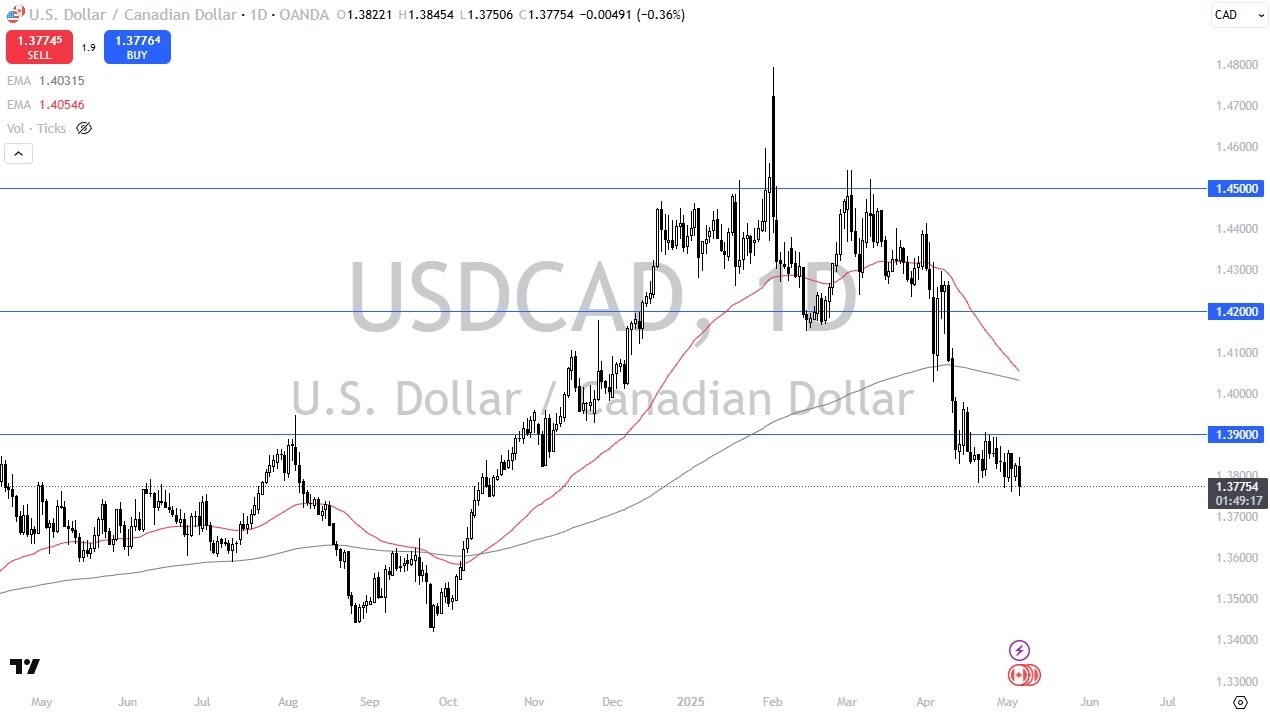

- During the trading session on Tuesday, we have seen the US dollar drop a bit against the Canadian dollar, as we continue to see a lot of noisy behavior.

- At this point in time, we see the 1.39 level above is a significant barrier, and I think at this point in time we will be watching that very closely.

- The market breaking above the 1.39 level would be a good sign, and it could open up the possibility of a move toward the 200 Day EMA, which is presently sitting near the 1.4033 region.

Trade Talks

During the session, Prime Minister Mark Carney met with Donald Trump, but nothing of significant importance was announced. Because of this, I think we don’t really have any information to get moving, at least not until we get through the FOMC, which is at the end of the day on Wednesday. The FOMC meeting, and perhaps more importantly, the press conference, could determine where we will go next. This is a market that has recently tested a major resistance barrier in the form of 1.45 and fell significantly. That being said, the trade talks did not produce any new news, so now we have to resort to technical analysis more than anything else.

The size of the candlestick for the trading session on Tuesday isn’t necessarily something that I’m overly concerned about, and we are still basically in the overall consolidation range. If we break down from here, then I would keep an eye on level 1.36, an area that’s been important more than once. This area is most certainly going to attract a certain amount of attention, and if we break down below that level, then we could see further selling. I suspect if we do, then you will have US dollar selling across the board yet again. Jerome Powell will have a lot to do with whatever happens next, so we will have to pay attention to the reaction to the press conference more than anything else, unless of course the Federal Reserve explicitly states they will be cutting soon.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.