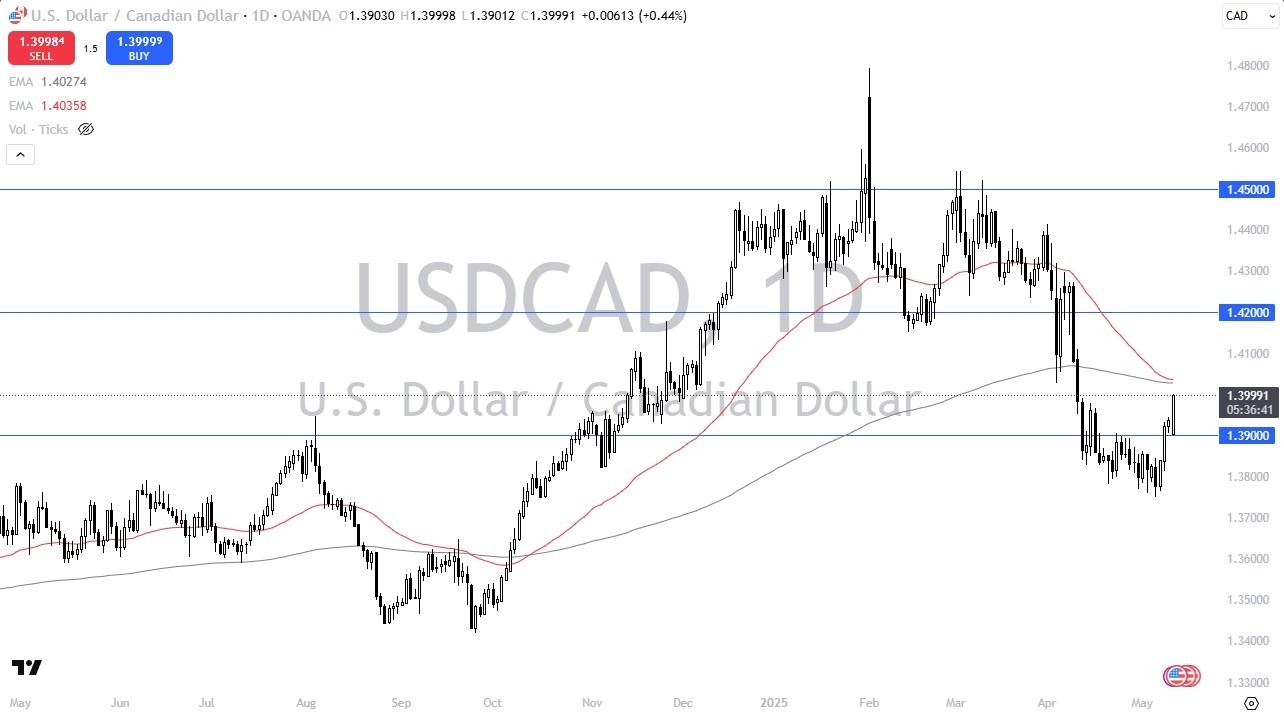

- The US dollar initially gapped lower but then turned right back around to show massive strength.

- Ultimately, this is a market that I think continues to rise because the United States signing a potential deal with China, which we made great strides towards over the weekend and still not having a deal with Canada, certainly damages Canada.

With that being said, the moving averages, the 50 day EMA and the 200 day EMA just above. And those could cause a little bit of dynamic resistance, but the 1.39 level and the 1.38 level underneath both are areas of potential support. And so far, it looks like they are in fact holding. You can even make an argument for a little bit of a falling wedge, but really at this point, I think you've got a potential move towards a 1.42 level if the US dollar continues to strengthen overall.

The oil markets rallying won't really help the Canadian dollar, at least not in this pair, mainly due to the idea of US production being much stronger than it was years ago. So, you will certainly hear a certain amount of analysts out there talking about watch oil, it'll strengthen the Canadian dollar. And while that may be true in several other pairs, it won't be true in this one.

Top Regulated Brokers

A Simple Bounce?

I think at this point in time, what you're seeing is a simple bounce and a continuation of the uptrend that we have seen for some while. To be honest with you, the Canadian economy really isn't something that compares to the US economy. And in fact, Canada is the worst performing of the G10 economies by a long stretch. So, it does make sense.

The traders want to go back into the US. When you do a Fibonacci retracement study, we are right around 61.8 % from the latest surge higher, or really, if you want to do it from the bottom of the consolidation area that we had been in for what seemed like a lifetime over course of a couple of years. We just bounced from the 61.8 % Fibonacci level. So technical traders, I think, are watching this and thinking we're going higher.

Ready to trade our USD/CAD Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.