- Thursday was Juneteenth in the United States, which of course is a federal holiday.

- Because of this, most American traders were not involved in the markets, and it suggests that we have a scenario where traders are going to be somewhat shrugging their shoulders based on the lack of liquidity.

- However, the candlestick from the Wednesday session was of course very important as well.

Technical Analysis

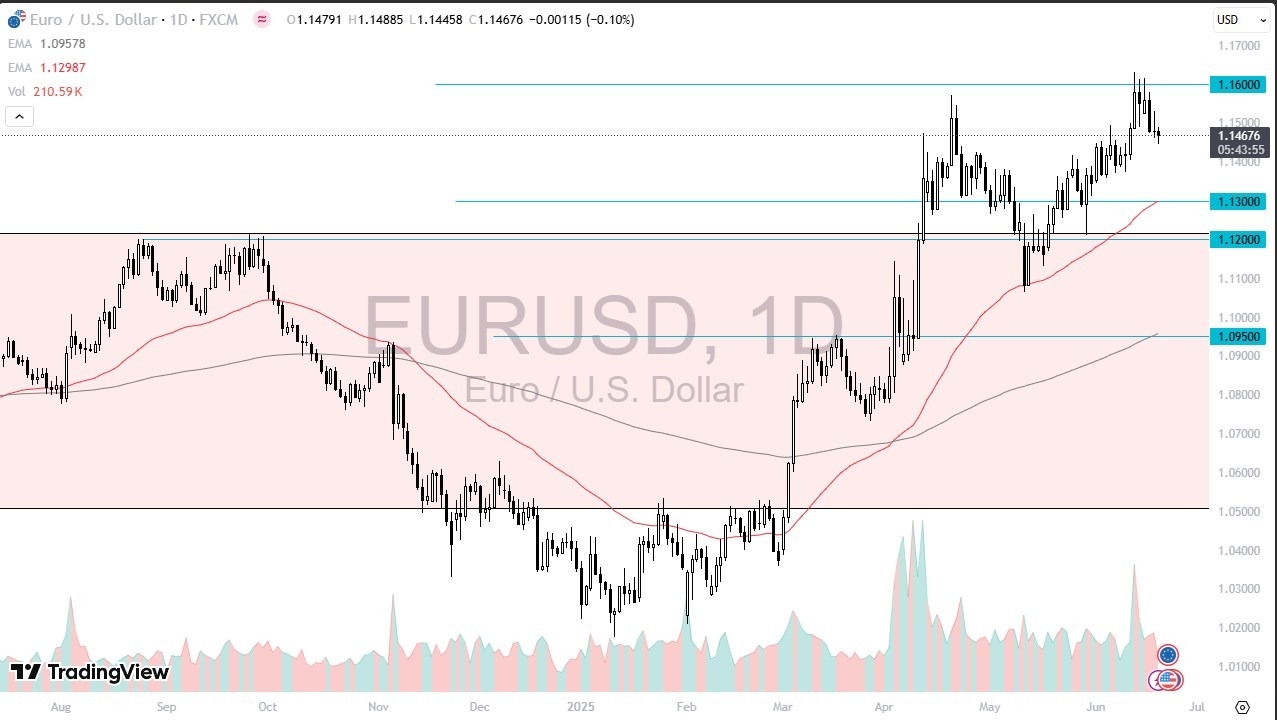

The technical analysis for this market is still bullish overall, but the fact that we ended up forming a shooting star on Wednesday, breaking down below the bottom of the candlestick opens up the possibility of a move down to the 1.14 level. The 1.14 level being broken to the downside of course opens up the possibility of a move to the 1.13 level, where we currently see the 50 Day EMA residing.

Top Regulated Brokers

On the upside, the 1.16 level is a major barrier, and therefore we will have to watch that very closely. If the market were to break above there, then the Euro would really start to take off to the upside. I think at this point in time though, we are more or less in a consolidation area, and we are trying to sort out where to go next. This is a pair that will be mainly driven by the overall attitude of the US dollar, which of course is considered to be a “safety currency”, and therefore the fact that we have so much going on in the Middle East in Ukraine at the moment, as well as all of the trade war rhetoric, makes it very likely that the US dollar will continue to be a big mover over the next foreseeable trading sessions.

When you look at the area that we are in right now, the 1.13 level being the floor in the 1.16 level being the ceiling, we are fairly close to the middle. Because of this, I feel that we are essentially “killing time” waiting for some type of clarity. I also am fully cognizant of the fact that it’s probably easier for this pair to rise and fall, but whether or not there is any real conviction is a completely different question.

Ready to trade our EUR/USD analysis and predictions? Here are the best European brokers to choose from.