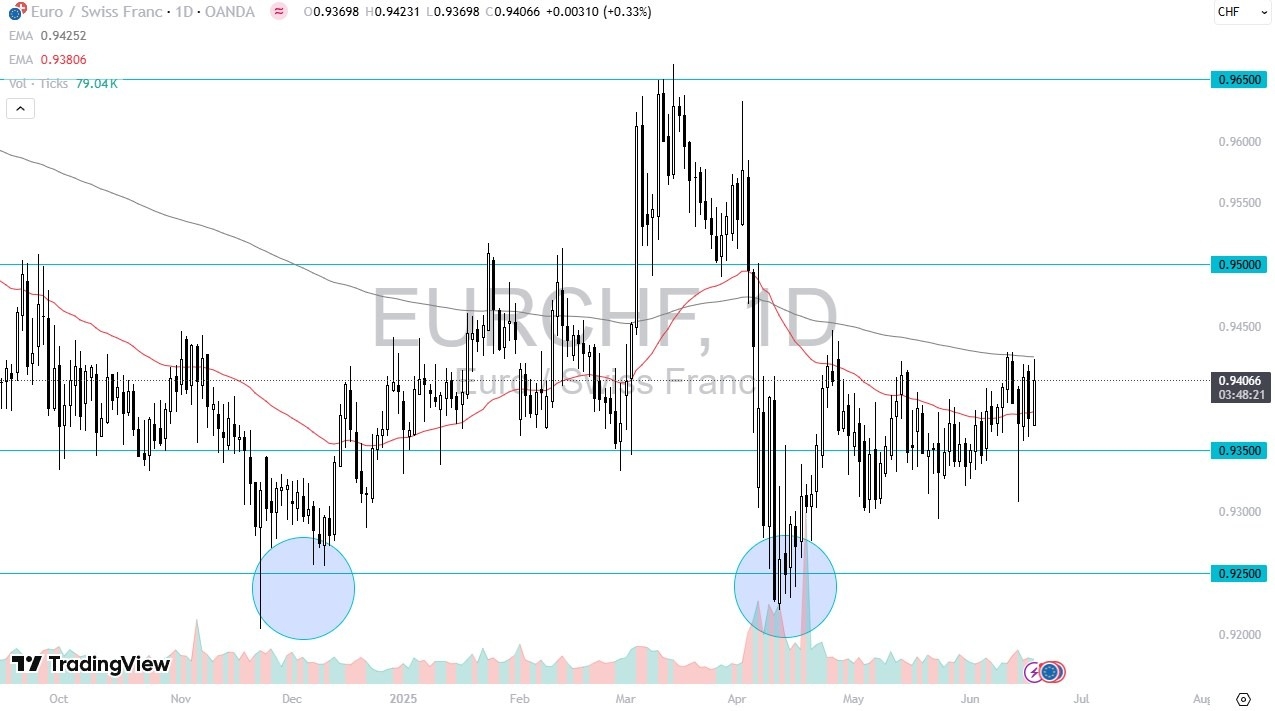

- The euro rallied rather significantly during the trading session here on Wednesday, reaching the crucial 200 day EMA yet again.

- The 200 day EMA is an indicator that a lot of people will be watching very closely.

- With this, I think you have to look at this as a market that is trying to really take off to the upside.

And if we can clear this 200 day EMA, the 0.95 level might be your next target. The reason I'm doing analysis on this pair right now is that the Euro against the Swiss franc is a very important risk appetite signal. As risk appetite continues to climb around the world, as a general rule, you see the Euro climb against the Swiss franc.

Top Forex Brokers

Pullback Incoming?

The market pulling back from here could open up a move down to the 0.9350 level, possibly even 0.93. If we break down below there, there's probably a lot of risk aversion out there. And my suspicion is you'll probably know why. On the other hand, if we get peace breaking out or just a generally good attitude around the world with multiple things at the same time, this is a pair that should take off.

Keep in mind that the Swiss National Bank has kept rates extraordinarily low and typically will do so for the long term. The Europeans have cut rates, but in the last meeting a few weeks ago, I believe, we had seen the ECB suggest that perhaps they're right about where they need to be as far as monetary policy. And if that's the case, then the euro becomes more attractive over the longer term. All things being equal. And that's the kicker here. All things being equal need to be positive. If so, this might be a nice sleeper trade for a really big move over the longer term.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.