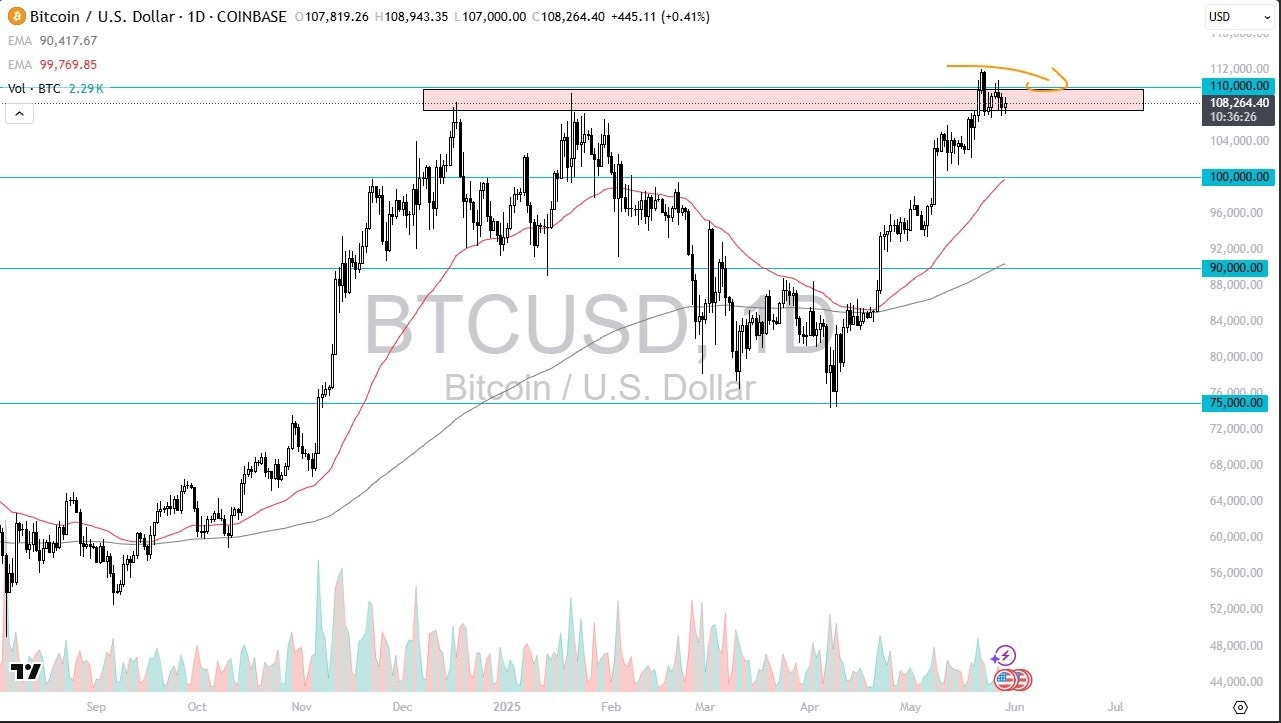

- Bitcoin continues to be very noisy in the short term perspective, but as I look at the chart, it’s not very difficult to see that we are trying to build up the necessary momentum to finally break to the upside.

- If we can break out to the upside, it opens up the possibility of clearing the $110,000 level resistance area and possibly sending Bitcoin to the $120,000 level.

- Short-term pullbacks are likely to continue to see a lot of interest, as traders will more likely than not jump into the market in order to take advantage of any value that comes into the picture.

Technical Analysis

Top Forex Brokers

The technical analysis for Bitcoin is obviously very bullish, as we are very close to the all-time highs, but I think you also have to realize that we gained something like 40% in the last month, so the market is probably fairly tired. That doesn’t necessarily mean that we need to get negative, just that we may need to work off some of the excess froth. This is perfectly normal, and I think it’s one of the situations where it’s an uptrend doing exactly what an uptrend will do most of the time, gathering more traders to continue to push it higher.

On a pullback, I would look at the market through the prism of buying on the dips and looking for “cheap bitcoin” along the way. The $105,000 level is an area that I think has a lot of support, and then after that we have a situation where the $100,000 level is even more supported. This is especially true as the 50 Day EMA is approaching this crucial level, so I think that’s essentially going to be the “floor in the market.” Ultimately, the market will have to determine where it wants to bounce from, but I think any pullback looks as an opportunity going forward.

Ready to trade daily BTC/USD forecast & predictions? We’ve made a list of the best Forex crypto brokers worth trading with.