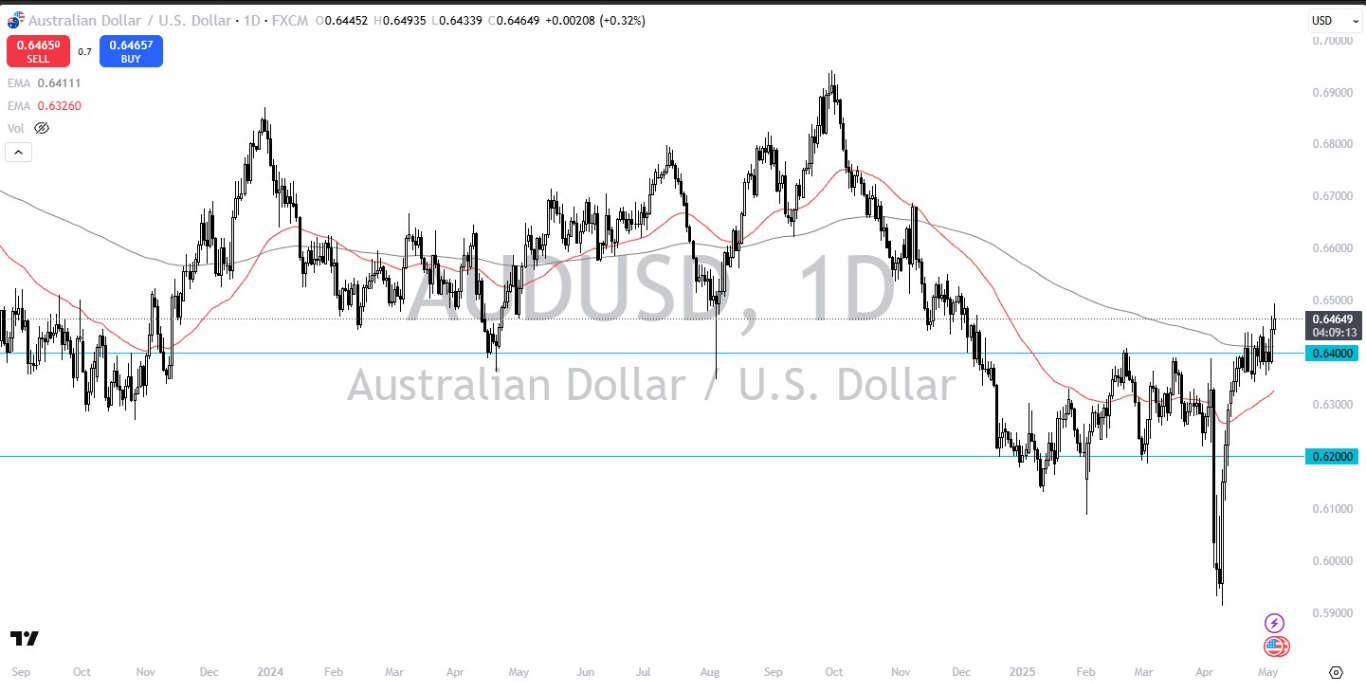

- The Australian dollar initially rallied during the day on Monday, but it looks like the 0.65 offering significant resistance.

- The 0.65 level is an important level, mainly due to the idea that it is a large, round, psychologically significant figure, but it is also an area where we have seen a lot of noise in the past.

- However, there are a lot of things going on in this general vicinity that could cause a bit of trouble.

Technical Analysis

Top Regulated Brokers

The technical analysis for this market is negative from a very long-term standpoint, but the last several weeks have of course been very bullish. The fact that we are trying to form a bit of a shooting star on Monday does suggest that perhaps we are running out of momentum, which might be a little bit more concerning as well, due to the fact that the last couple of weeks we have been sideways, so people will have expected that those who are bullish may have finally spent enough time sideways to turn this market positive from a longer-term standpoint.

Keep in mind that the 200 Day EMA is closer to the 0.64 level, and we have been going back and forth over the last couple of weeks around this indicator. The market does tend to pay close attention to the 200 Day EMA for definition of the trend, and while we did break above it, it is relatively flat so it’s not as we have a lot of momentum quite yet. However, I do think this creates a lot of pressure at the 0.65 level that could turn things around and send this market much higher.

Keep in mind that the Australian economy is highly levered to the Chinese economy, so these things will move in tandem. There are some recent signs that perhaps the Americans and Chinese are starting to at least attempt to come together for conversation, so this helps the Australian dollar. However, I think we have a lot of work to do before we are “free and clear” to go to the upside for a huge move.

Ready to trade our daily AUD/USD Forex analysis? Check out the best forex trading platform for beginners Australia worth using.