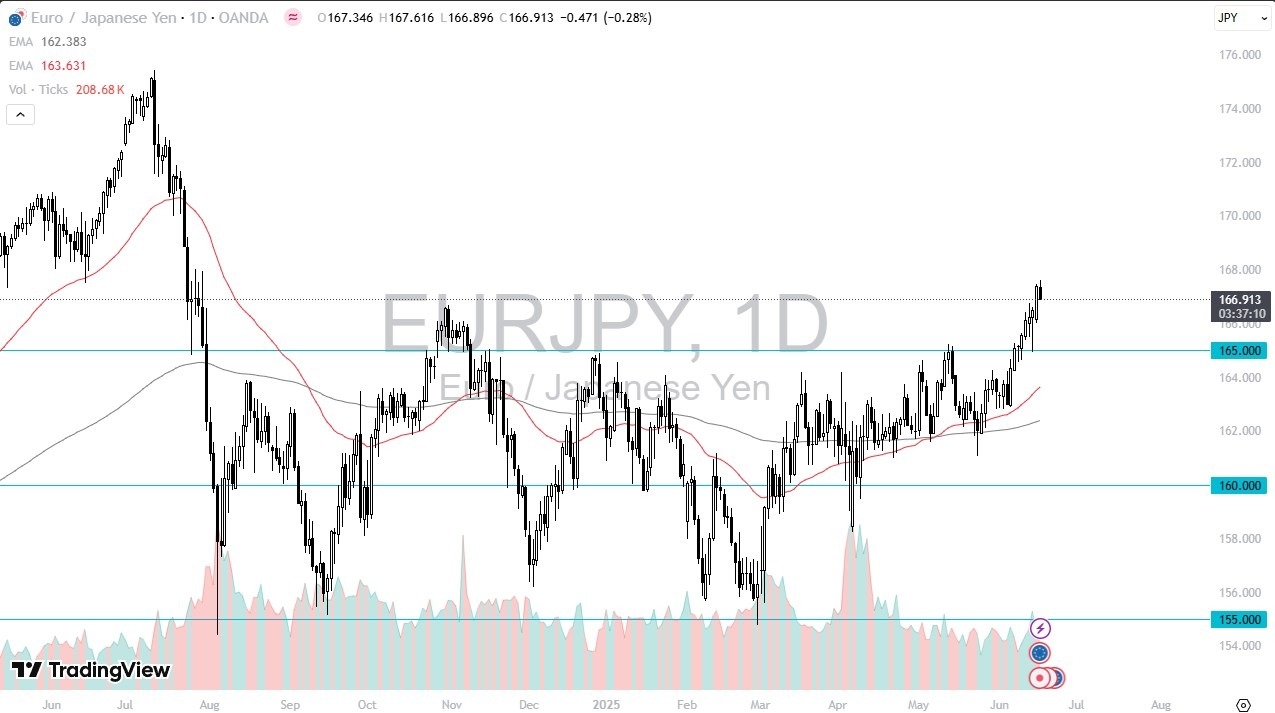

- The Euro had initially tried to rally a bit during the course of the trading session on Tuesday, only to collapse and start falling pretty significantly.

- That being said, we are right in an area that previously had been fairly important resistance.

- So, I'm watching the 168 yen level for a potential breakout.

If we can get above there, then I do think that the euro can really take off. The problem, of course, that we have is there's a very massive and very real risk off type of environment out there just waiting to happen with the Iranian conflict with Israel. And now, possibly other countries as well. In other words, things could get a lot worse with risk appetite in not only this market, but most.

Top Forex Brokers

Buying on the Dip? Maybe.

So, with that being the case, I think we have to look at this through the prism of buying on the dip situation, unless the Middle East gets even worse. Currently, I believe that the 165 yen level is an area that people are watching very closely as it has been both support and resistance. And I think a lot of market memory will be found there. It's also large, round psychologically significant figure as well.

With this being the case, I think you have to look at this through the attitude of trying to find value in euros against Japanese yen. And it's probably worth noting that the interest rate differential favors Europe, and the Bank of Japan is very likely going to have to step in and do something to protect the Japanese bond market, which has looked atrocious as of late. 165 yen is my line in the sand, but as things stand right now, I'm looking to buy dips, unless something changes in the overall attitude of markets.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.