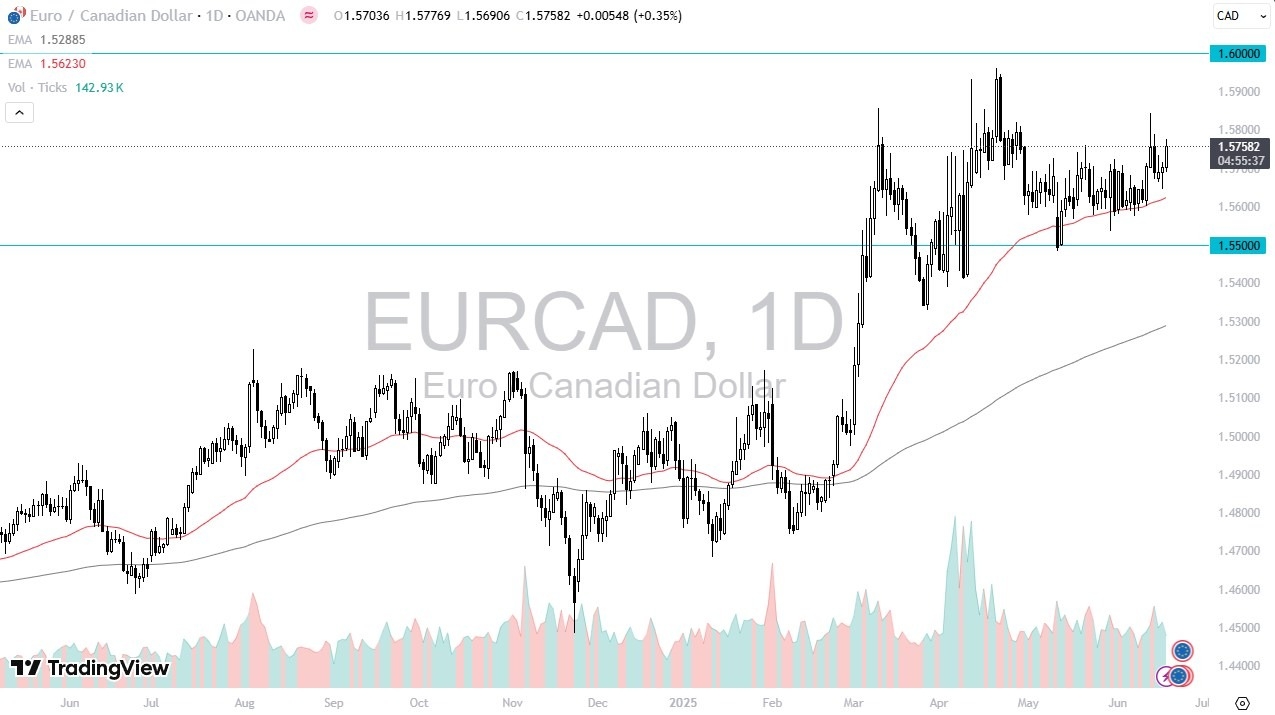

- During the trading session on Wednesday, we’ve seen the Euro rally quite nicely against the Canadian dollar, as we are in the midst of a larger consolidation area.

- This is a market that is looking at the 1.58 level as a potential barrier, as the last several sessions have seen selling pressure in that area.

- Furthermore, the market is likely to continue to see a lot of volatility, because this is an environment that is not conducive to easy trading in just about any asset, and not just this currency pair.

Technical Analysis

Top Forex Brokers

The technical analysis for this pair is one of the consolidation, but with a slight upward twist. The 50 Day EMA, sitting just above the 1.56 level and rising, has offered a certain amount of support in general. This has been the case for a couple of weeks, and at this point it almost acts as if it is a bit of a trend line. Anything below that level probably opens up a move down to the 1.55 level, which is a large, round, psychologically significant figure, and an area that has been very important multiple times.

To the upside, if we can break above the 1.58 level on a daily close, then it’s possible that we could go looking to the 1.5950 level. The 1.60 level above there is likely to offer a significant amount of resistance and a bit of a barrier, if we can break above there, then I think you could see a bigger move, but really at this point in time is going to be difficult for the Euro to break above there.

Ultimately, I believe that this is a market that remains “buy on the dips”, but I also recognize that the market will be very volatile. The Canadian dollar is obviously influenced by crude oil, but we also have the fact that the Euro has been relatively strong against a multitude currencies. I think this remains a range bound market that a lot of short-term back and forth type of traders will love.

Ready to trade our CAD Forex forecast? Here’s some of the top trading account in Canada to check out