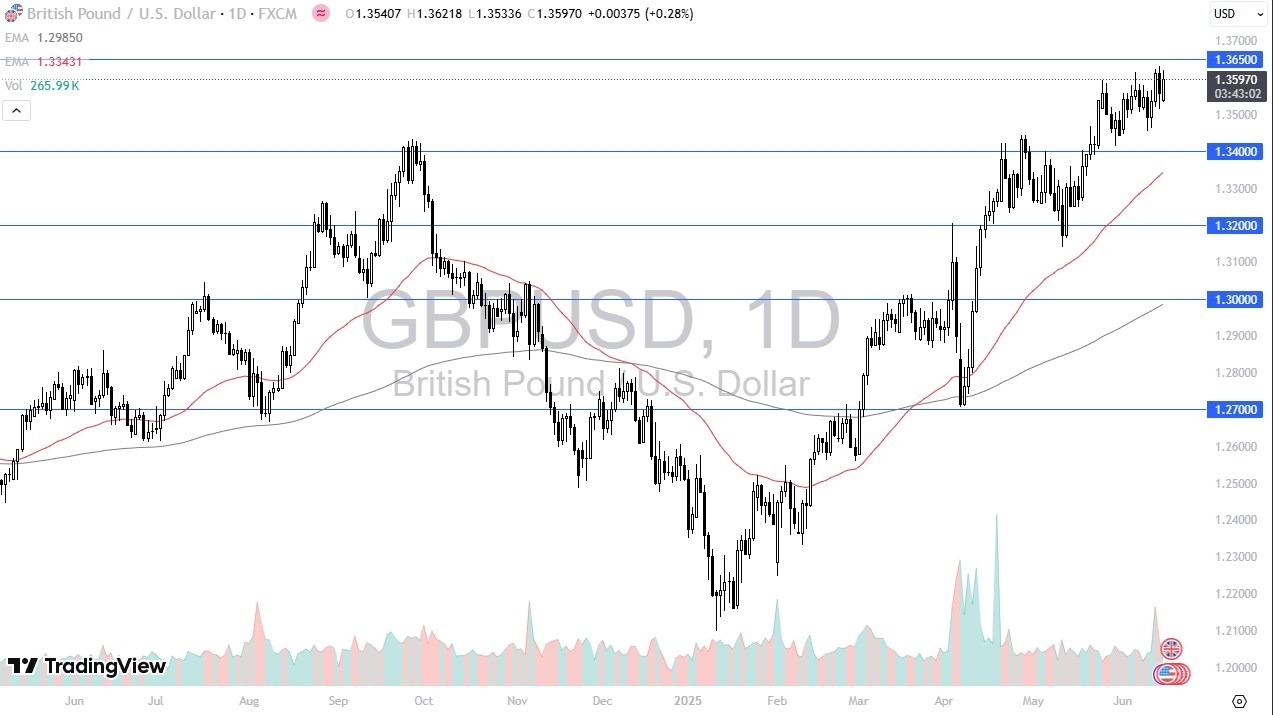

- The British pound has rallied quite nicely during the trading session here on Monday, but we still see the 1.3650 level above as a major barrier.

- And I think it is a market that you have to look at pullbacks as opportunities and therefore value in the British pound, if we can break above the 1.3650 level, then it opens up a move to much higher levels and perhaps to the 1.40 level.

- The market has plenty of support to at least the 1.34 level.

As long as we can stay above there, I think you have a situation where traders are willing to step in and take advantage of the momentum in the Pound, or maybe just massive weakness in the US dollar itself. This is something that would probably signal US dollar weakness in general at that point.

Top Regulated Brokers

On a Break Lower

Anything below there I think probably has a situation where then we start to look at the 50 day EMA, possibly the 1.32 level underneath. I'm not expecting a major breakdown at this point, but if momentum picks up meaningfully, we could see the emergence of a longer-term uptrend. For now, however, the market appears stuck in a sideways "barcode pattern," characterized by repetitive up-and-down movement without clear direction.

Top Regulated Brokers

But eventually we'll get some type of catalyst to break us out of this 250 point range. And once we do, we should have a 250 point move in either direction, although the timing is somewhat unknown. This would be the so-called “measured move” completing itself. That being said, there are a lot of moving pieces out there that we need to keep an eye on.

Ready to trade our GBP/USD Forex analysis? Here are the best regulated trading platforms UK to choose from.