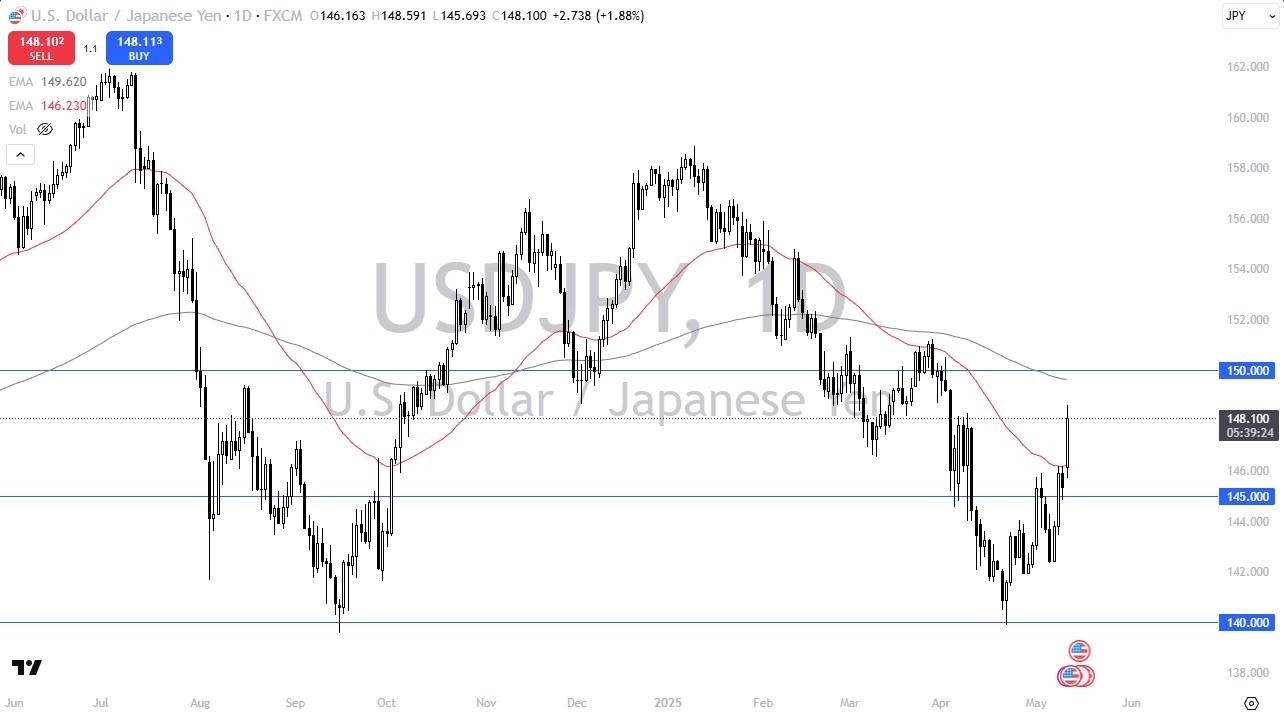

- The US dollar has rallied rather significantly during the trading session on Monday as we kick off the week on a risk on type of note.

- That being said, a lot of this is going to be based on the idea of swap being paid at the end of every day and then, we get some type of tariff relief coming from the United States and China.

- That makes people think about risk on behavior and therefore you start to see the Japanese yen fall.

Furthermore, it's worth noting that the United States is definitely seeing inflows during the trading session on Monday, not only in the currency markets, but also the stock market.

Short Term Pullbacks

Top Regulated Brokers

So, with that being said, I think we've got a situation where short-term pullbacks offer buying opportunities like I've been saying for some time. I think the 140 yen level is going to end up being a massive floor in the market but do keep in the mind that if we get a lot of concern in the market again, we could see the Japanese yen strengthen.

Short-term pullbacks offer those buying opportunities I've been talking about, especially near the 50 day EMA. The 200 day EMA sits just below the 150 yen level, which has a lot of psychology attached to it.

So, if we can break above there, that's a very bullish sign. But right now, I think we've got a situation where we've definitely started to see some short covering. We definitely are starting to see a certain amount of momentum. All things being equal, this is a market that I think will continue to find value hundreds, especially considering, like I said, you get paid at the end of every day.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.