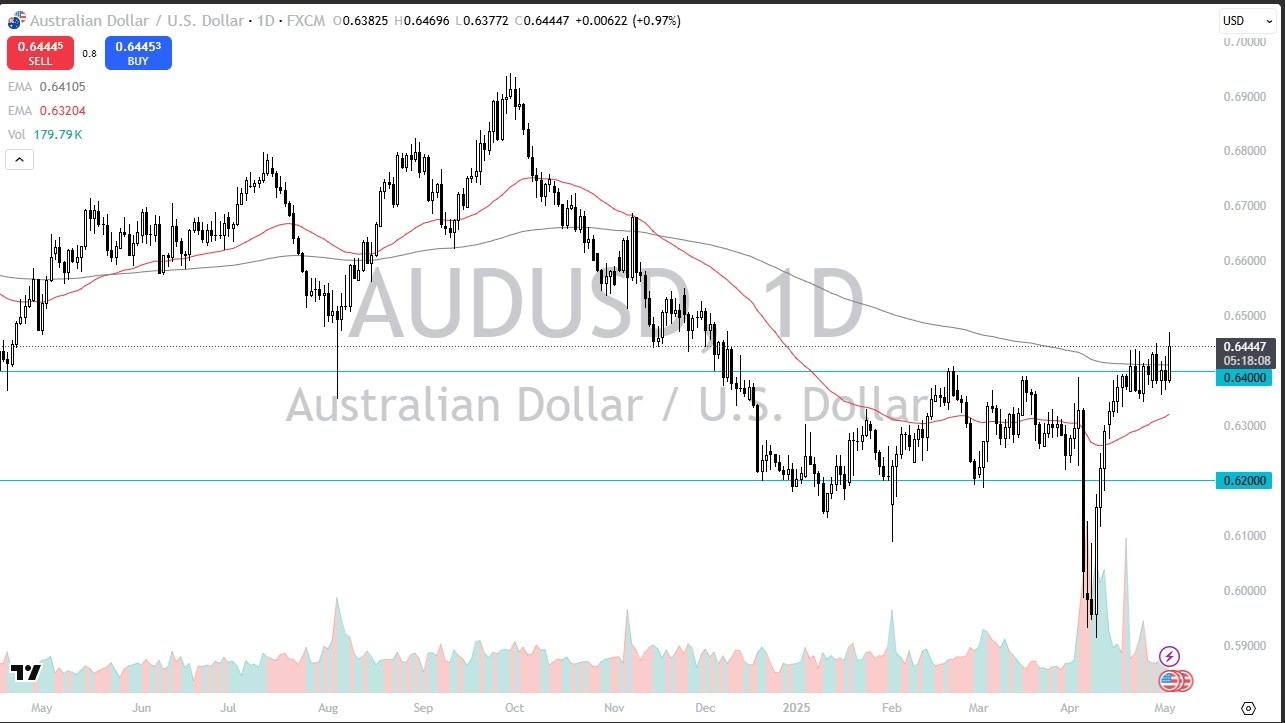

- During the trading session on Friday, we have seen the Australian dollar rally again, but we are starting to see a little bit of hesitation.

- It looks as if we are trying to do everything we can to break out, but keep in mind that the market is struggling a bit to hang on to the gains outside of the previous consolidation area. The 200 Day EMA sits right in the middle of this consolidation area, so that of course is something that has been a major factor in this market over the last several sessions.

Technical Analysis

The technical analysis for this pair has been fairly neutral over the last couple but we had shot straight up in the air for a while and the question now at this point in time we have to keep in mind is whether or not we can continue to go higher, meaning whether or not we had worked often of the excess froth. The 50 Day EMA sits just above the 0.63 level and is rising. This of course is a technical indicator that a lot of people pay close attention to and it could keep the market somewhat afloat. If we were to break down below that level, then it would obviously be negative.

Nonetheless, it’s worth noting that the market has been very bullish recently, so the fact that we work off all of that froth might be exactly what was needed. Furthermore, you also have to keep in mind that there are whispers out there about the Chinese looking for a deal with the Americans now, and that of course has a major influence on what happens with the Australian dollar as the Australian economy is so highly levered to the Chinese economy.

Top Regulated Brokers

The size of the candlestick is bullish, but it’s also a little bit disheartening that we could not close at the very top of the range. If we could, then the market could go much higher, perhaps reaching the 0.66 level. After that, we could be looking at 0.68, but keep in mind that this is a market that will remain rather choppy, even in an up move.

Potential signal: I would be a buyer on a break of the Friday candlestick to the upside. I would have a stop loss at 0.6350, and aim for the 0.66 level.

Ready to trade our free Forex signals? Here are the best forex platforms in Australia to choose from.