- While the light sweet crude oil market was a bit positive during the early hours of Thursday, after Donald Trump suggested that the tariffs against China could be lowered.

- When he was referring to the meeting this weekend in Switzerland between American and Chinese delegates, the market took off like a rocket.

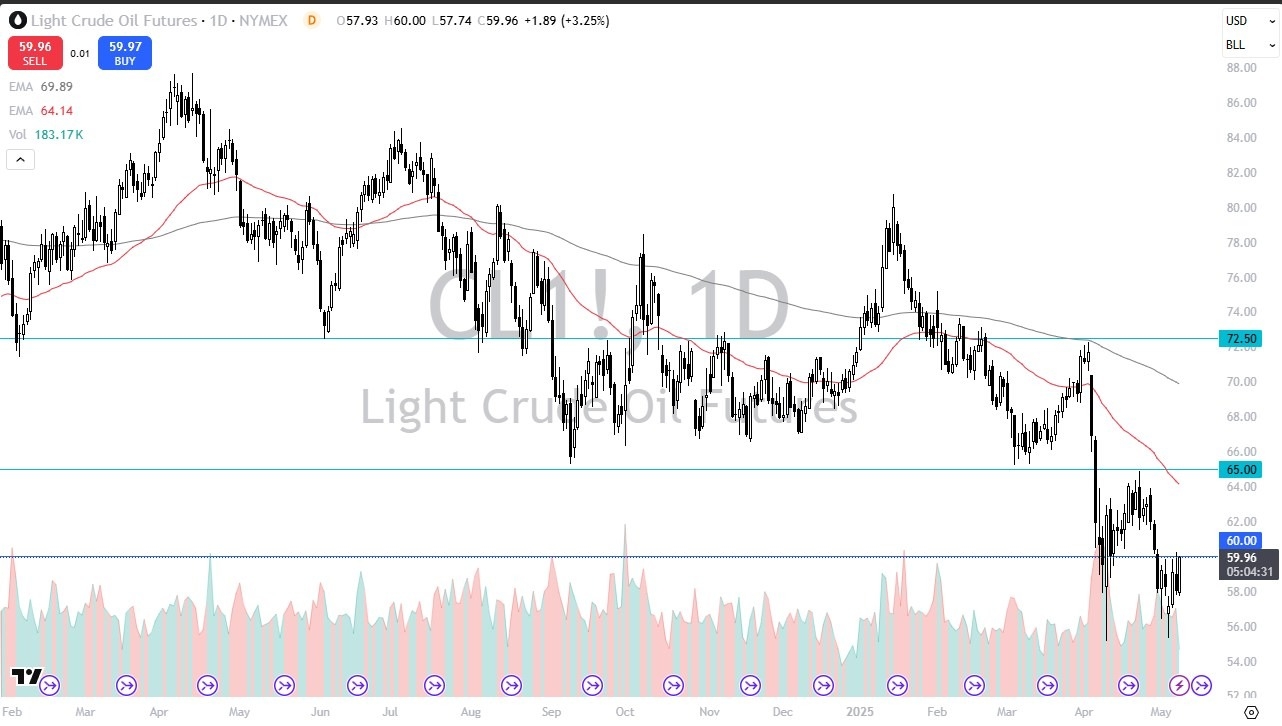

- At that point, crude oil rallied all the way back to the $60 level, an area that offered resistance over the last 3 or 4 sessions.

- This is an area that I think you need to pay close attention to, because if we do break above that level, it means something.

Technical Analysis

The technical analysis around the $60 level is quite interesting, and despite the fact that we have been in a very negative trend, it is becoming obvious that the $60 level is crucial. If we can break above there and stay above there for a daily close, I think you have a real shot at crude oil recovering a bit. This could send crude oil toward the $62 level rather quickly, followed by the 50 Day EMA which sits right around the $64 level.

On the other hand, if we do break down from here and continue to see the $60 level act as a massive barrier, then it confirms that the crude oil market just is not ready to go higher. That would make some sense, because quite frankly there’s a lot of “what if” involved in what’s going on at the moment. Furthermore, you have to keep in mind that there are disappointing headlines over the weekend, but it may actually turn things around and start causing a lot of selling pressure. Regardless, you need to be cautious with your position size, because this could be a place where you find a lot of trouble if you are not careful.

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.