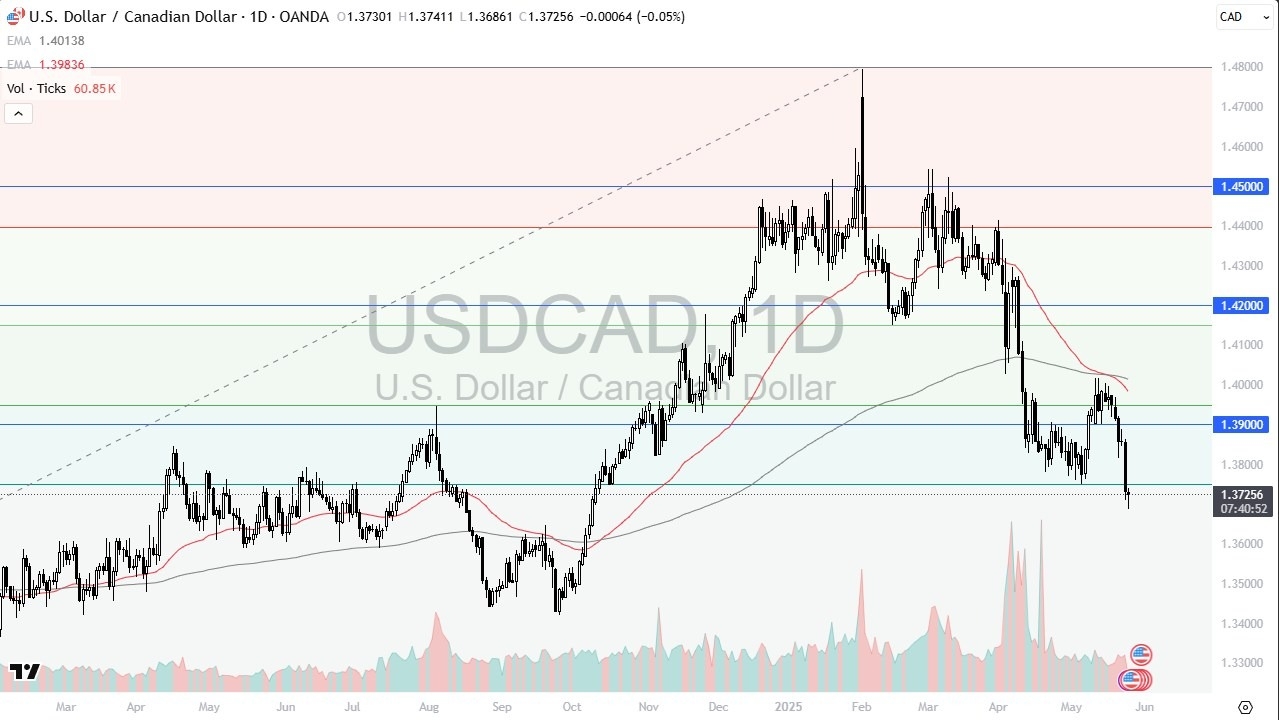

- During the trading session on Monday, we saw the USD/CAD pair drop, but it has bounced enough to form a bit of a hammer. However, keep in mind that it was Memorial Day in the United States, so at least New York wasn’t involved at this point in time.

- The Canadian market itself isn’t big enough to really move things, so that explains why we had a fairly tight range for the session. The 1.37 level seems to be an area that is pushing back against some of the selling pressure.

Pressuring the 1.37 level could open up the possibility of a move down to the 1.35 level, as it is an area that has been a major support level previously, and an area that I think if we break down below there, we could absolutely reverse the overall trend from the longer-term perspective, and we could fall quite a bit further from there. That being said, the US dollar is more likely than not going to continue to fight against the Canadian dollar, because most of the “pro Canadian” news at the moment is the fact that they dropped tariffs against the US, at least the retaliatory ones, and they won’t go into a recession with the very country that they have to negotiate a trade agreement with.

Top Regulated Brokers

Cross-border Flows

It’ll be interesting to see how this plays out, because the reality is that 85% of Canadian exports to end up in the United States, and eventually, the Americans will get what they want out of the trade negotiations, although it could take several months. Because of this, think it’s only a matter of time before we are shorting the Canadian dollar again, but I also recognize that as things stand right now, the total pressure on the US dollar probably has a little bit of a knock on effect here. I’ll be watching the 1.38 level above, because if we can clear that area, then the market could go looking to the 1.40 level which of course is where the 50 Day EMA and the 200 Day EMA indicators currently reside.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.