- The British pound has rallied a bit during the trading session on Wednesday, as we have recouped about 50% of the losses from the previous session.

- That being said, I still think there is a lot of work to do with turning things around, with the risk appetite being a major driver of where markets go.

- With this, I think you have to understand that this is a market that thrives on risk appetite in general, with the Swiss franc being a major safety currency.

Technical Analysis

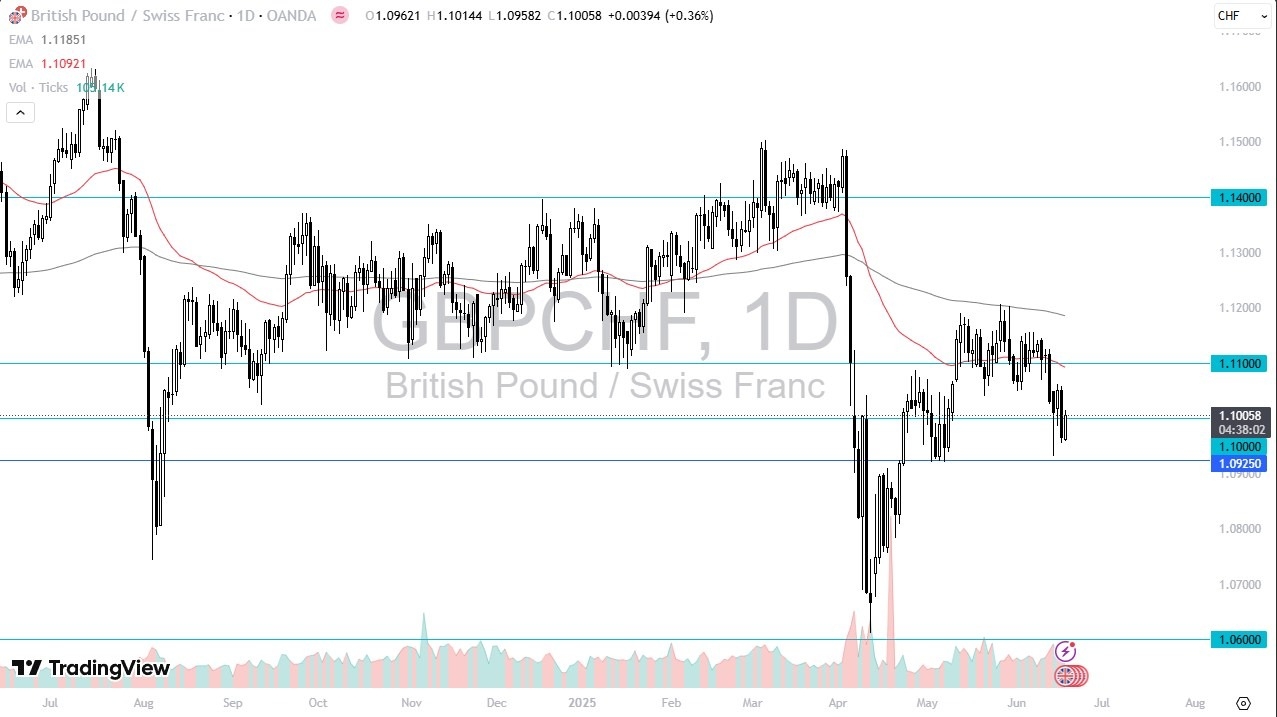

The technical analysis for this pair is somewhat sideways in the short term, but the fact that we had sold off so viciously on Tuesday suggest that there are a lot of concerns out there. Furthermore, the candlestick from Thursday of last year ended up forming a massive hammer. Breaking down below that, and subsequently the crucial 1.09258 level, could kick off a major selloff at this point in time. In that environment, I could see the British pound dropping down to 1.06 CHF, an area that’s offered support previously.

Top Forex Brokers

On the other hand, if we can rally from here and break above the 1.1060 level, it opens up the pathway to the 1.11 CHF level. Anything above there would open up the possibility of a move to the 200 Day EMA near the 1.12 CHF level, which has been previous resistance.

Ultimately, this is a market that I think is on the precipice of making a bigger move, and at this point in time I’m watching this market very closely. In the short term, it’s possible that we will go back and forth, but I also recognize that the pair does tend to be rather explosive when it comes to the idea of good and bad news pushing it around, and I do think that in the short term we are sideways, but longer term we have a couple of levels in the form of 1.11 and 1.0925 that could give us clues for bigger movers.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.