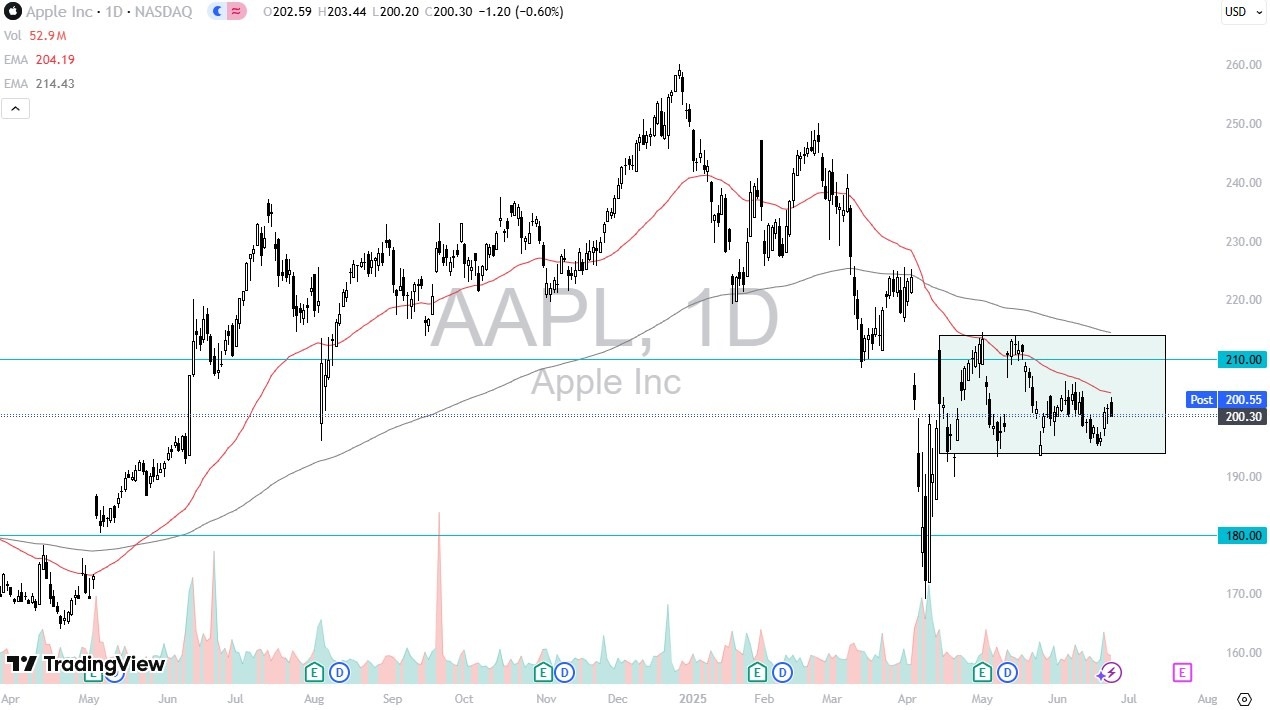

- Apple has had a tough session on Tuesday, dropping six tenths of a percent pulling back from the 50 day EMA.

- That being said, the market is still very much in a consolidation area.

- I think part of what's going on is that we are about halfway between earnings calls. We aren't close to a dividend.

So, traders are just looking for the next catalyst to get moving. This could come in the form of some type of agreement between the United States and China, which is a major problem for Apple itself as it chooses to produce its iPhones in China and therefore it causes chaos with their supply chain when we have trade wars. I think that there’s still a bit of an overhang on this stock, but I also recognize that traders are creatures of habit, especially when it comes to the “Wall Street Darlings” such as Apple, Netflix, and Nvidia.

Top Forex Brokers

Technical Analysis

If we can turn around and break above the 50 day EMA, then it's possible that Apple makes a move towards the $230 level, possibly via the 200 day EMA, which is a little closer to the $215 level where I'd expect a little bit of a hiccup as far as noise or even short-term resistance to a higher move. But this is a market that looks fairly cheap historically speaking.

Top Forex Brokers

It continues to have fairly decent volume. The next earnings call is going to be late July 23rd. So, between now and then it might be choppier than anything else but watch that 50 day EMA for a potential breakout and move higher as this could have larger funds adding to their positions that almost always include at least some AAPL holdings.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.