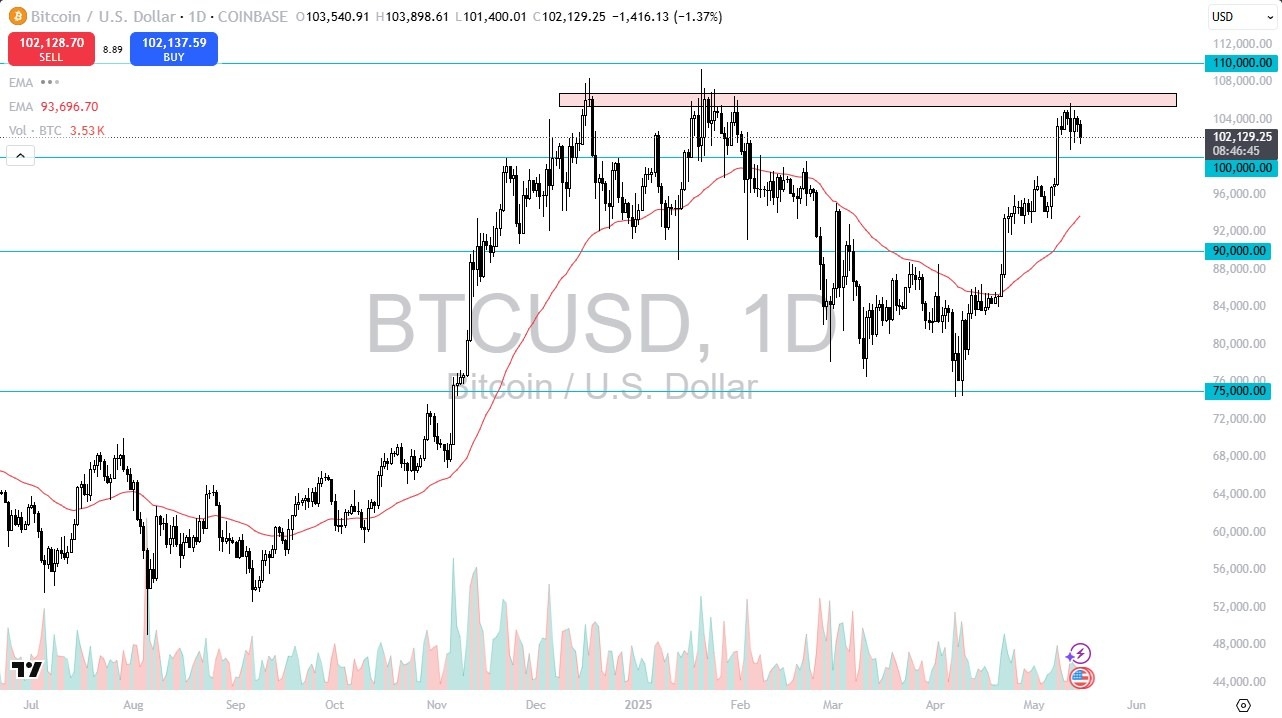

- During the trading session on Thursday, we saw the bitcoin market drop a bit, but it’s obvious that there are buyers underneath because for the 4th day in a row we have seen buyers step in and pick up the lower part of the consolidation range.

- The $100,000 level underneath looks to be a massive floor in the market, and over the last 5 or 6 days, we have seen the same action, with buyers picking up the market at the first signs of trouble.

The shape of the candlestick is a hammer, and we have seen several of those in a row, and therefore it makes a certain amount of sense that we would see plenty of support continue in this market, at least as long as we can stay above the $100,000 level. The $100,000 level courses a large, round, psychologically significant figure, and an area that will more likely than not continue to see a lot of options barriers there as well. Regardless, this is a market that has gone higher for some time, and I think there are still plenty of people that would like to find a little bit of value that they can take advantage of and what’s obviously a very bullish market.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is obviously very bullish, but over the last week or so we have seen sideways action that suggests we are trying to digest this big move. That makes sense, but if we were to break above the $106,000 level, then I think you have a real shot at this market moving to the $110,000 level. The $110,000 level has been crucial multiple times, and I think that will continue to be a massive barrier. If we were to break above there, then we have a real shot at this market taken off to the upside, and really starting to race much higher. At that point, we would have the next leg up, and buyers of course would be chasing with plenty of “FOMO.”

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.