Gold

Gold markets obviously have been at the forefront of everybody’s thought process lately, and this last week would have been no different. With that being said, it’s probably worth noting that we are seeing hesitation above the $3.400 level for the 3rd week in a row. This doesn’t necessarily mean that gold is going to fall apart, but I do think we have some work to do to get moving. That being said, you should also keep in mind that the US and Chinese delegates meet this weekend.

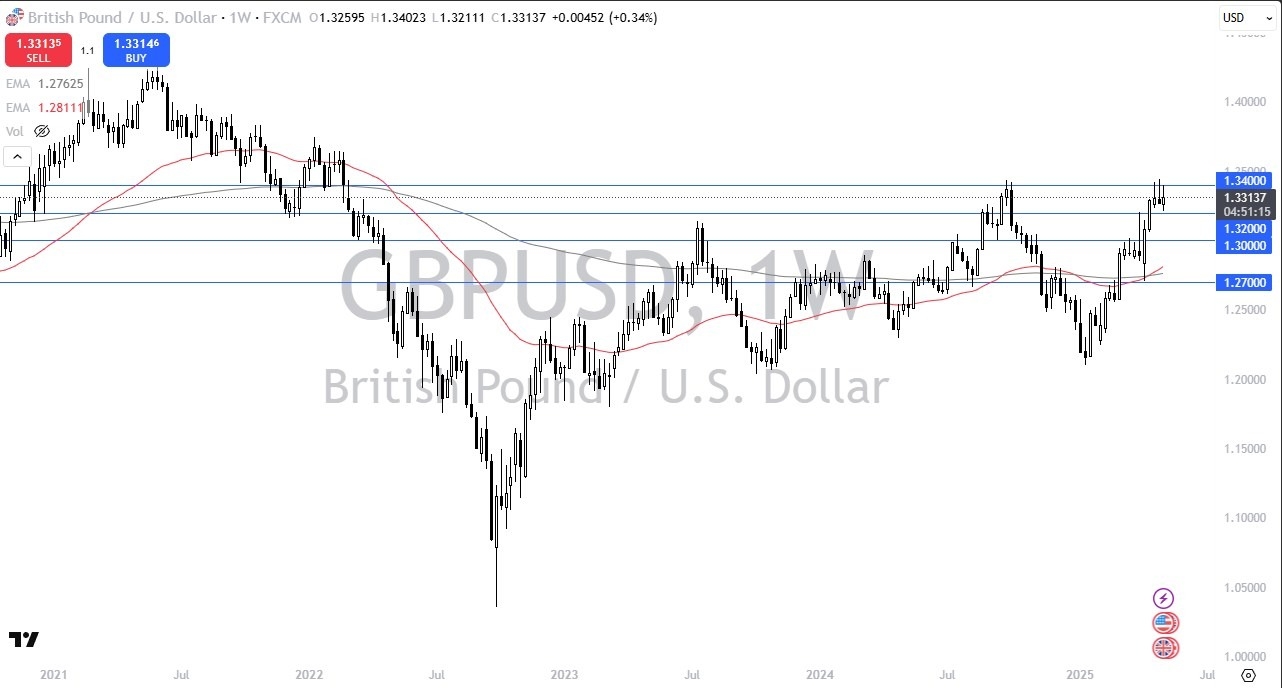

GBP/USD

This is one of the most interesting charts for me on the weekly timeframe in the world of forex. Quite frankly, we are struggling mightily to break above the 1.34 level, and the fact that we are finishing the week with a candlestick that looks a lot like a shooting star, and preceded by 2 actual shooting stars, tells me that we are on the precipice of a potential strengthening of the US dollar. By contrast, if we can break above the 1.35 level, the British pound could soar at that point, perhaps picking up another 500 pips. Nonetheless, it’s worth noting that there are several charts starting to hint that the US dollar is potentially going to make a comeback.

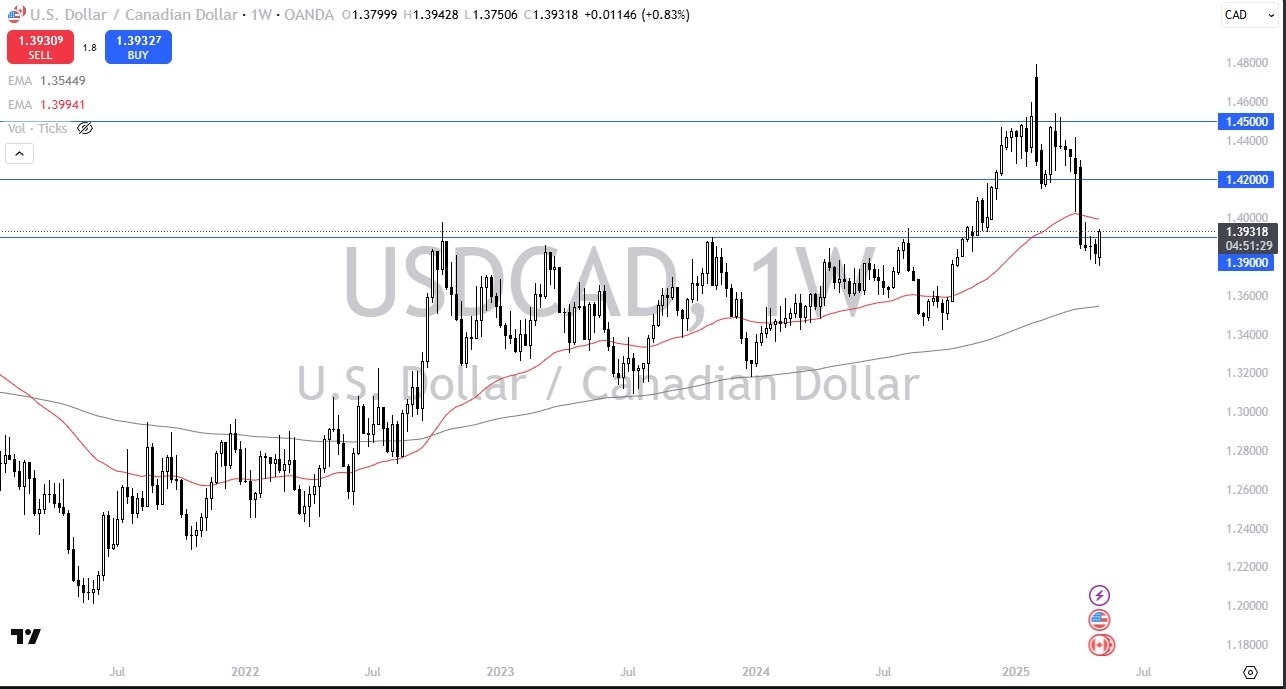

USD/CAD

This is one of those charges I was speaking about. The engulfing candlestick on the weekly chart suggest that buyers have stepped in and started buying the greenback against the Canadian dollar in mass. This makes sense, as Canada still does not have a trade deal with its most important trading partner, the United States. By extension, this means that the Canadian economy is going to remain under pressure, and therefore I think we will see the greenback continue higher.

Top Regulated Brokers

EUR/USD

This is an interesting chart as well, as we have seen market participants go in both directions all week, as we tested the 1.12 level at the very lows, but have since bounced quite nicely. By doing so, this suggests that we have a situation where traders are simply waiting to see what the US dollar does overall. If we break down below the 1.12 level, this could be a very negative turn of events. In order to get overly bullish of the euro itself, I would have to see this market clear the 1.15 level handily.

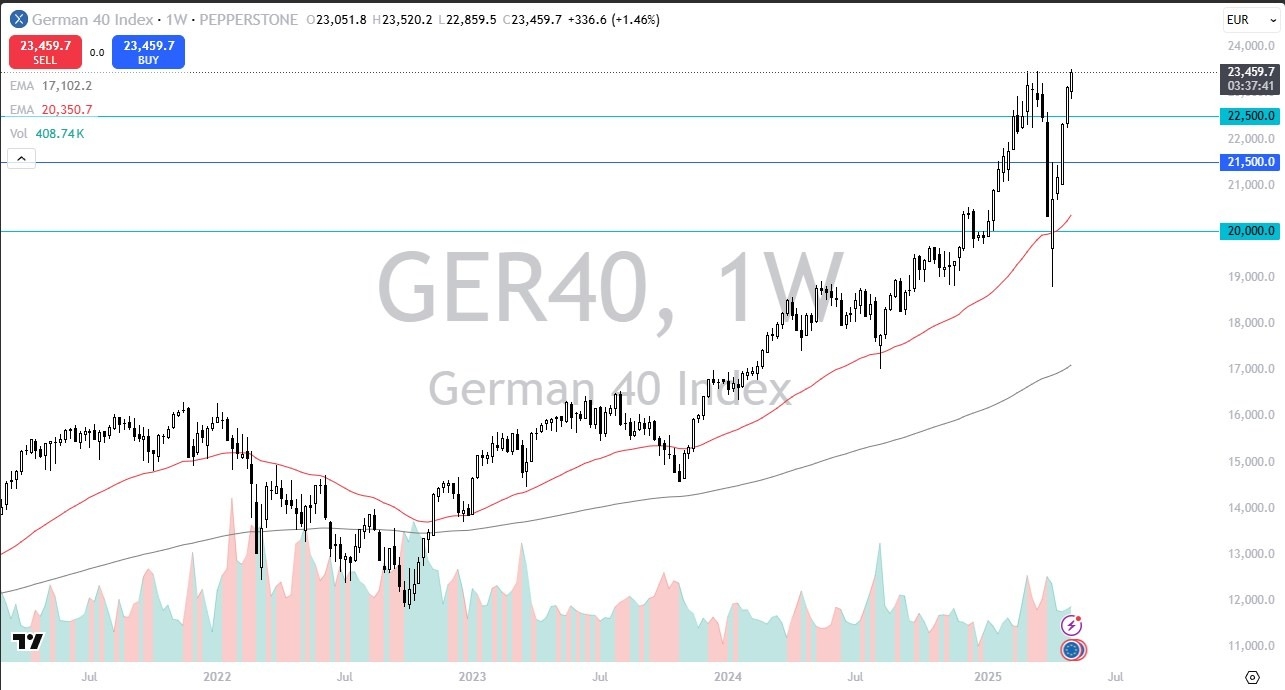

DAX

The German index had another bullish week as it looks like we are trying to do everything we can to break out to the upside. This obviously is a bullish turn of events, and it is somewhat surprising that we have yet to have a significant pullback. If we were to see that pullback, I would anticipate that the €22,500 level should offer significant support. On the upside, I assume we are going to go looking to the €24,000 level above, perhaps even the €25,000 level.

NASDAQ 100

The NASDAQ 100 has been very noisy during the week, but it is trying to respect the 20,000 level as a bit of a magnet for price. It’s interesting how we have behaved, mainly due to the fact that the market is waiting to see what happens with the latest trade tariffs, and of course the meeting between the Americans and the Chinese over the weekend. I suspect this is the next major fundamental situation the traders will be paying close attention to. If we can break above the 20,320 level, then I think the NASDAQ 100 has a real shot at going higher.

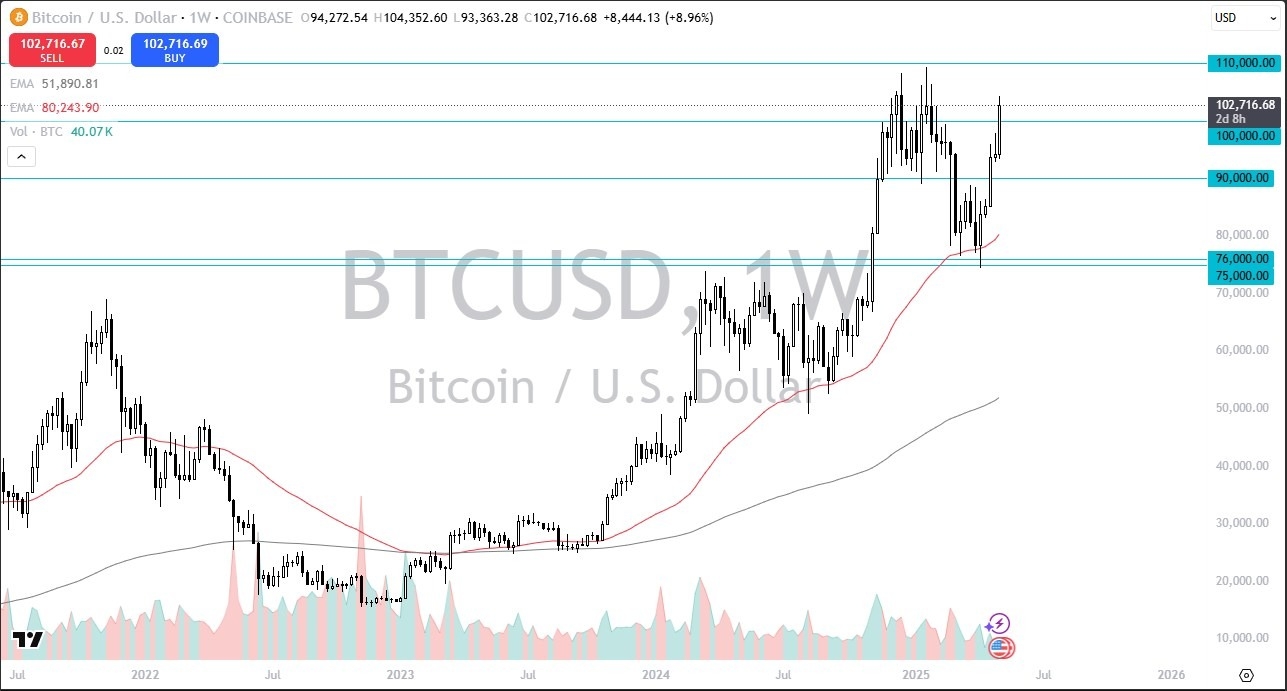

Bitcoin

Bitcoin of course continues to rally rather significantly, as we have seen quite a bit more risk-taking out there by traders. That being said, this is a market that I think continues to be very volatile, but I also recognize that a pullback would not necessarily be the worst thing to happen to it after all, we have gained 40% over the last couple of months, which obviously is a little overdone. With that being the case, I remain bullish, but I recognize that you need to look for value at this point in time. Chasing trade might be a great way to lose some money. I’d be particularly interested in the $100,000 level, as well as the $95,000 level.

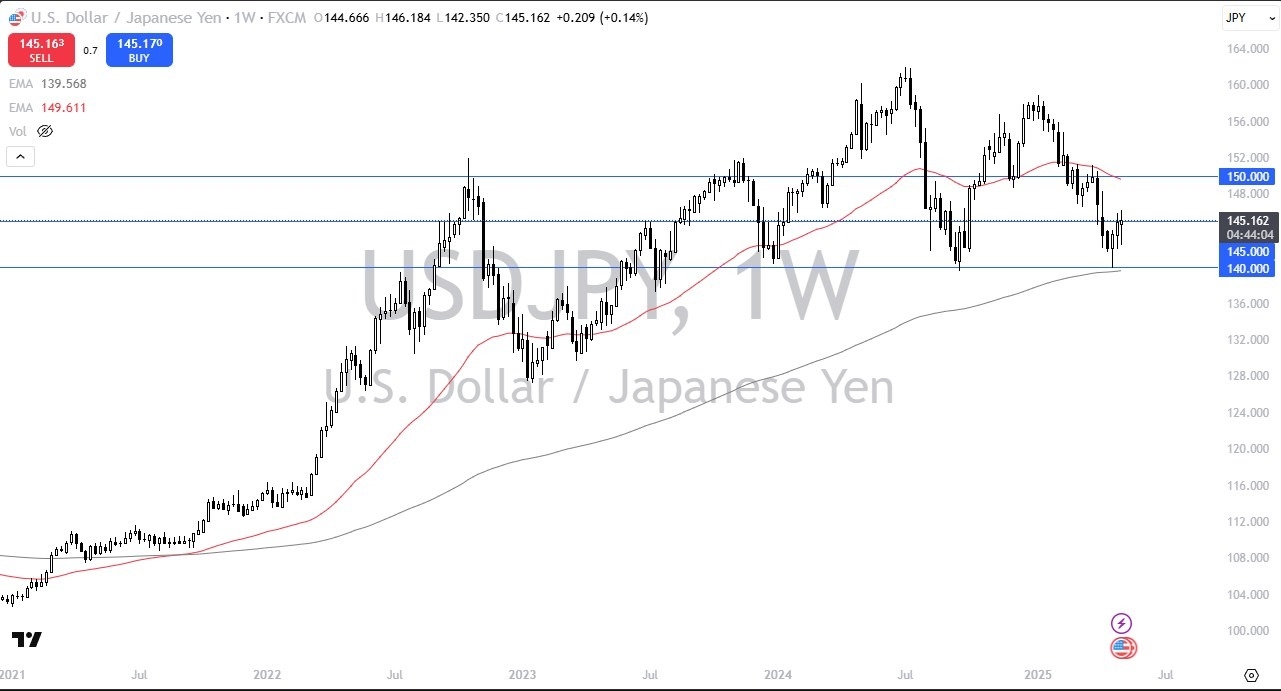

USD/JPY

The US dollar is gone back and forth against the Japanese yen during the bulk of trading during the past week, as we continue to dance around the ¥145 level. This is a market that’s in the process of bottoming, and I think it still has a real shot to go higher if we get any type of good news coming from the trade situation with Americans, or quite frankly, if we continue to see traders chase the interest rate differential in this market. Short-term pullbacks should continue to be buying opportunities with the ¥140 level being a massive support area.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.