- Silver broke down significantly during the trading session on Wednesday, as we continue to see a lot of noise in this market.

- That makes sense, considering that silver is very volatile to begin with, and we have to keep in mind that the silver market is also one that is highly sensitive to a lot of external pressures.

- The most obvious one of course is going to be demand for silver in industrial use cases. With the tariff wars going on, we have seen a lot of noise in silver due to this fact alone.

However, we should also keep in mind that it is considered to be the “poor man’s gold”, meaning that it is also a precious metal. Part of the reason that we have fallen so significantly during the day in my estimation is that interest rates in the United States climbed quite drastically. Because of this, the interest rates being higher means that you can get a guaranteed return on a bond instead of taking a bit in a risky market like silver. However, if you position size correctly, silver can be a great market to trade.

Top Forex Brokers

Technical Analysis Remains the Same

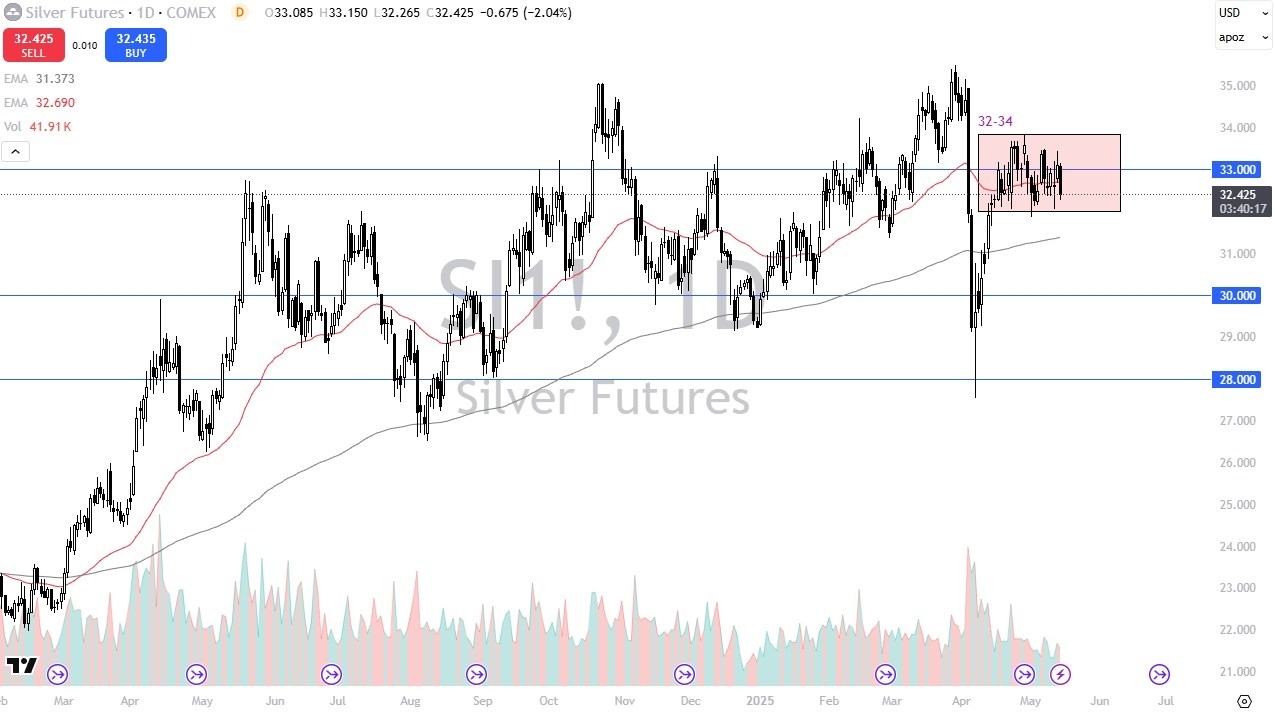

Despite the fact that the market has fallen rather significantly during the trading session on Wednesday, you also have to keep in mind that we have in fact bounced. While we may not get back most of the losses in the short term, the reality is that the market is at least showing signs of trying to find its floor near the bottom of the consolidation area, which is currently found at the $32 level. We have been trading between the $32 level at the bottom, and the $34 level at the top.

The size of the candlestick is somewhat negative, but we also have the 50 Day EMA sitting right in the middle of this candlestick, and of course the $33 level is considered to be “fair value” in this $2 range. If we break out of this range, then you can make a bigger trade, but as things stand right now, it’s very likely that we continue to see a lot of back and forth short-term trading.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.