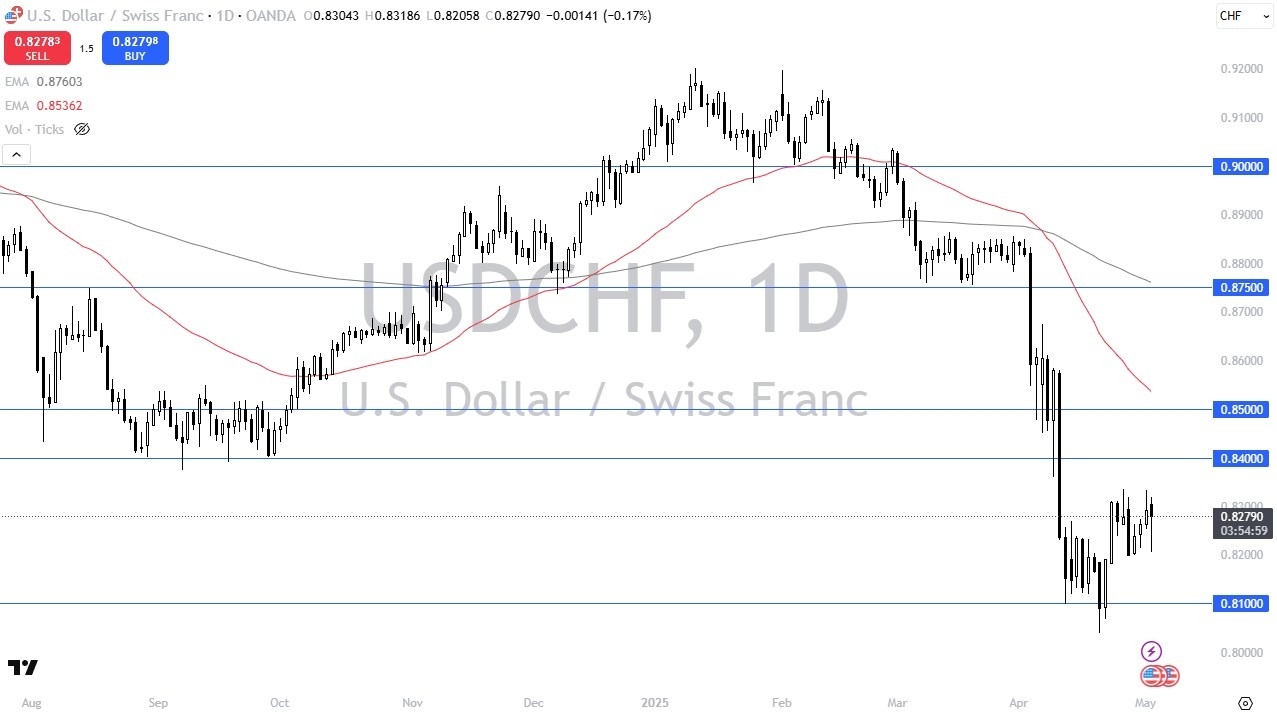

- The US dollar initially fell pretty significantly during the trading session on Friday, only to turn around and show signs of life.

- The hammer that is forming for the trading session, of course, is a very bullish sign, and I think we continue to try to build some type of bottoming pattern here in the dollar against the Swiss franc.

Keep in mind that even though the US dollar is considered to be a safety currency, so is the Swiss franc, and this pair will actually rise in times of more risk appetite, which is exactly what we are seeing. The market about a week and a half ago had two very impulsive, positive candlesticks. And since then, we've just kind of meandered. One would have to think that the Swiss are certainly going to be happy with the Franc losing strength. And at this point in time, if we can break above the highs that we have made over the last, say, six or eight candlesticks, then it opens up a move to the 0.84 level and then eventually the 0.85 level.

Pullback Offer Opportunities?

Short-term pullbacks are buying opportunities from what I can see, and it looks like the 0.81 level will continue to be a floor in the market. That being said, it's not necessarily going to be easy to go higher from here. After all, we are in a significant downtrend, but we are starting to show signs that we are in fact trying to turn the tide. This is true in multiple currency pairs, not just this one. As the US dollar had been so oversold, then I think a bounce was somewhat inevitable. The real question is going to be whether or not we can break above that 0.85 level. Because there is the scenario that we rally, show signs of exhaustion, and just start selling off again. As things stand right now in the very short term, I'm looking at buying dips.

Top Forex Brokers

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.