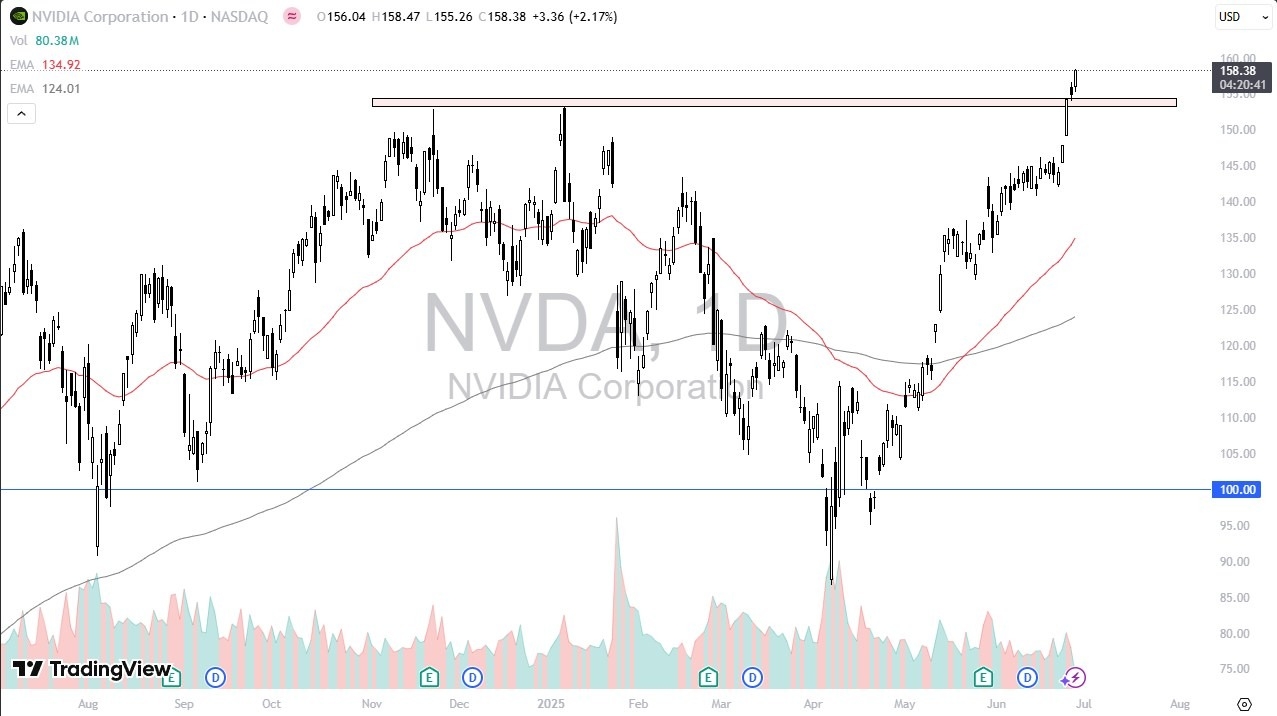

- Nvidia continues to be one of the better performing stocks in the United States, as we have seen Nvidia break out to all-time highs over the last couple of days.

- As I write this on Friday, we are still seeing a massive amount of momentum, and there are murmurs of a Chinese trade official suggesting that the United States and China have a trade agreement in place, which in and of itself probably makes Nvidia a little bit more attractive as well, although the details of any restrictions on Nvidia in China are still lacking.

Nonetheless, the one thing that we do have in this market is momentum, and quite frankly, a lot of the time that is enough. This is especially true with “hot stocks” like Nvidia, which is up over 60% since the market bottom. While the NASDAQ 100 and other indices have been extraordinarily impressive, it’s worth noting that Nvidia has led the way.

Top Forex Brokers

Keep in mind that Nvidia is still the major beneficiary of major AI infrastructure investments, with its demand outstripping its supply, suggesting that Nvidia still has a massive growth path going forward. It also has over $53.53 billion in cash, of 24% from the previous quarter. That being said, despite the fact that Nvidia has seen such a massive run, it appears that we are still very early in the cycle, and the drop during the tariff announcements may have been “a generational buying opportunity.”

Technical Analysis

Obviously, the technical analysis for Nvidia is very bullish, as the 50 Day EMA is all the way down at the $135 level and moving at roughly a 45° angle. We had the “golden cross” occur about a month ago, when the 50 Day EMA broke above the 200 Day EMA. Now that we have broken above massive resistance at the $155 level, since early the previous all-time high, we are now breaking out and entering an impulsive phase yet again. In other words, there’s just no way to short this market but if we do get some type of massive pullback, traders will be looking to pick up a bit of value here.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.