After retesting support at $100,000 last Wednesday – in what many analysts called a healthy correction following its record high of $112,000 on May 22 – Bitcoin (BTC) rallied more than 10% over 4 days to hit $110,635 on Monday before bulls paused to catch their breath.

BTC/USD 1-Day Chart. Source: TradingView

A survey of analysts on X shows a widespread consensus that it's only a matter of time before King Crypto rallies to a new all-time high as tailwinds are starting to stack in its favor.

Along with continued BTC purchases by Strategy and a growing number of companies adding it to their treasuries, ETF demand also continues to rise, with BlackRock’s IBIT recently becoming the fastest ETF in history to surpass $70 billion in assets under management.

$IBIT just blew through $70b and is now the fastest ETF to ever hit that mark in only 341 days, which is 5x faster than the old record held by GLD of 1,691 days. Nice chart from @JackiWang17 pic.twitter.com/5VeGT9twpQ

— Eric Balchunas (@EricBalchunas) June 9, 2025

According to market analyst Moustache, amid its push for a new ATH, the monthly RSI for Bitcoin is now in oversold territory, a development that has previously been followed by “the best time of the entire cycle.”

#Bitcoin

— ???????ⓗ? ? (@el_crypto_prof) June 10, 2025

Monthly RSI of $BTC is moving into oversold territory.??

Whenever this happened in the last 13 years, we saw the best time of the entire cycle in the following weeks and months. pic.twitter.com/VIyn8mEILS

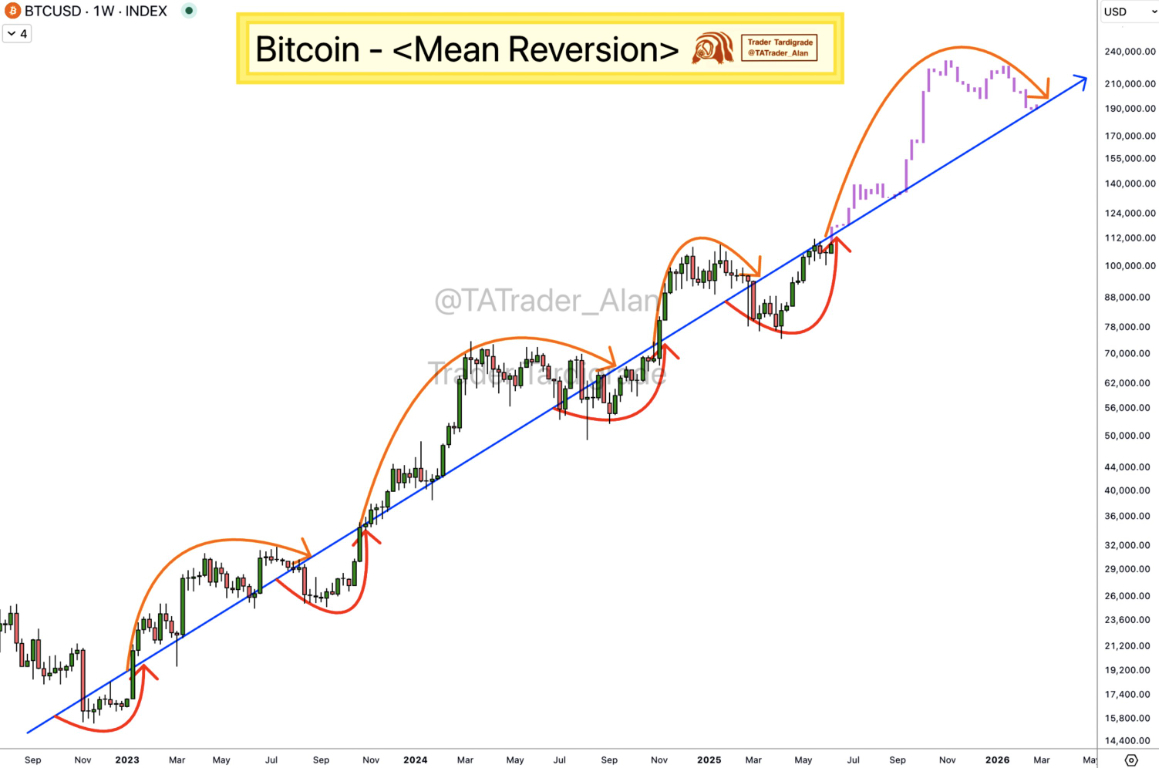

Trader Tardigrade posted the following chart highlighting that “Bitcoin has demonstrated a perfect Mean Reversion central line along its uptrend since late 2023, spanning 2.5 years on the weekly chart.”

BTC/USD 1-Week Chart. Source: Trader Tardigrade

“$BTC has recently returned just below this central line,” they added. “If it breaks through, it could rise to $230,000 before pulling back to the central line.”

And on-chain data shows that one whale is betting on a rally higher coming sooner rather than later, opening a $300 million long on BTC with 20x leverage.

A whale just opened a $300M long on $BTC with 20x leverage...

— Greg Miller (@greg_miller05) June 10, 2025

Does he know something we don’t? pic.twitter.com/KfCB0Xbfqz

With trade war escalations possible amid broader economic concerns and heightened geopolitical tensions, whether such exuberant bullishness is well warranted or sorely misguided remains to be seen.

At the time of writing, Bitcoin trades at $109,675, an increase of 3.75% on the 7-day chart.

Ethereum Gains on Rising Institutional Adoption

Crypto’s second-ranked token by market cap, Ether (ETH), is also exciting market watchers as it hit a 15-week high of $2,827 on Tuesday and looks poised to break out of the consolidation range it's been in since May 10 and challenge resistance at $3,000.

ETH/USD 1-Day Chart. Source: TradingView

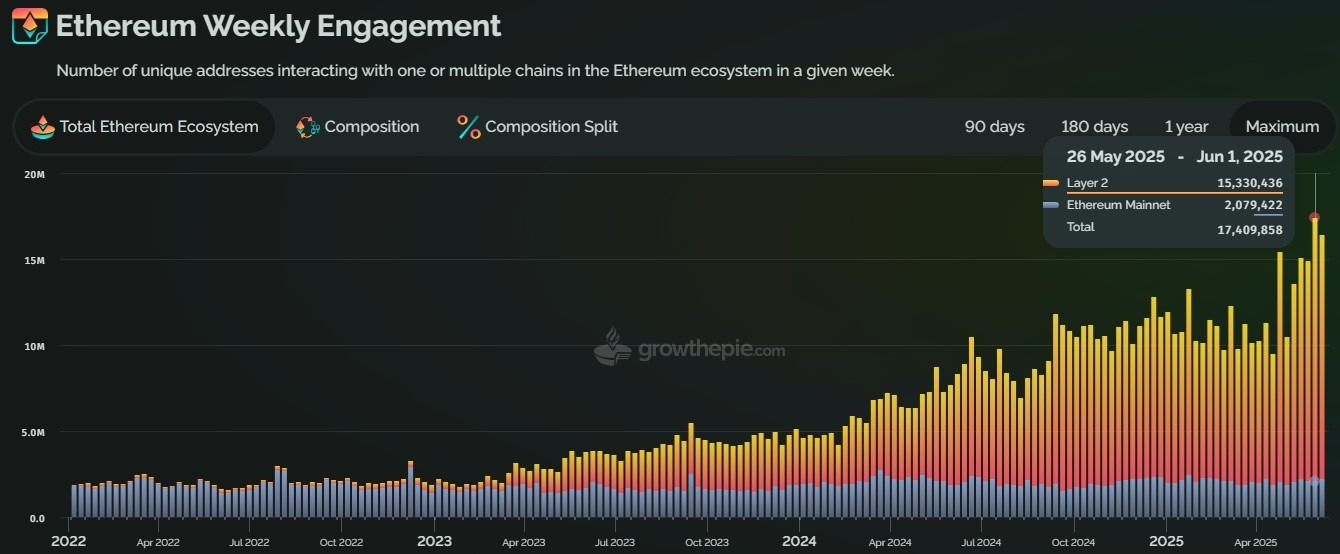

Along with Ether’s rising price, the Ethereum network is also experiencing increased adoption, with the number of unique active addresses hitting an all-time high of 17.4 million in early June.

Ethereum Weekly Address Engagement Chart. Source: growthepie

The network also set a new record in terms of the amount of Ether staked on the Beacon Chain, hitting 34.8 million ETH on Sunday, eclipsing the previous high on Nov. 10, 2024.

After remaining relatively stable above 33 million staked ETH for the past year, activity started picking up momentum in early June – suggesting that hodlers are not interested in selling at the current price and would rather earn a yield and increase their stack instead.

According to Dune Analytics, the amount of Ether locked up amounts to 28.7% of the current circulating supply, and that number could soon surge higher as the industry anticipates the approval of spot Ether ETF staking by the US SEC.

Following the recent filing by ETF provider REX Shares that used “regulatory workarounds” to include staking capabilities, Bloomberg ETF analyst Jeff Seyffart suggested that staked Ether ETFs could debut “within the next few weeks.”

And institutions seem to have gotten the memo on Ether’s promise, as BlackRock’s iShares Ethereum Trust (ETHA) has seen 23 consecutive trading days of inflows, according to data provided by Farside Investors.

The latest digital asset fund flows weekly report from CoinShares shows that Ether led all assets in inflows last week, with deposits totaling $224 million, further indicating that institutional investors are increasing their exposure to the top smart contract platform.

As a result of the growing institutional adoption, analysts across X are now in full on bull mode for Ether, predicting a new all-time high soon on the way to price discovery and a potential $10,000 ETH.

Ethereum is back in beast mode.$ETH smashed through $1.5K and $2.2K like paper.

— Merlijn The Trader (@MerlijnTrader) June 10, 2025

Now it’s staring down $4K.

Next stop? Price discovery.

$10K isn’t a dream it’s a setup. pic.twitter.com/ldU1wLFeVx

At the time of writing, Ether trades at $2,793, an increase of 5.9% on the 7-day chart.