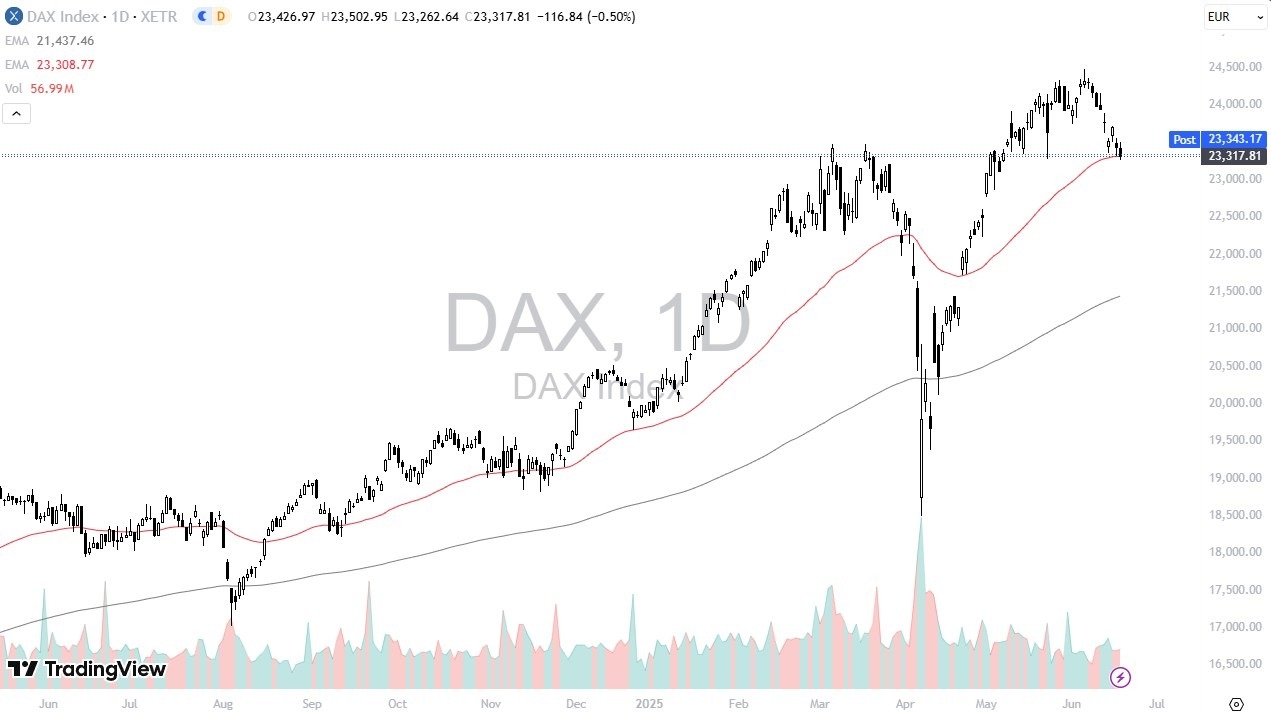

- The DAX has dropped a bit during the trading session on Wednesday in open cry trading, reaching the crucial 50 Day EMA.

- The 50 Day EMA also sits right around the €23,300 level, which is an area that has also been important multiple times, so I think you need to look at this through the prism of a market that has been very bullish but is taken a bit of pullback in order to offer some value as we are testing the same area as previous resistance.

Trend Still Intact

The trend is still very intact in the text, and I think there is really nothing on this chart that would suggest otherwise. All things being equal, I do think that the buyers will return sooner rather than later. The 50 Day EMA is an indicator that a lot of people will be paying attention to, and of course the DAX is the first place people look to put money in when trying to invest in the European Union overall. Breaking down below then opens up the potential move to the €23,000 level, and then the €22,500 level, filling a gap from early May.

Top Forex Brokers

I have no interest in shorting the DAX, but if we start to see this market selloff, what I will probably do is start shorting other European indices that are much more vulnerable. What I mean by this is that I might start shorting Spanish, Italian, and other indices around the EU which aren’t quite as “blue-chip” or considered to be “as safe as Germany.

The text typically will quite often lead other indices in whatever direction they are going, so even if you are not looking to trade the text itself, it’s a wonderful indicator for other things such as the IBEX, AMX, MIB, and others on the continent. That being said, it’s probably worth noting that the indices around the world overall seem to be fairly positive.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.