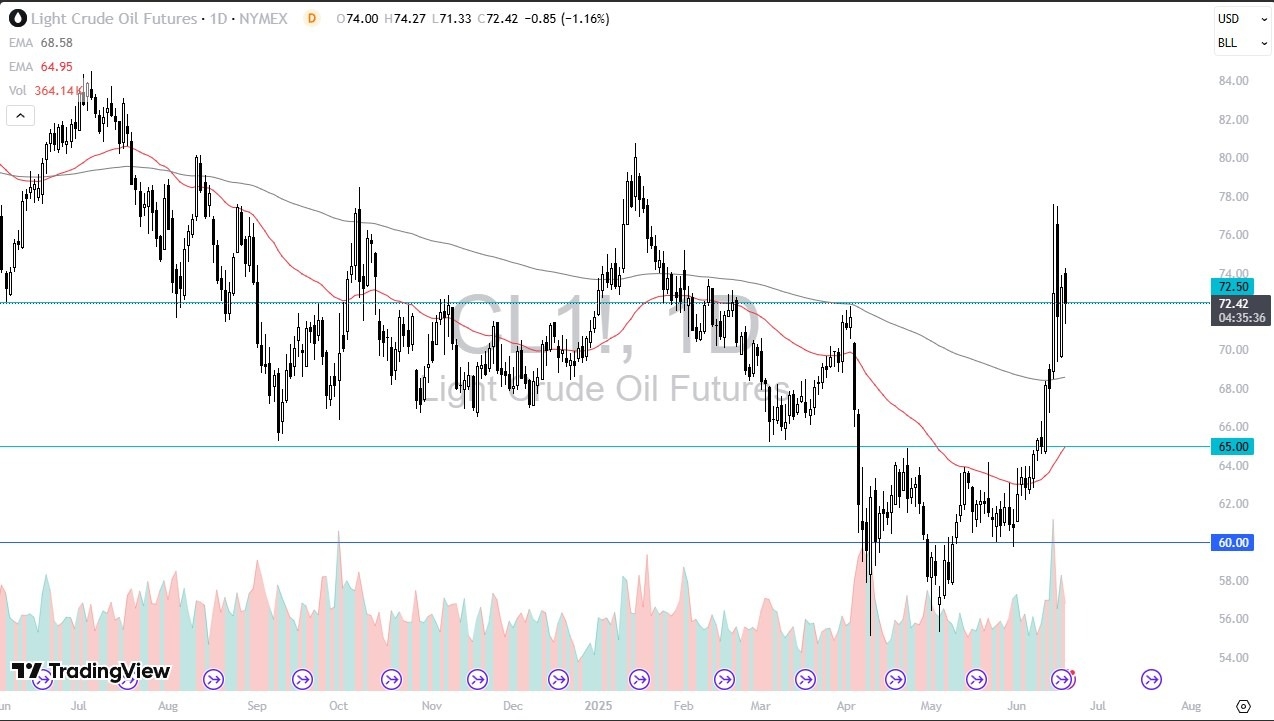

- The light sweet crude oil market has rallied a bit during trading here on Friday as we continue to just simply go back and forth.

- This is a market that continues to pay close attention to the $60 level as a potential support level.

- But at this point, you also have to keep in mind that there is a significant amount of resistance above the 50 day EMA currently sits right around the $63.50 level and is dropping.

So, I think we have a situation where we are just squeezing and therefore, I think we will try to build up the necessary inertia to determine which direction we want to go in the longer term. Trend changes, or at least potential ones, are always messy.

On the Move Higher…

If we can break above the $65 level, that opens up a pretty significant move to the upside from what I see, probably a move to the $70 level where the 200-day EMA currently resides. If we were to break down below the $60 level, then it opens up the possibility of a drop down to the $55 level where we have seen a bit of a double bottom form.

Top Regulated Brokers

Ultimately, I do think we are in the midst of a bottoming process because when you look at the longer-term charts, it's right around here that the market has paid close attention to for a long time. And we again have formed that double bottom. So, I do think that the market's trying to lean to the upside. There were a lot of concerns out there when it comes to demand, as well as supply. Supply was a little overdone, but ultimately, I think you've got a situation where traders look at this as value and they will more likely than not end up buying dips.

Ready to trade our Crude oil Forex analysis? We’ve made a list of the best Forex Oil trading platforms worth trading with.