- The Nasdaq 100 did the same thing during the trading session on Wednesday as it did on Tuesday and Monday as well. And that is to sell off initially only to turn things around and rally again.

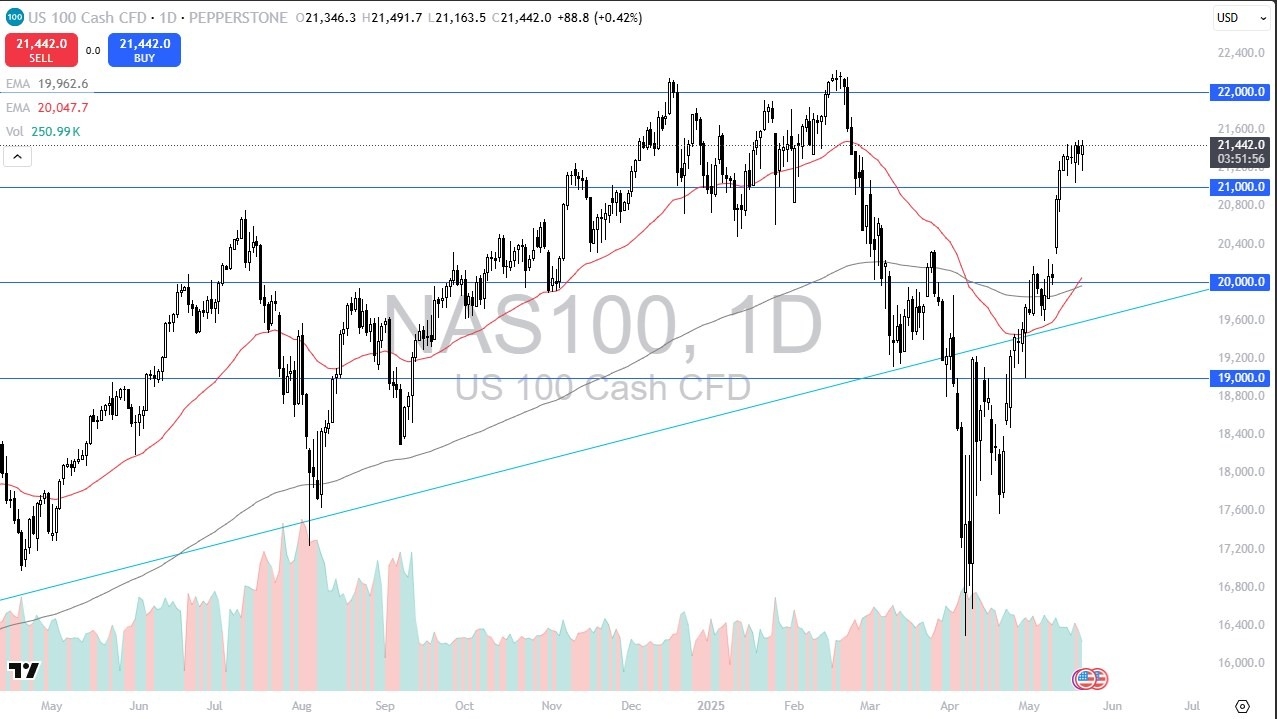

- All things being equal, this is a market that I think will remain somewhat elevated. Although I don't necessarily believe that the market is quite ready to go higher when you look at it overall, it is elevated, it is using the 21,000 level as support.

But more importantly than that, it is a market that although bullish has gotten too far ahead of itself, and I think ultimately, we are going to work off some of the froth, you can work off some of the froth by either pulling back and offering value or going sideways of course is just as doable as a pullback but you need some time to work off some of that excess markets simply have to be careful to try to go straight up in the air so what you need to see is comfortable acceptance of a price, and then another reason to go higher. I think we will eventually get that.

As Things Stand Currently

Top Forex Brokers

But as things stand right now, the 21,000 level looks likely to be support. And if we were to break down below there, then we could go looking at the 20,000 level on a significant pullback where the 50 day EMA currently is crossing the 200 day EMA, which is the so called golden cross. I think at this point, though, you have to be thinking upside rather than down and any pullback probably offers a buying opportunity. This is a market that has been very strong over the last several weeks, and as a result, this is a market that you should hope to see short-term drops.

Ready to trade the daily forex analysis? We’ve made a list of the best online CFD trading brokers worth trading with.