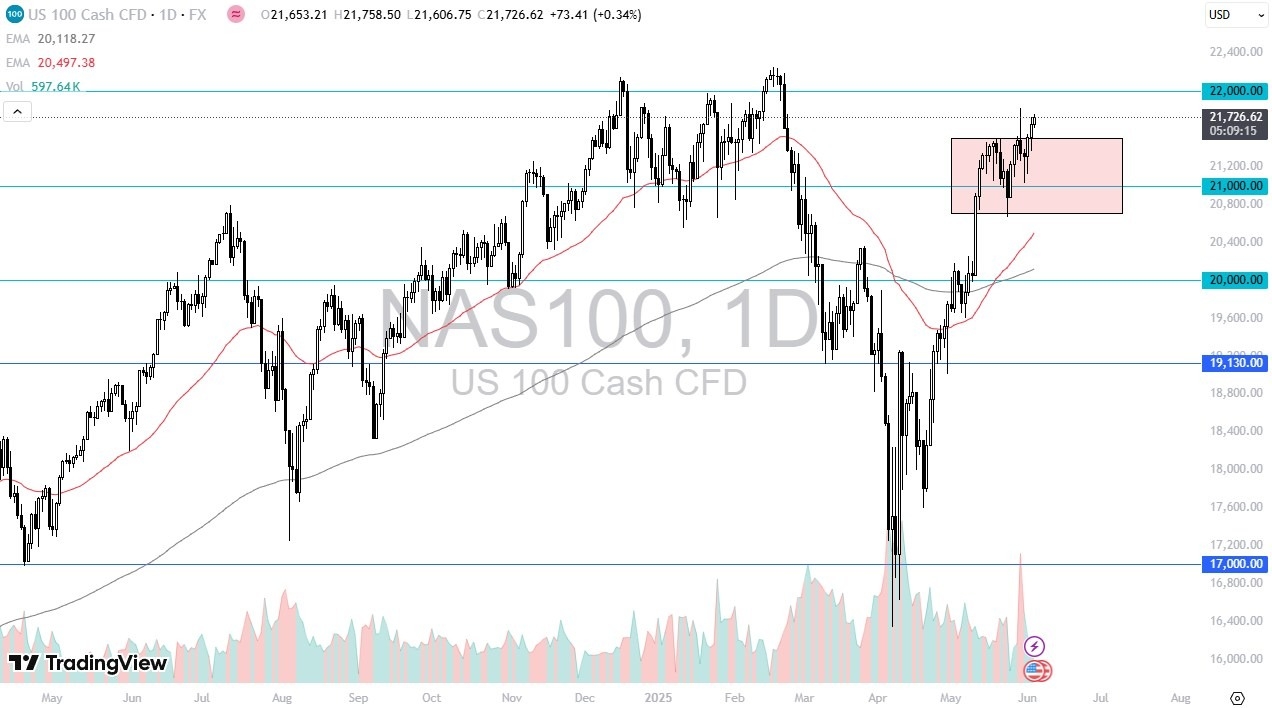

- During the Wednesday session we saw the NASDAQ 100 grind higher during the overnight session as well as the early hours in New York.

- The question now is whether or not we can continue rally from here?

- As I watched the futures market, it is worth noting that in the middle of the day we just seem a bit “stuck”, with a lot of volume coming into the market.

The question will be whether or not that volume is intended to drive prices higher, or is it intended to take profit and send prices lower?

Top Forex Brokers

Remember Announcements this Week

During the session on Wednesday, we have seen the ADP Non-Farm Employment numbers come out much lower than anticipated, with the US adding 37,000 jobs during the previous month, instead of the anticipated 111,000. Because of this, traders are starting to worry about the employment situation, and therefore Friday will be an interesting session as the Bureau of Labor Statistics Non-Farm Payroll number will be coming out. Adding fuel to the fire is the fact that the ISM Services PMI numbers came out at 49.9 instead of the 52.0 number expected.

The biggest problem we have now is the fact that there is an entire generation of traders that are banking on liquidity in order to drive stocks higher. They have no idea what it is like for companies actually have to earn their way to higher valuations, as the entire stock market has been about liquidity since the Great Financial Crisis. I suspect that traders will celebrate bad news before it’s all said and done, although a short-term pullback would make a certain amount of sense I suppose. That short-term pullback probably bought into as a potential value trade, at least until we break down below the 20,750 level. Breaking below that level opens up a move down to the 50 day EMA, and then the 20,000 level. On the upside, if we can break above the 22,000 level it’s only a matter of time before we break out to a fresh, new highs.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.