Potential Signal:

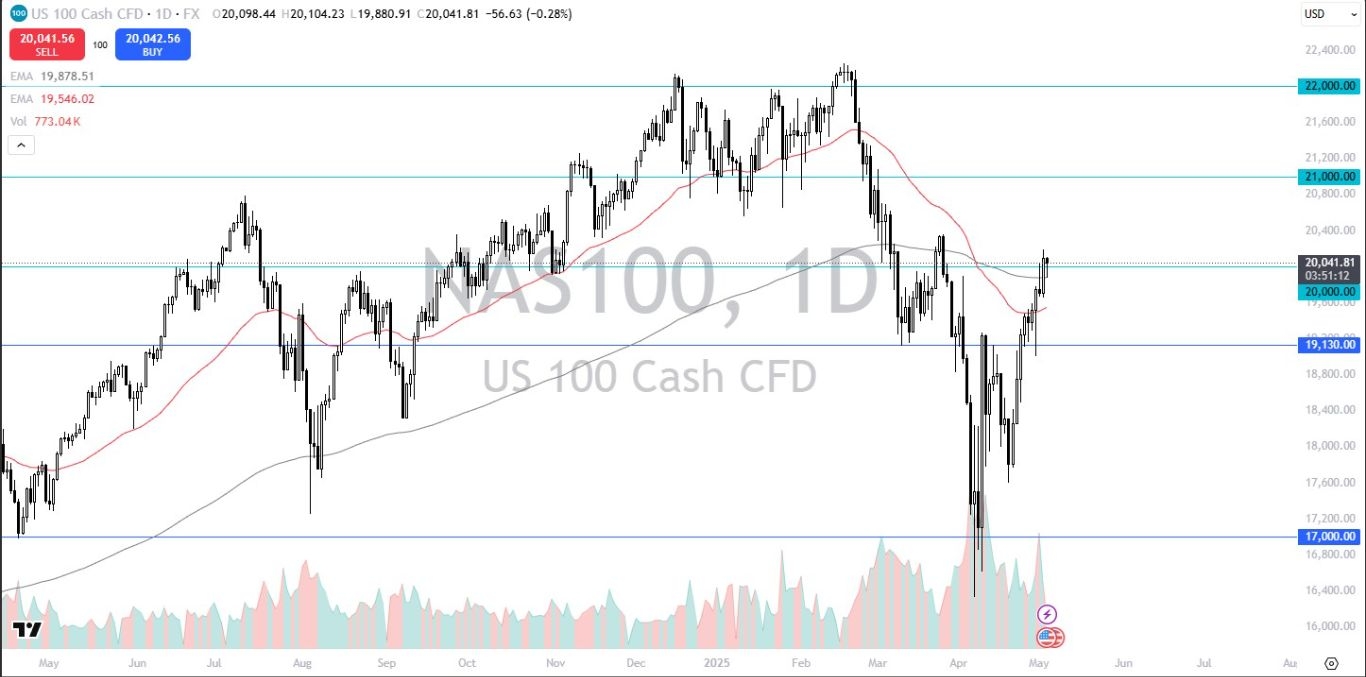

- I’d be a buyer of the NASDAQ 100 on a clearance of the 20,400 level, but I would need to see a daily close above that level.

- I would simply put a stop loss just below the 20,000 level, and aim for the 22,000 level.

- At the 21,000 level, I would have my stop loss at break even.

The NASDAQ 100 initially started falling at the open on Monday but found enough support near the 200 Day EMA to turn things around and show signs of life again. The NASDAQ 100 has been a leader in the United States recently, but we also have to keep in mind that the Russell 2000 had a very good session most of the day as well. Because of this, I do think that stock markets are doing everything they can to continue going higher, but the volatility has a lot of people sitting on the sidelines.

Top Regulated Brokers

Technical Analysis

I believe the technical analysis for the market speaks for itself. We broke above the crucial 20,000 level on Friday, as well as the 200 Day EMA. By pulling back the way we have and then bouncing, this does suggest that perhaps the NASDAQ 100 is going to do everything it can to continue to the upside, but I also recognize that we have a lot of noisy action in this general vicinity. You can make an argument that we are at a major swing high, where the market tried to get to the 20,400 level on 26 May, but failed. If we can clear that swing high, it’s very likely that the NASDAQ 100 Will Make It Way back to the all-time highs.

If we were to break down from here, the 50 Day EMA sits right around the 19,700 level and is rising. After the massive hammer from the Wednesday session, I think this suggest fact have plenty of buyers underneath willing to get involved I don’t have any interest in shorting the NASDAQ 100 in the short term. It’s not until we break down below the 19,000 level that I would about the entire index itself.

That being said, keep in mind that the Federal Reserve have the FOMC meeting and statement on Wednesday, as well as the press conference and all that comes with it. Market participants will be watching that very closely, to get an idea as to where we might be heading longer term.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.