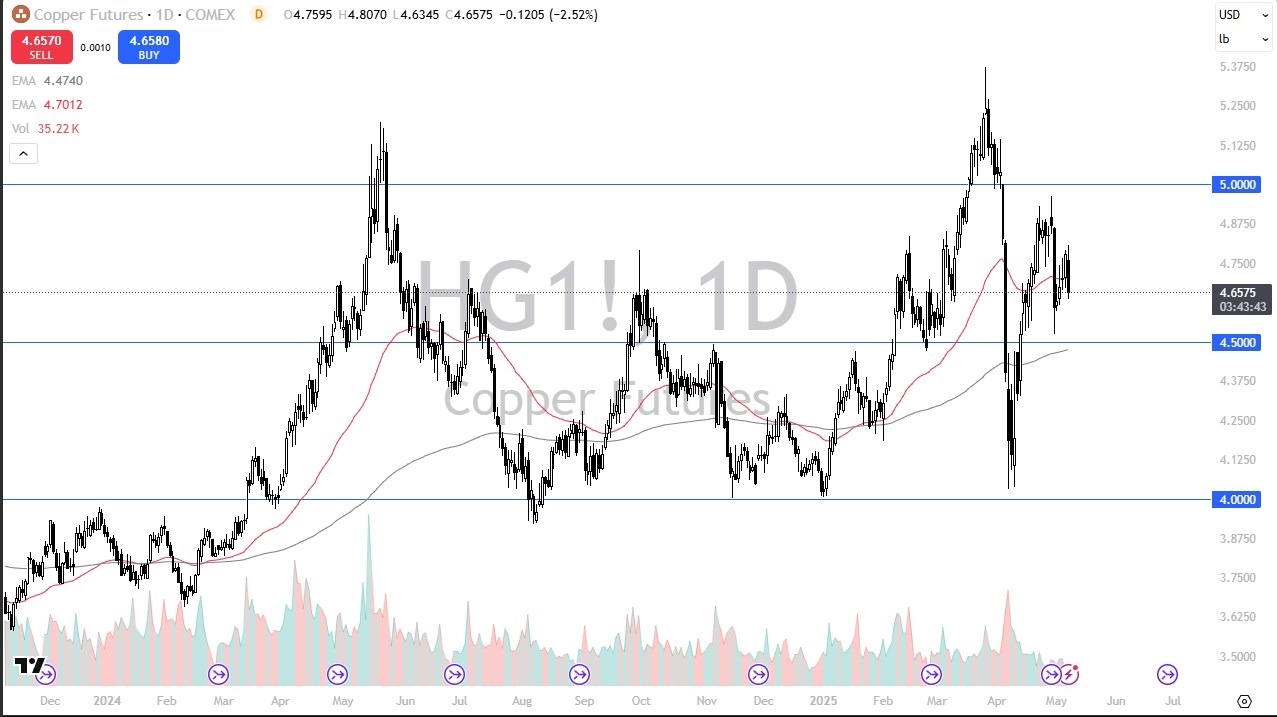

- The copper market initially did try to rally during the trading session on Wednesday but gave back gains rather quickly near the $4.80 level to drop pretty significantly.

- By doing so, it looks as if copper is still trying to sort out what's going to happen between the Americans and the Chinese.

- Now, I found this interesting because we initially got a shot higher sometime around the first hour or so of futures trading.

And basically, the same time it was announced that the Americans and the Chinese are going to start talking in Switzerland fairly soon. But then we fell. I think what that tells you is that the market isn't quite convinced that there is going to be a huge demand for copper coming out of China, which also can tell you that the market isn't quite convinced that these talks are going to produce anything of significant value, at least not anytime soon. That being said, it is the first real sign of progress. So, it is something that could come into the picture and move things.

A Few Levels on the Chart

Top Forex Brokers

But as you'll notice on the chart, I have the $5 level and the $4 level, marked with the $4.50 level in the middle of splitting the price. We are sitting just above that $4.50 region, at least from a longer holistic sense of the word. So I think we are still reasonably well supported near the $4.50 level. And it is worth noting that the 200 day EMA sits here. That could provide a little bit of a floor. Now, I know a lot of people don't trade copper, at least a lot of retail traders don't, but copper is an excellent tool to get an idea on what the global growth expectations are. As things stand right now, I think you have a market that is somewhat confused, but there could be a buy-in opportunity closer to the $4.50 level. Furthermore, later in the day, we get a Federal Reserve interest rate decision, and if for some reason they did cut rates, that might help copper. If we break down below the 200 day EMA, then we could see copper do a round trip back to the $4 level, where I'd anticipate a lot of support. For what it is worth, volume has been dropping on the way up. So, I don't think we have an overly bullish market. I think we've got a neutral one, but that $4.50 level could be an interesting entry.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.