- The crude oil market gapped lower during the Tuesday open, as we continue to see a lot of noisy behavior out there, as traders are trying to get a grip on the crude oil market as Israel and Iran continue to bomb each other.

- Ultimately, this is a market that previously has seen some bullish behavior, and now it looks as if we are just finding a reason to finally go higher based on this war.

Technical Analysis

Top Regulated Brokers

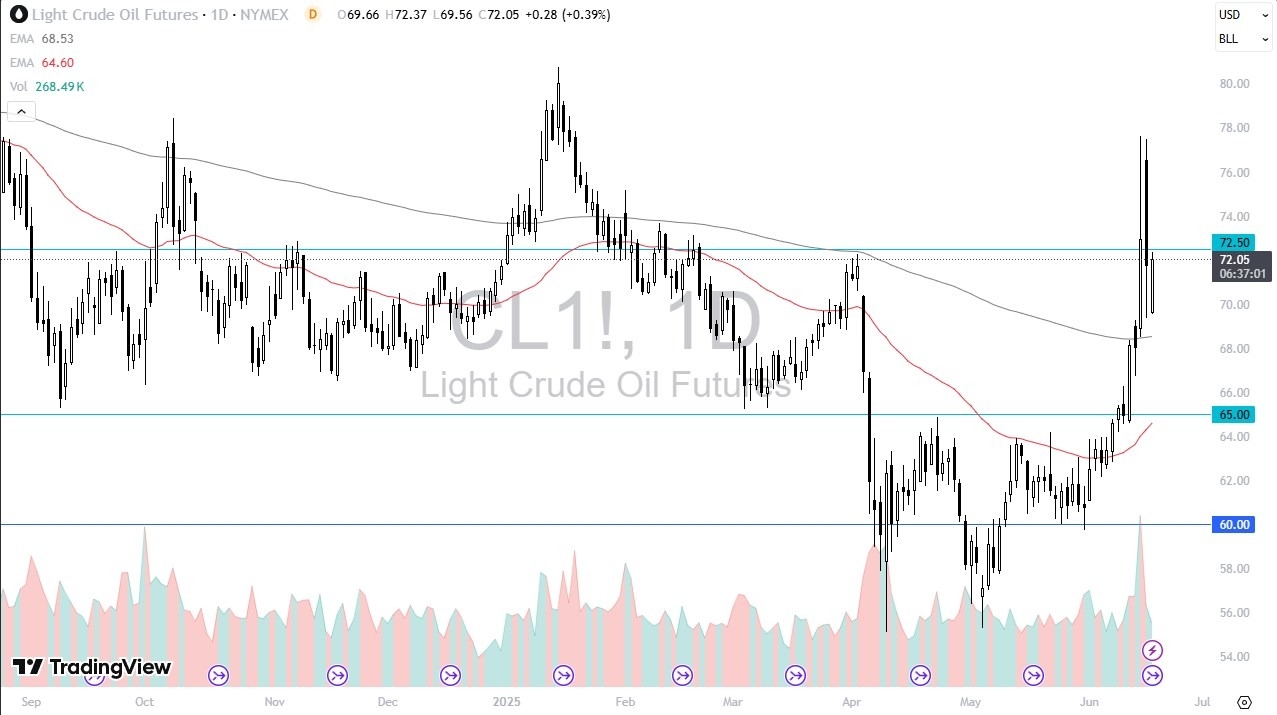

The technical analysis for this market is obviously very bullish, but you should also consider the fact that the gap lower to kick off the session isn’t a good sign, but the fact that we then turned right back around to recapture the positivity tells me just how much underlying pressure there is when it comes to this market. I have no interest in trying to get short of the oil market, mainly due to everything that’s going on at the same time, and it would only take one quick headline to turn things completely around.

The 200 Day EMA is sitting just below trading at the moment, and it suggests that we are going to continue to see that as an area of interest as well, especially as we had bounced from just above that level. All things being equal, this is a market that I think continues to be very noisy, but we had been forming a basing pattern long before this war kicked off, so this was just the excuse that we needed. Because of this, I think that the market is also looking at the fact that higher demand is probably coming in the form of summer driving, so that is something worth paying attention to also.

If we were to break down below the 200 Day EMA, that would be a fairly negative turn of events and could send this market down to the $65 level, where the previous neckline of an inverted head and shoulders set, and also where the 50 Day EMA currently resides. Because of this, I think that your “floor in the market” if we do start falling.

Ready to trade our Crude oil Forex analysis? We’ve made a list of the best Forex Oil trading platforms worth trading with.