- The Australian dollar initially plunged at the open on Monday as you would expect, due to all of the “risk off” headlines out there with the Americans bombing the Iranian nuclear facilities, and the expected retaliation by the Iranians.

- The Australian dollar is highly sensitive to risk appetite, so this all ended up tracking about how you would expect.

- That being said, we have turned around quite drastically since then, and it looks as if the Australian dollar has some life in it.

Technical Analysis

The technical analysis for this pair is very mixed at the moment, which makes sense considering that the world is very erratic place currently. The US dollar is considered to be a “safety currency”, so it’s not a huge surprise to see that it has caught a bit of a bid against currency such as the Australian dollar in the New Zealand dollar.

Top Regulated Brokers

However, as the day has gone on people have started to suggest and perhaps even believe that there will be a major escalation in the Middle East. Whether or not that is actually true remains to be seen of course, but ultimately it looks like a market that has quite a bit of belief in the idea that perhaps things will settle down.

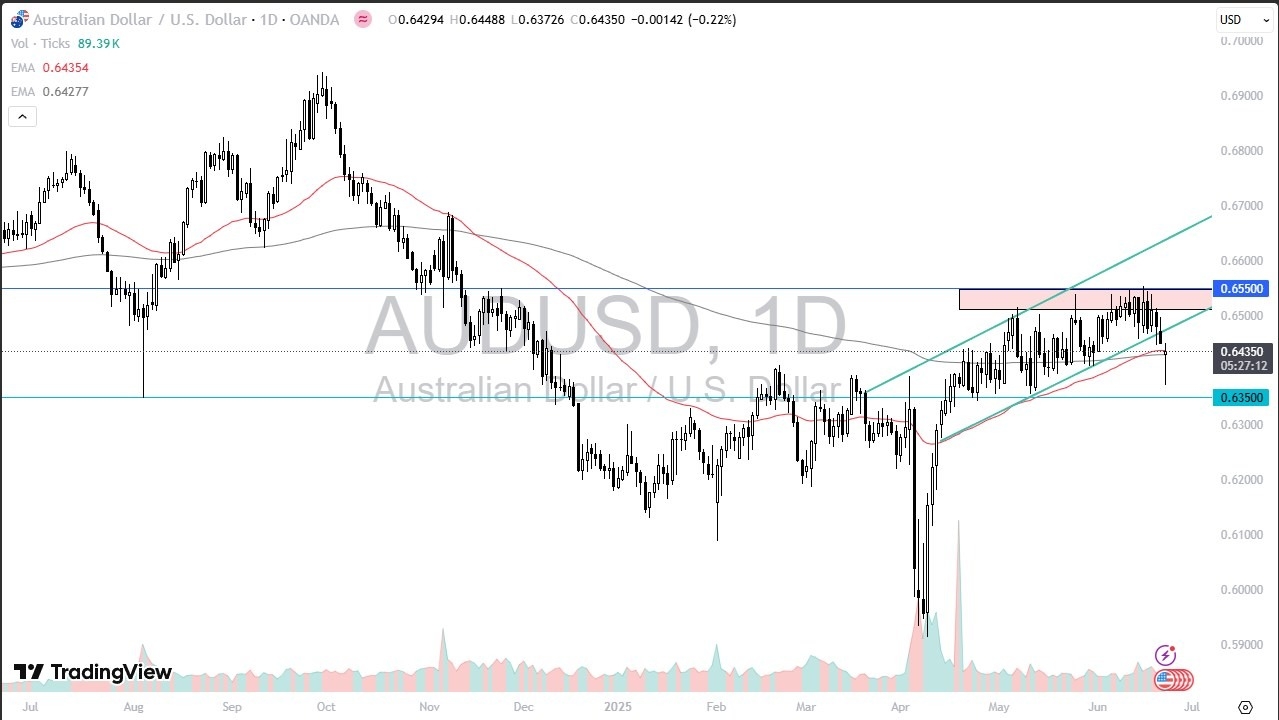

Previously, we had been in a major grinding up trending channel, and we even managed to break down below the 50 Day EMA, which is where we are as I do this analysis. If we can break back above there, we might make a run toward the 0.65 level, a large, round, psychologically significant figure. That of course will attract a certain amount of attention, and it has been a bit like a ceiling at the moment. On the other hand, if we break back below the bottom of the daily range for the trading session on Monday, then we could open up a move down to the 0.6350 level and below. This is all about risk appetite at this point in time.

Ready to trade our Forex daily analysis and predictions? Check out the largest forex brokers in Australia worth using.