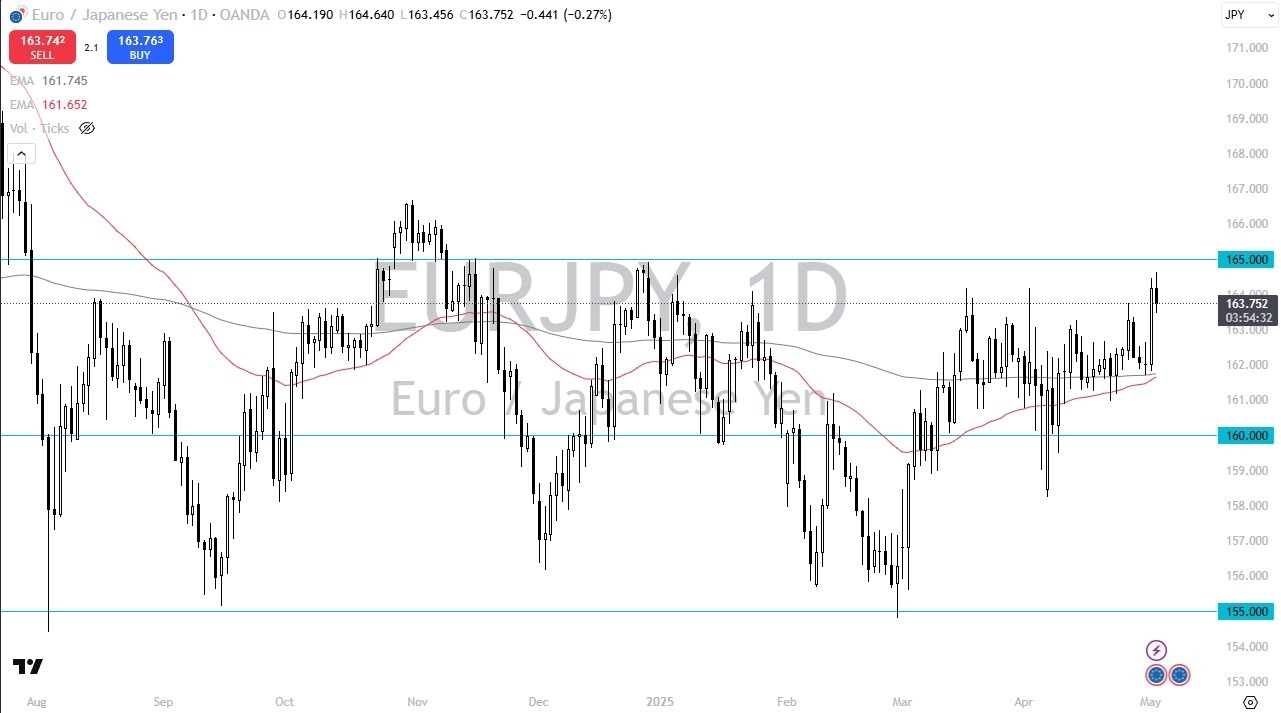

- The euro initially did try to rally a bit during the course of the trading session on Friday, but it looks as if the area near the 165 yen level could continue to be a bit of a barrier.

- That area is of course an area that has been important multiple times in the past. It'll be interesting to see how this plays out.

We had the massive candlestick during the previous session that came into the picture to offer a lot of upward momentum. And then the pullback on Friday, which shows that we are not simply going to rip through the 165 yen level by breaking above there. Then we could go looking to the 166.50 level and therefore the swing high back in November. Short-term pullbacks from here make a certain amount of sense. And I think they offer buying opportunities because quite frankly, we are starting to see the Japanese yen suffer.

Top Forex Brokers

There is Support Below

In general, the 200 day EMA sits around the 162 yen level with the 50 day EMA sitting just underneath there. The 50 day EMA looks as if it is going to try to cross above there. And if it does, that is the so called golden cross, which a lot of traders look for a bit of inspiration to the upside. It's a late indicator typically, but what I have found is that the Golden Cross tends to do much better than the opposite, the negative version of this called the Death Cross. We are going sideways. We are getting ready to try to break to the upside. And now the question is, will we have to pull back towards the movie and averages or will we clear 165 yen and then just simply rip to the upside.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.