- The US dollar initially rallied during the trading session on Tuesday, only to turn around and show signs of weakness.

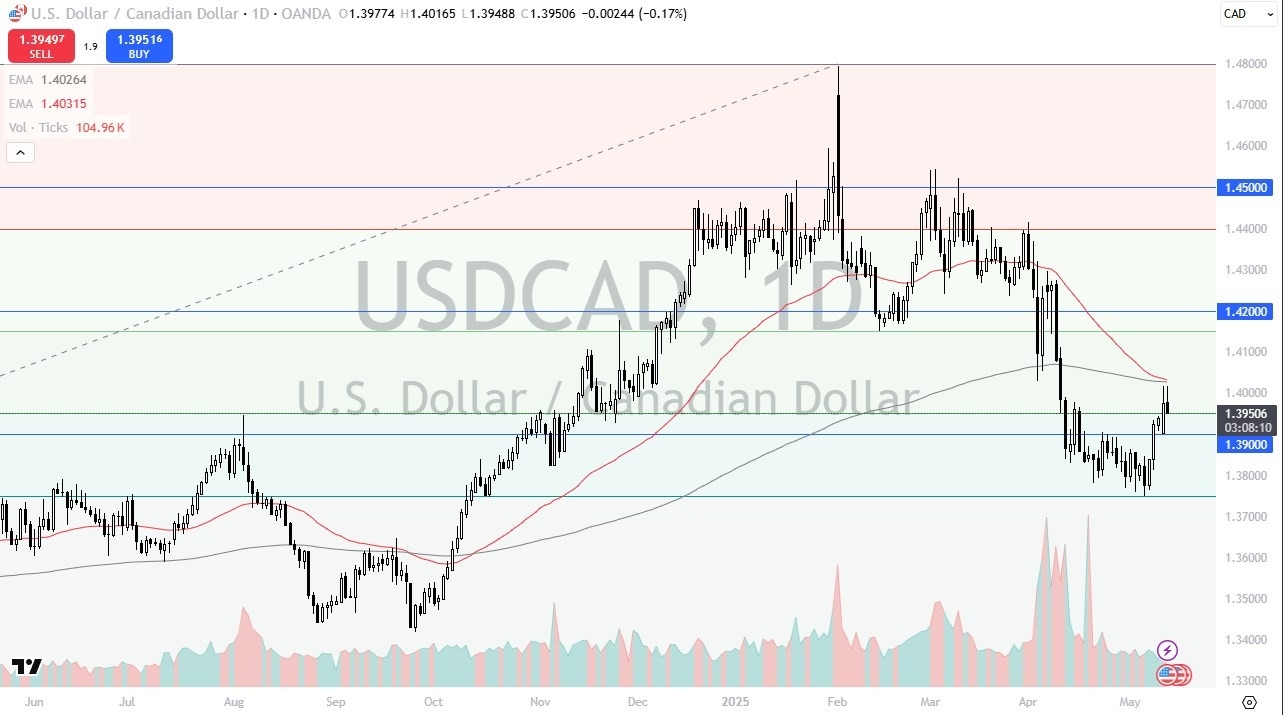

- That being said, the market has seen the 200 day EMA offer a little bit of a barrier, which is not a huge surprise.

- I also recognize that we have a scenario where if we turn around and break above these two moving averages, I think the dollar goes looking at the 1.42 level, an area that would be significant resistance as it was significant support in the past.

If we do fall from here, the 1.3750 level is an area that's seen buyers. So, we'll have to wait and see if we break through there. More likely than not, we get a bit of sideways action in this general vicinity while we try to sort out where to go next. Remember, the US and Canada do not have a trade agreement right now, and this could have a major influence on the Canadian dollar.

Oil Continues to Be a Non-Factor

Top Regulated Brokers

The oil market does not have the effect it used to because quite frankly, the Americans are basically energy independent at this point. Although you can make an argument for heavy crude is a little bit of an outlier, as most of that in North America comes from Alberta as well as Alaska. But right now, we have a scenario where I think we're trying to find our footing.

A bounce from here is a buying signal. I think this is a buy on the dip market still. When you look at the longer term chart, you can see exactly what's going on. We are testing the top of this range. And I think that market memory still comes into the picture to cause a bit of support.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.