- On Wednesday, we’ve seen the British pound fall apart during early trading, only to turn around and show signs of life again.

- At this point in time, the market looks as if it is going to try to form a bit of a hammer for the Tuesday session, and that of course would be a strong sign.

- That being said, we also get the CPI numbers coming out of the United States on Wednesday, which of course is potentially going to be important for where the US dollar goes next. Obviously, that will have a knock on here British pound more for it, depending on what the dollar is doing.

Technical Analysis

Top Regulated Brokers

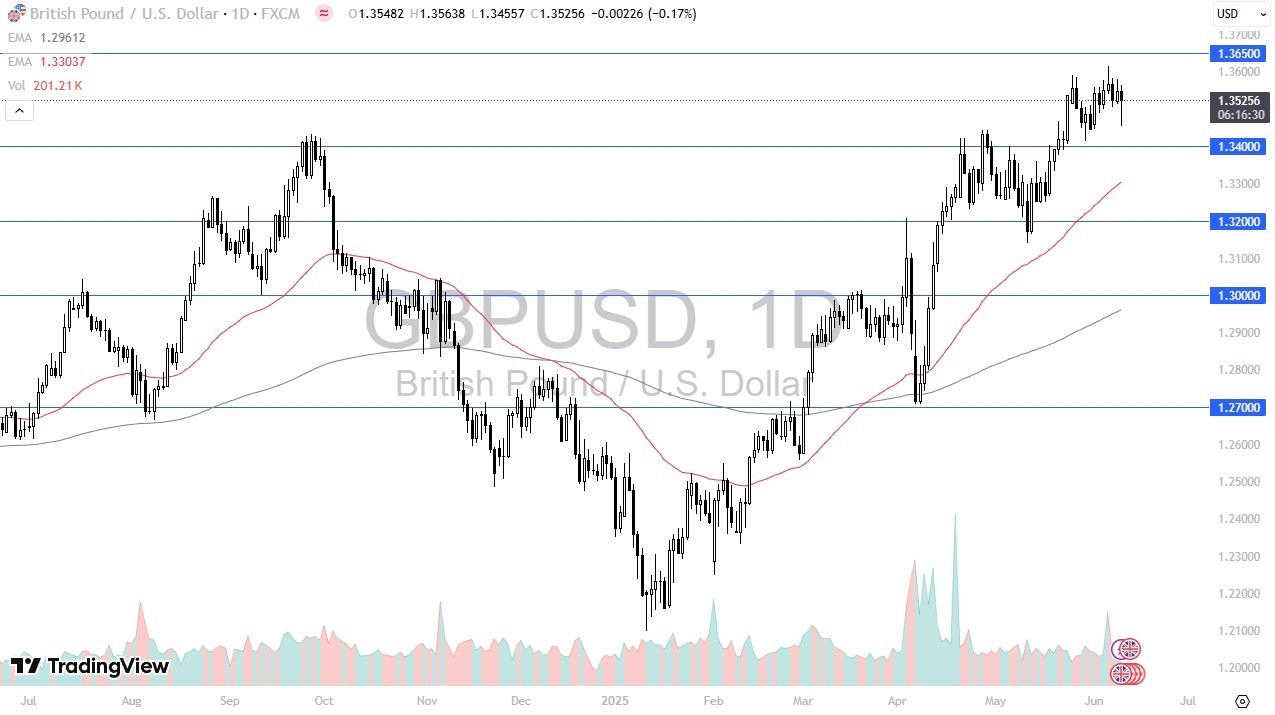

The technical analysis for the British pound obviously is bullish over the longer term, but we have a massive amount of resistance just above that is starting to cause several issues. The 1.3650 level is an area that’s been important multiple times, but quite frankly we can even break above the 1.36 level. Underneath current trading, we have the 1.34 level offering support. If we could break down there, the market could open up the possibility of a move down to the 1.33 level, where we find the 50 Day EMA, which is rising at the moment. Below there, we have the 1.32 level, which is the next major support level.

Ultimately, I think we are more likely than not to see a lot of sideways and choppy action, but ultimately, we will need some type of catalyst to get bigger move going. I think the CPI numbers could possibly be that, but be honest, we seem a little bit “stuck” at the moment, which this time of year can be somewhat difficult to deal with via a lack of involvement in the market as summertime can be quiet. In the short term, I think we are looking at this prism of the 150 pips range for short-term range bound traders.

Ready to trade our daily Forex GBP/USD analysis? We’ve made this UK forex brokers list for you to check out.