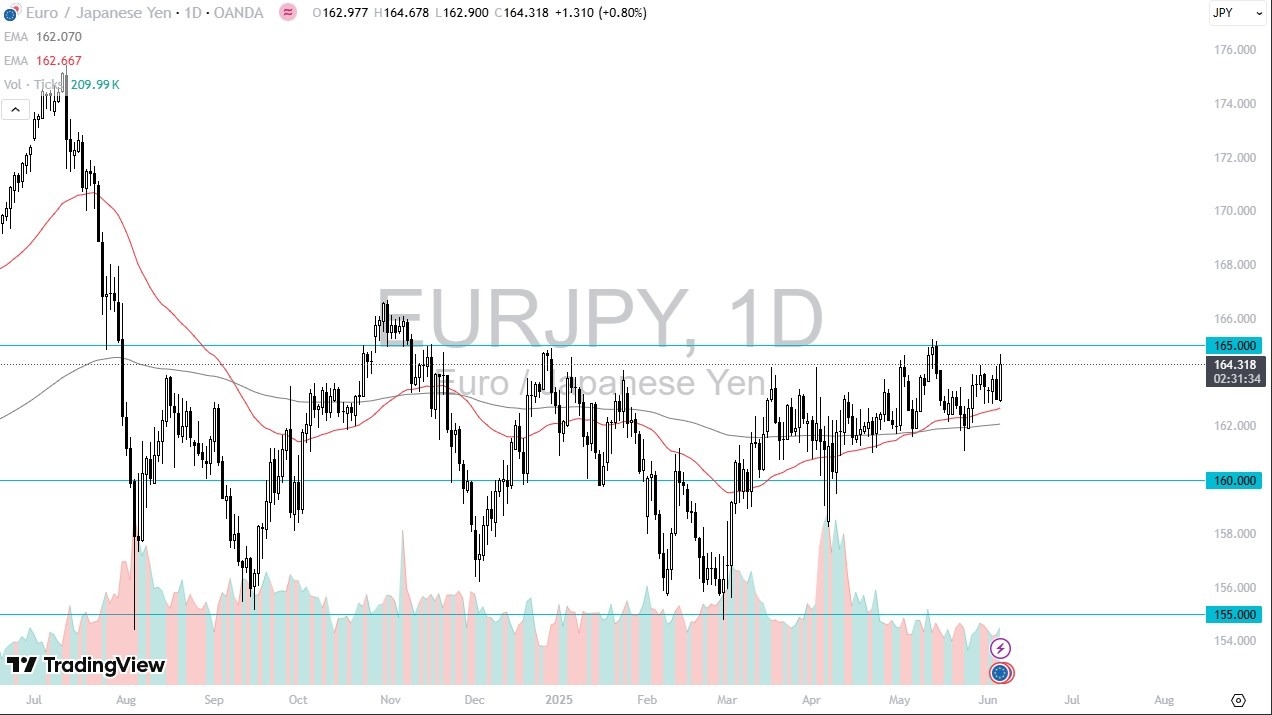

- The Euro has rallied rather significantly during the trading session on Thursday against the Japanese Yen as we continue to threaten the crucial 165 Yen level.

- If we can break above this area, then we may go much higher, but it is worth noting that it's been very difficult to get beyond this level.

- That being said, we also have an area of about 100 pips that's been very noisy.

So, I do think this is very difficult to overcome. I don't think it's impossible. I just think it's difficult. And that's something to keep in the back of your mind. With that being the case, I am looking to short-term pullbacks as potential buying opportunities in an environment that quite frankly is pretty confusing at times as we just don't seem to have any real wherewithal on any of these moves. We're basically doing what is akin to printing a barcode here.

Top Forex Brokers

Watching the 165 Handle

That being said though, I am watching the 165 yen level, cause it could lead to much bigger things. I would look at the rest of the Japanese yen related pairs and see how the yen's doing against other currencies as well, as I don't think this is just a Euro thing. I think this is every bit as much a yen related to trade than a euro related trade.

I think this has a lot to with the Bank of Japan not being able to tighten monetary policy soon. And of course, the problems in the Japanese bond market are well known, while Europe seems to be doing at least fairly well, although Germany is probably heading back into a recession before it's all said and done. Ultimately, this is a market that I'm watching for a breakout, we just don't have it quite yet.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.