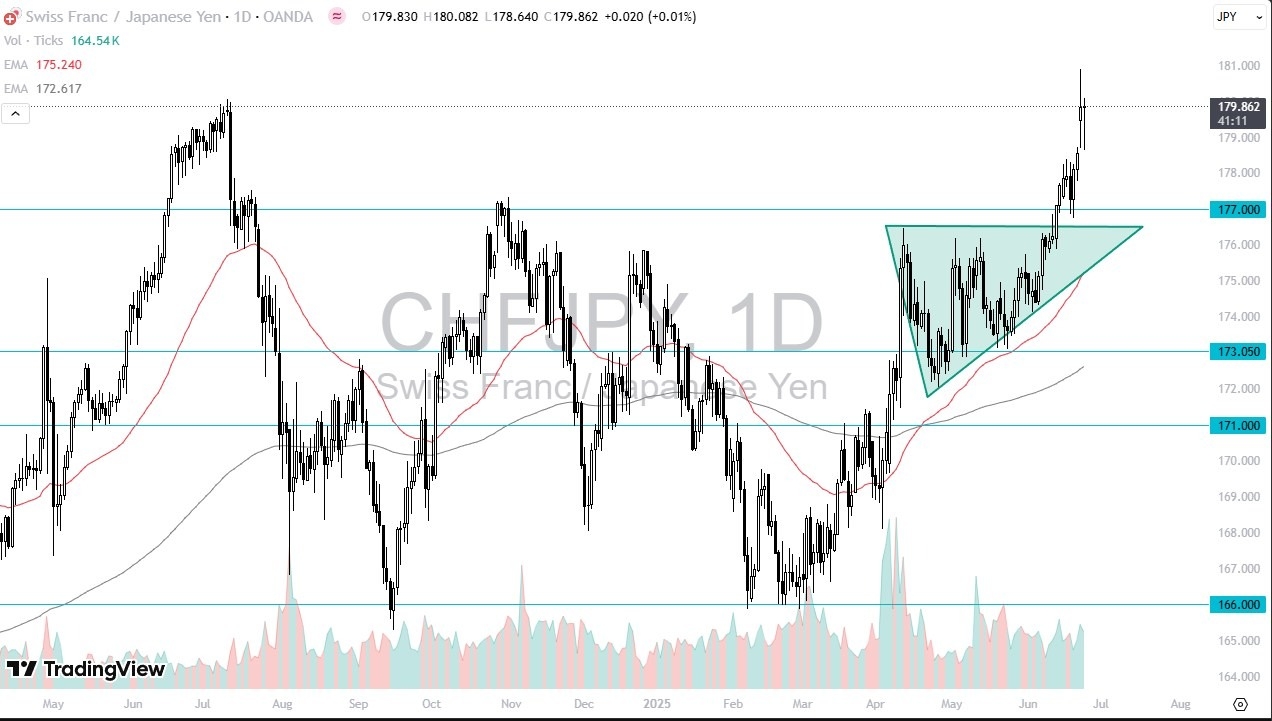

Potential trade:

- On a move above 181 yen, I am buying with a stop loss at 179.50, and a target of 184.

The Swiss franc against the Japanese yen is a pair that I watch quite closely due to the fact that both of these are considered to be funding currencies and something that people use a lot for carry trades. Simply put, it's not so much a matter of trading this particular pair directly, but it's getting an idea as to which one of the currencies is weaker than the other. I think it's obvious here that the Swiss franc is infinitely stronger than the Japanese yen. So, if we get more risk on in other pairs, I want to short the yen. I don't want to short the Swiss franc for obvious reasons.

If You Choose to Trade in This Market

Top Regulated Brokers

That being said, if you do choose to trade this pair, and I have before, it wouldn't be the first time. I think at this point in time, the 181 yen level is a major barrier. If we can break above there, then this pair continues to go higher. short-term pullbacks could open up the possibility of support near the 177 yen level as we had broken out of a major ascending triangle and would be seeing a certain amount of market memory attached to it as it was resistance in his now support. So, I think traders will be watching that very closely. We are a little extended, but that's okay.

This is a pair that, like I said, isn't necessarily heavily traded, but it is an excellent tertiary indicator for other trades. For example, trading the dollar against the Japanese yen or the Swiss franc. If the US dollar is weakening, and you are choosing a safety currency such as the franc or the yen. Clearly, the franc is the stronger of the two, so you have to put all of this together. A break above 181 yen has this market moving to the upside.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.