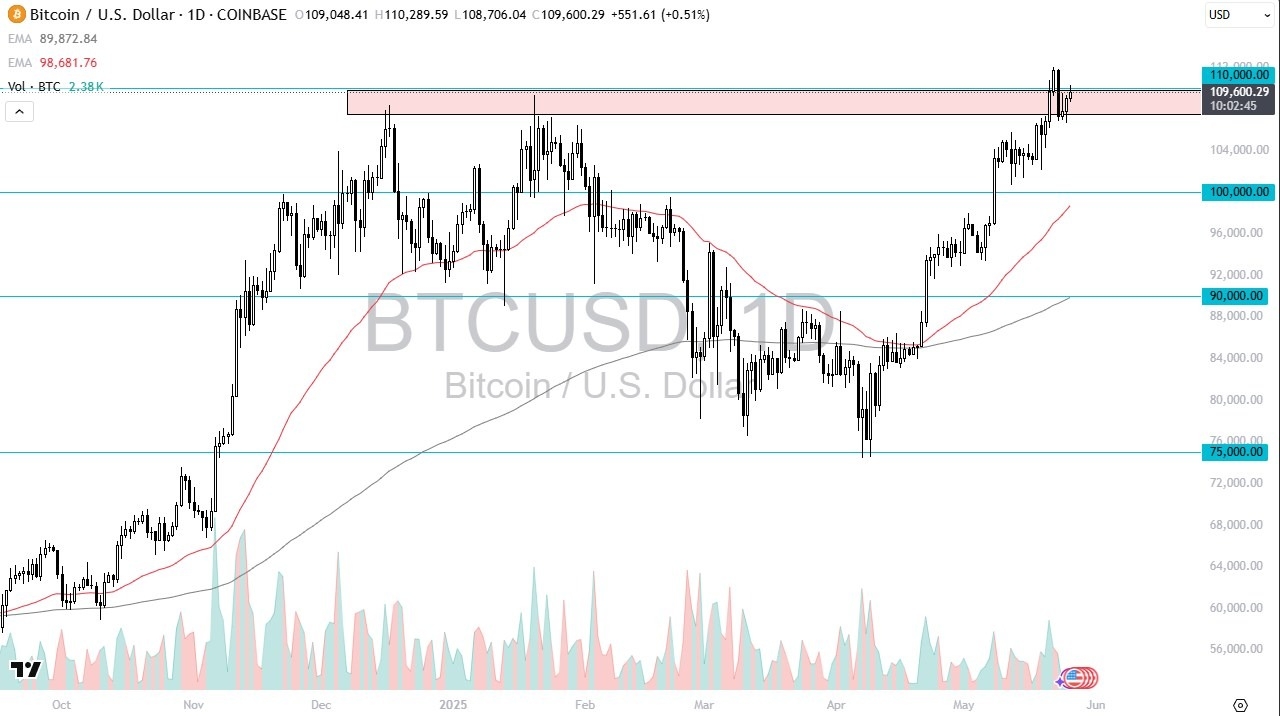

- Bitcoin has rallied a bit during the trading session on Monday in what was Memorial Day in the United States.

- So, there might have been a little bit of liquidity missing, but really at the end of the day, I think what we're doing is trying to grind to the upside and take out this candlestick from last week on Friday that was so negative.

If we can break above the top of that candlestick, then it is a very strong sign that Bitcoin is going higher, probably towards $115,000 in the short term. Short term pullbacks, I think, still offer value that people will be looking at, especially near the $106,000 level. This will mainly come down to risk appetite as Bitcoin is traded like an ETF on Wall Street now. So, it does have a bit of a correlation to what stocks are doing these days. Short-term pullbacks I do think offer value that a lot of people are willing to take advantage of because quite frankly, it's hard to look at this chart and not argue that we're in an uptrend and that we are not positive. Really at this point in time, it's not until we break down below the $100,000 level that I would consider anything negative. The 50-day EMA sits right around there and that of course is something that pays close attention to. And if we were to break down below there, then okay, fine, things get ugly. But right now, this is a market that certainly looks like it wants to take off. It really doesn't come down to whether or not you believe in Bitcoin. What I believe in is that the price is going higher. I don't care if it's ever used. I recognize that it is a vehicle for trading at this point.

Top Forex Brokers

Bitcoin and the Real World. Who Cares?

I do get a lot of questions about whether or not it's ever going to be used in the real world. And personally, I'm not a believer, but I recognize here that it's an asset that's going up in value. And really at the end of the day, that's what matters for traders. So, with that being said, if you just change the symbol on this chart, change it to Apple or to Google, you'd be a buyer. It's the same thing here. One of the hardest things about Bitcoin is to erase your bias in both directions. But as things stand right now, everything on the chart says that we will probably try to go higher.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.