- Bitcoin initially did pull back a bit during the Monday session as we had gotten a little overdone in the short term but over the weekend, we'd seen a lot of noise about US debt being downgraded which quite frankly was a big nothing burger, and now we've seen the market turn back around and fall.

- That being said though, later in the day we've seen buyers come back in. So, I think really what we're seeing here doesn't have anything to do with a lot of the noise out there when it comes to debt.

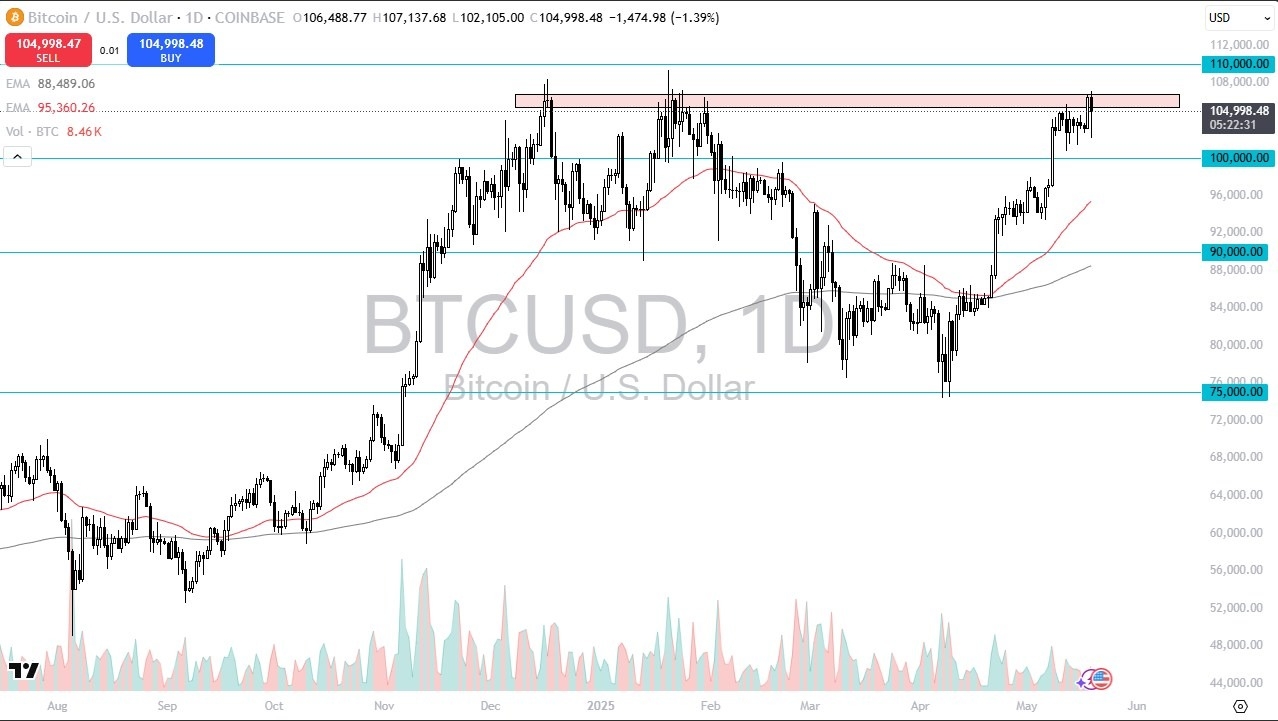

- I think it has a lot to do with trying to build up the necessary momentum to take out all of the supply between $106,000 and $110,000.

I believe this is a market that is probably going to be sideways for a while, but it definitely is tilting to the upside. Sooner or later, we will get buyers in this market that will break out. The timing is difficult, but if you're a longer-term trader, this is an easy market to buy. You just have to close your eyes for a couple of weeks, couple of months, couple of days. You just don't know how it plays out.

Major Levels to Watch

$100,000 is of course a significant round figure that I think a lot of people will be paying close attention to. And of course, underneath there we have the 50 day EMA right around the $96,000 level and rising that comes into the picture as well. I have no interest whatsoever in trying to get short of Bitcoin.

Top Forex Brokers

And I don't think that it's going to be an easy thing to do in this environment. If we break the $110,000 level, it's very likely that we will see another FOMO leg in this market. The risk appetite around the world is starting to increase and that obviously is felt in this market. So, I think it’s really only a matter of time before we break out and short-term dips provide opportunities.

Potential signal(s): I am a buyer above $110,000 with a stop loss at the $106,000 level, aiming for $125,000. If we pull back from here, I am a buyer anywhere near the $100,000 level, with a stop loss at the $98,000 level, aiming for $108,000.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.