Bullish view

- Buy the AUD/USD pair and set a take-profit at 0.6545.

- Add a stop-loss at 0.6350.

- Timeline: 1-2 days.

Bearish view

- Sell the AUD/USD pair and set a take-profit at 0.6350.

- Add a stop-loss at 0.6545.

The AUD/USD exchange rate surged briefly to its highest level since December 4 as investors reflected on the latest Australian election and the strong US nonfarm payrolls (NFP) data. It rose to a high of 0.6468 on Monday, up from the year-to-date low of 0.5913.

Australia election and US jobs data

The AUD/USD pair rose after Anthony Albanese became the first Australian prime minister to claim back-to-back victories in over 20 years. He won by a landslide as the Labor Party won almost 90 seats.

Top Regulated Brokers

The election means that his policies and those by the Reserve Bank of Australia (RBA) will continue. Analysts expect that the central bank will cut interest rates in its May 20 meeting as concens about Donald Trump’s tariffs continue.

The AUD/USD pair also jumped after the US published encouraging nonfarm payrolls (NFP) that were higher than expected. The data showed that the economy created 177k jobs in April, higher than the median estimate of 138k. It had created 185k a month earlier.

The unemployment rate remained unchanged at 4.2%, while the average hourly earnings remained at 3.8%.

Its rally also happened after China expressed openness to deliberate with the United States on tariffs. A potential deal between the two countries would be a good thing for Australia because China is its biggest trade partner.

The next key catalyst for the AUD/USD pair will be the upcoming Federal Reserve meeting on Wednesday. Economists expect that the bank will leave interest rates unchanged at 4.50%.

The Fed has come under pressure from Donald Trump, who has insisted that it cuts interest rates. Officials have insisted that they will only cut rates to cut interest rates when inflation falls towards 2%.

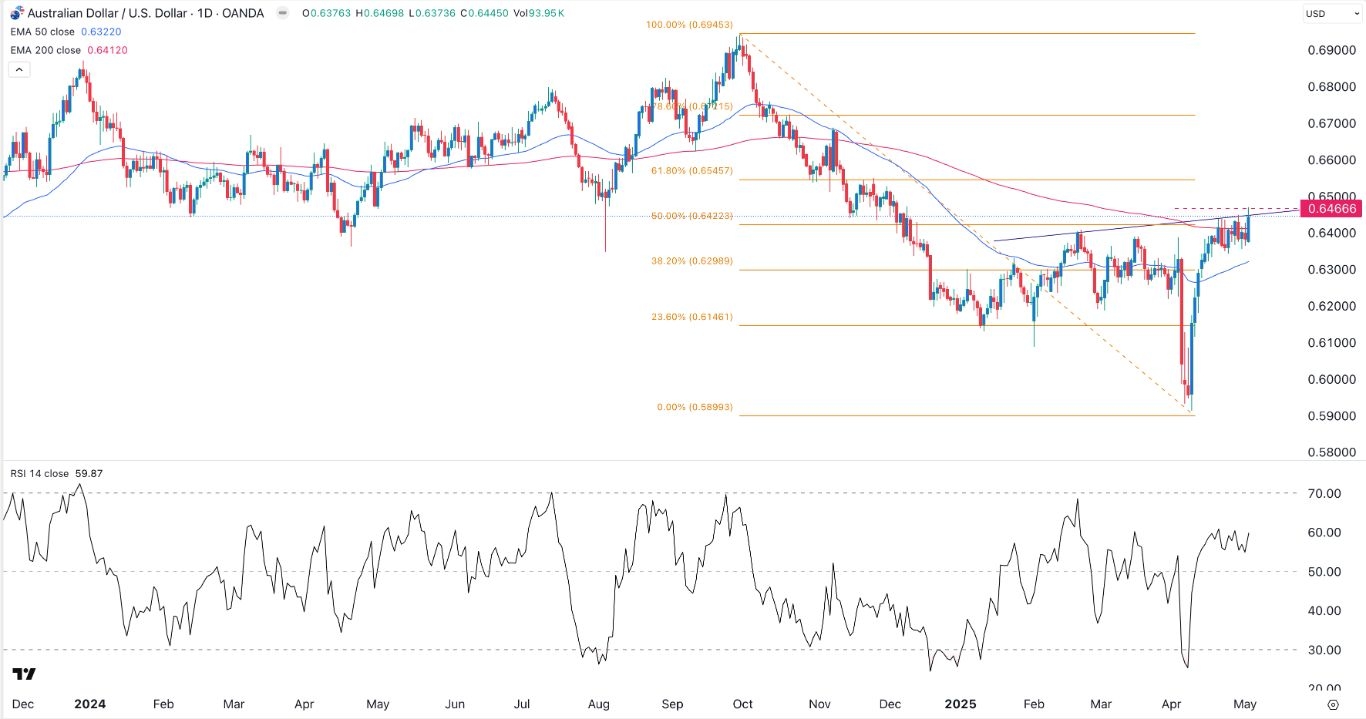

AUD/USD technical analysis

The daily chart shows that the AUD/USD exchange rate rose to a high of 0.6466, its highest swing since December last year. It has moved above the 200-day moving average, a sign that bulls are gaining control.

The pair has moved above the inverse head and shoulders pattern. Also, the Relative Strength Index (RSI) has moved above the neutral point of 50. It has also jumped above the 50% Fibonacci Retracement level.

Therefore, the pair will likely continue rising as bulls target the key resistance level at 0.6545, the 61.8% retracement level.

Ready to trade our free Forex signals? Here are the best forex platforms in Australia to choose from.